Research

An Epic Judgement

Economic review of the Epic v. Apple landmark case.

On November 25, the first class action complaint alleging price fixing in the interest rate swap (“IRS”) market was filed. This is the latest in a recent string of allegations against the major banks and suggests that no corner of the financial markets is out of reach.

Fideres has conducted extensive analysis for this latest complaint and in this alert we give an overview of the current allegations and our findings to date.

Having historically traded over-the-counter (“OTC”), now, as part of the Dodd-Frank reforms, certain IRS are required to trade on dedicated trading platforms called swap execution facilities (“SEFs”). There are two types of trading on SEFs: request for quote (“RFQ”) trading and central limit order book (“CLOB”) trading.

In RFQ trading, a market user requests a quote from a minimum of three dealers for a particular IRS trade. This format (apart from the requirement to request a quote from at least three dealers) is similar to pre-Dodd-Frank IRS trading, whereby the dealer and market user will each know the other party’s identity.

CLOB trading meanwhile is designed to work more like a traditional exchange, e.g. the type of exchange that stocks are traded on. CLOBs work by exchange members providing liquidity to the exchange in the form of executable quotes with the best prices always sitting at the top of the pile. As such, any market user trading on a CLOB can be confident that they are getting the best available price at that point in time. In theory, there is no requirement for liquidity providers on CLOBs to be dealers and there have been expressions of interest from buy-side firms in providing liquidity to these platforms.1

The complaint accuses ten Wall Street banks2 and two SEFs3 of colluding to prevent exchange-trading for IRS. Specifically, it is alleged that in order to maintain their respective market shares, the banks enforced so-called name give-up policies on CLOB-style SEFs and any SEF that did not comply was deprived of all liquidity.

Name give-up works by disclosing the counterparties’ identities to each other after the trade is completed. Such practices don’t exist on exchanges in other markets, but serve here to allow the banks to identify any non-dealers providing liquidity to the CLOB and thereby eroding the banks’ market share. It is alleged that any non-dealer firms providing liquidity to CLOBs would be contacted by the banks and be warned that continuing this behaviour would lead to the firm being cut off from the banks’ other services. Name give-up also allows banks to identify the trading positions of buy-side firms, giving them a distinct informational advantage over the rest of the market.

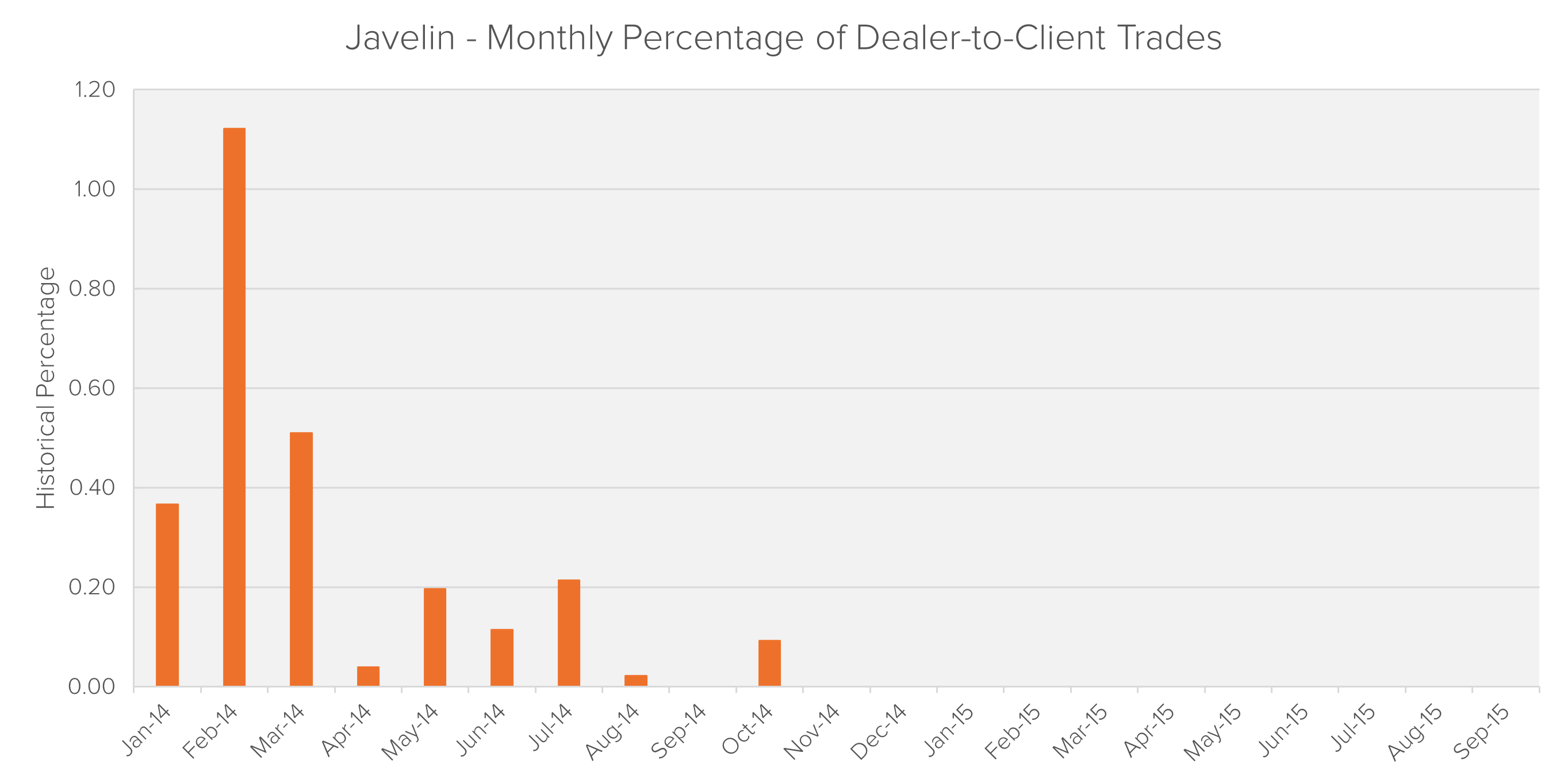

The complaint makes some specific allegations of the banks withdrawing liquidity from SEFs operating as fully anonymised CLOB-style trading platforms, i.e. platforms without name give-up policies. One such allegation concerns Javelin LLC. Javelin wanted to set up an all-to-all trading platform for IRS and had the support from numerous buy-side firms, second tier banks and RBS. However, it is alleged that when the remaining banks caught wind of its intentions, they agreed to not provide any liquidity to Javelin in order to protect their market share. The result of this alleged agreement is depicted in the following chart, where we can clearly see that Javelin now has no market share in IRS trading on SEFs.

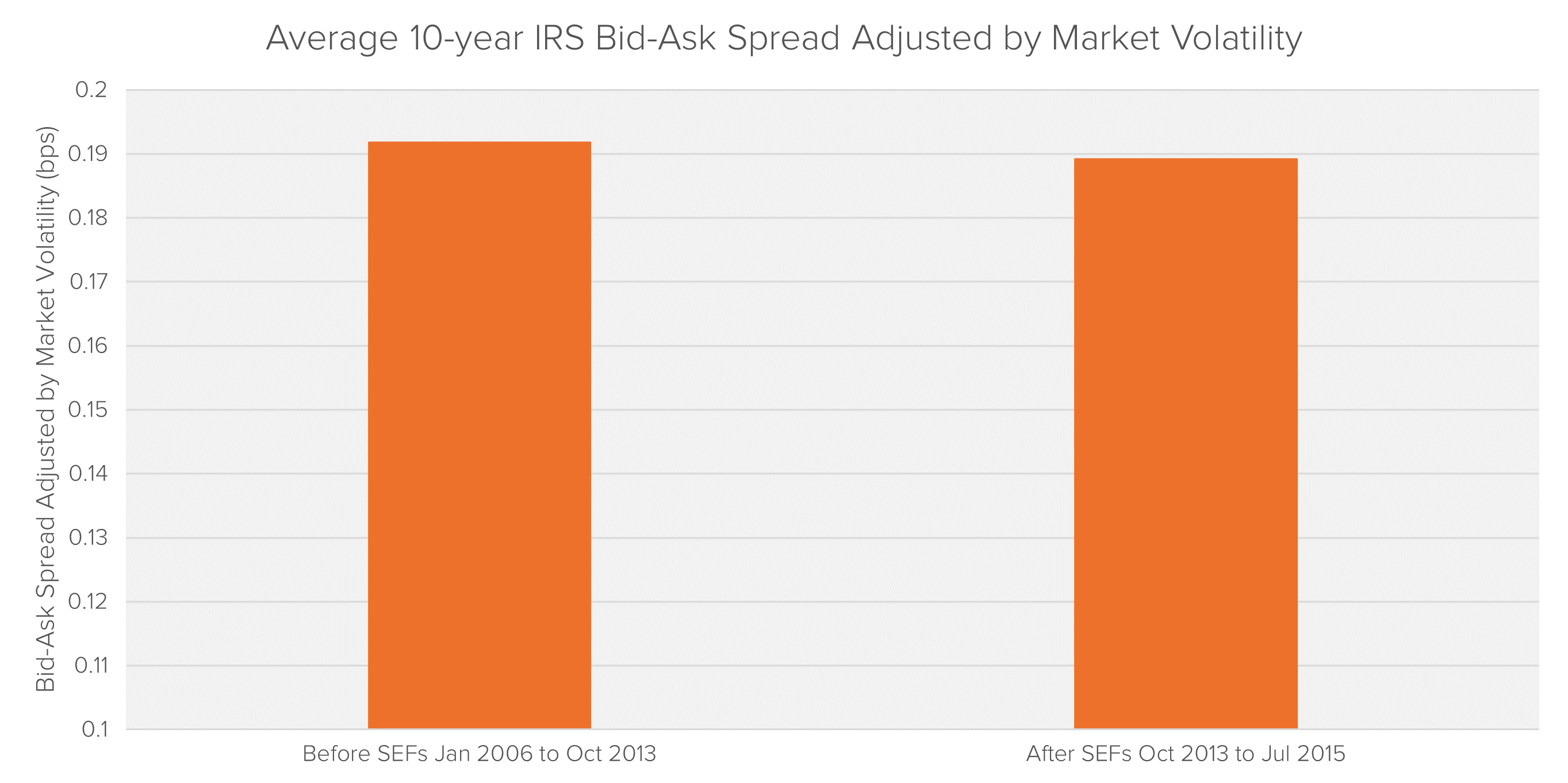

In order to protect their anonymity, the vast majority of buy-side firms execute their IRS SEF trades on RFQ platforms, while CLOBs are being used predominantly for inter-dealer trades. As mentioned previously, RFQ trading is very similar to pre-Dodd-Frank trading and has not served to increase the liquidity or transparency of the IRS market. This is clearly evidenced by the lack of any significant compression in bid-ask spreads after the introduction of SEFs, as shown in the chart below.

In conclusion, it seems from the above that despite the introduction of SEFs approximately two years ago, the users of the IRS market have not benefitted from any cost-reducing liquidity or transparency.

1 See, for example, Risk.net – ‘Top of the swaps’, November 2014.

2 The defendant banks are Bank of America, Barclays, BNP Paribas, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JP Morgan, Royal Bank of Scotland and UBS.

3 The defendant SEFs are ICAP and Tradeweb.

In 2009, Alberto co-founded Fideres. As a partner, Alberto has mainly focused on developing market analyses and novel methodologies aimed at identifying anomalous or illicit behaviors such as: market manipulation, benchmark fixing manipulation, product mis-selling, anti-competitive conduct and discrimination conduct.

Since 2014 Alberto is the managing partner of Fideres Inc USA, Fideres’s US arm. Alberto has acted in an expert witness capacity in disputes involving banks and brokers, on one side, and institutional investors or consumers, on the other side. Examples of such disputes include mis-selling claims on complex financial derivative products and hedging solutions, LIBOR manipulation and fraud claims.

From 2005 to 2009, Alberto was head of Structured Products at the Royal Bank of Scotland in London, leading a team responsible for the structuring of synthetic credit derivatives products and customer driven solutions. In this capacity Alberto oversaw the development and execution of structured products such as CLOs, CDOs, credit default swaps, total return swaps.

From 2004 to 2005, Alberto led the Fixed Income team as Director, Head of Structuring at ABN AMRO. In this role, Alberto was responsible for the delivery of credit related solutions to institutional clients, for developing and executing regulatory capital and balance sheet solutions for global financial institutions, and for developing fund structure for the commercialization to private investors of structured products utilizing fund and insurance products platforms.

From 1997 to 2004, Alberto was at the UBS Limited as Fixed Income. Between 2003 and 2004 Alberto was Global Head of Structuring. In this role, Alberto led a team responsible for the Interest Rates and Credit Derivative Structured Products Desk.

Alberto began his career in New York, where he joined Credit Agricole in 1996 as an Associate in the Structured Products team.

Alberto holds two engineering Masters Degrees: from Ecole Centrale Paris, France and the Polythecnic of Turin, Italy. Alberto is fluent in Italian, French and Spanish.

Economic review of the Epic v. Apple landmark case.

Key Points In June 2023, the SEC published a complaint against Coinbase, a centralized cryptocurrency exchange that controls 76% of the market, all...

Fideres replicates ESMA’s study on closet indexers.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330