Research

Market Power In The Ivory Tower

Evidence of collusive behaviour in academic publishing.

The US corporate bond market is the largest in the world with yearly issuance volumes of around $1.5 trillion and a total outstanding amount of $18.3 trillion.1

Fideres has analysed the issuance pricing of corporate bonds for the period 2010-2015 and found evidence which hints to systemic under-pricing of approximately 0.5%. In turn, this implies that over the same period US corporates may have paid as much as $18 billion in excess interest.

Fideres’s work also shows that alternative pricing mechanisms (such as the auction system used by the US government) have the potential to deliver more competitive pricing to corporate bond issuers. It seems anachronistic that corporate bonds are still priced and sold using the same opaque system used before the internet revolution.

In order to issue debt in the form of a bond, firms typically appoint a bank (also referred to as a dealer) to act as lead manager. The role of the lead manager is to advise the bond issuer on the price and placement of the bond and to sell it to its client base.

The incentives which exist that could encourage a dealer to under-price a bond are the result of two potential conflicts of interest.

A simple question arises: if the phenomenon is so widespread, why aren’t corporate issuers keeping dealers accountable? Alternatively, why don’t dealers point out this phenomenon to corporate clients in order to take business away from their competitors?

Firstly, the potential under-pricing of bonds is driven principally by an asymmetry of information. Dealers who manage the placement of the bonds know the level of demand from investors, but the corporations which issue the bonds and access the capital markets generally do not. Since the incentives of the two parties are not aligned, there exists a principal agent dilemma, which corporations cannot overcome since they lack the relevant information. The result is that lead managers may have an incentive to price the bond cheaply at the expense of their clients in order to achieve extra profits.

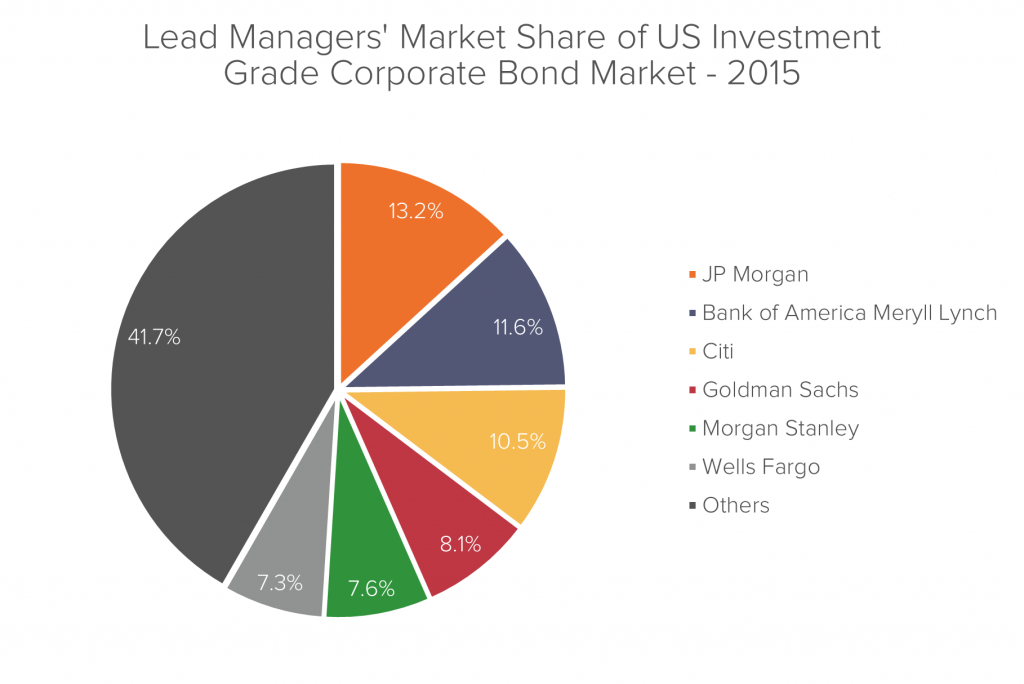

Source: Thomson Reuters

Source: Thomson ReutersSecondly, upon learning of the under-pricing, the senior management of the firm which issues the bonds are then either unwilling or unable to challenge the pricing due to their firm’s dependency on the multitude of services that are provided by banks. The issue is then entrenched by a market concentration which prevents smaller financial firms from winning business from the larger players (see chart above).

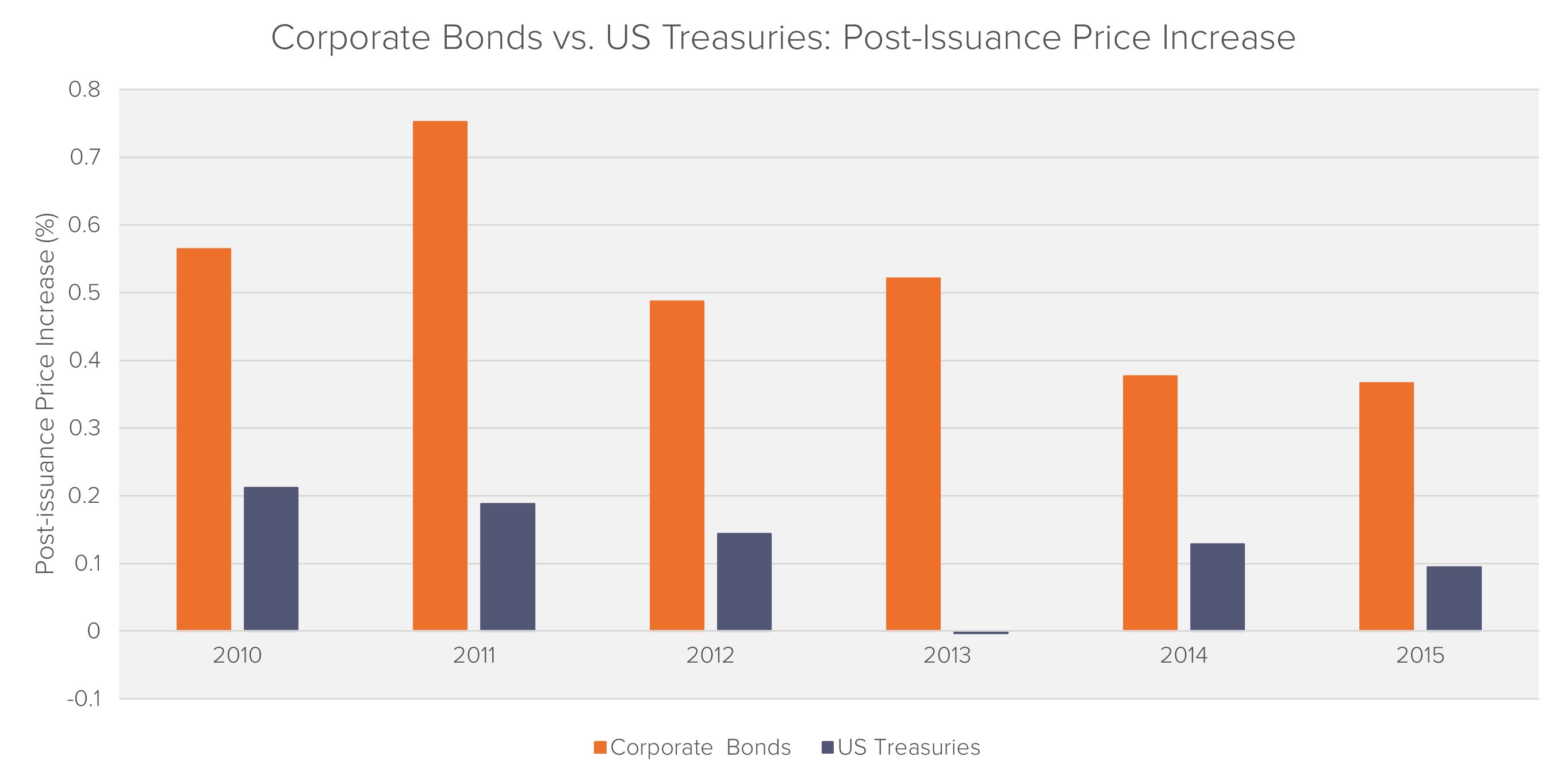

Fideres has found that there is a substantial price increase of over 0.50% in price terms over 70% of the time on the first day of trading. This is after accounting for any interest and credit risk. The trend then generally continues over the next 3-5 days. This compares with government bonds which show an average price increase of only 0.15% over the same period.3

Source: Bloomberg, Fideres’s calculations

Source: Bloomberg, Fideres’s calculationsEven more notable however is the fact that banks have proven considerably more effective in pricing their own bonds. Fideres found that dealers bonds increased in the period after issuance by only 0.30%.

1 SIFMA.

3 Fideres analysed a sample of over 700 corporate bonds issued after 1 January 2010 and valued between USD 500 million – USD 1 billion. For comparison we analysed a sample of US Treasury notes issued after 1 January 2010.

In 2009, Alberto co-founded Fideres. As a partner, Alberto has mainly focused on developing market analyses and novel methodologies aimed at identifying anomalous or illicit behaviors such as: market manipulation, benchmark fixing manipulation, product mis-selling, anti-competitive conduct and discrimination conduct.

Since 2014 Alberto is the managing partner of Fideres Inc USA, Fideres’s US arm. Alberto has acted in an expert witness capacity in disputes involving banks and brokers, on one side, and institutional investors or consumers, on the other side. Examples of such disputes include mis-selling claims on complex financial derivative products and hedging solutions, LIBOR manipulation and fraud claims.

From 2005 to 2009, Alberto was head of Structured Products at the Royal Bank of Scotland in London, leading a team responsible for the structuring of synthetic credit derivatives products and customer driven solutions. In this capacity Alberto oversaw the development and execution of structured products such as CLOs, CDOs, credit default swaps, total return swaps.

From 2004 to 2005, Alberto led the Fixed Income team as Director, Head of Structuring at ABN AMRO. In this role, Alberto was responsible for the delivery of credit related solutions to institutional clients, for developing and executing regulatory capital and balance sheet solutions for global financial institutions, and for developing fund structure for the commercialization to private investors of structured products utilizing fund and insurance products platforms.

From 1997 to 2004, Alberto was at the UBS Limited as Fixed Income. Between 2003 and 2004 Alberto was Global Head of Structuring. In this role, Alberto led a team responsible for the Interest Rates and Credit Derivative Structured Products Desk.

Alberto began his career in New York, where he joined Credit Agricole in 1996 as an Associate in the Structured Products team.

Alberto holds two engineering Masters Degrees: from Ecole Centrale Paris, France and the Polythecnic of Turin, Italy. Alberto is fluent in Italian, French and Spanish.

Evidence of collusive behaviour in academic publishing.

A Fideres Special Antitrust Investigation into the UK CO2 Market.

Panel banks abuse their power to extract monopoly rents from the market to the detriment of other market users.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330