Research

Crossed Wires

Is the focus on horizontal concentration between US wireless carrier networks misplaced?

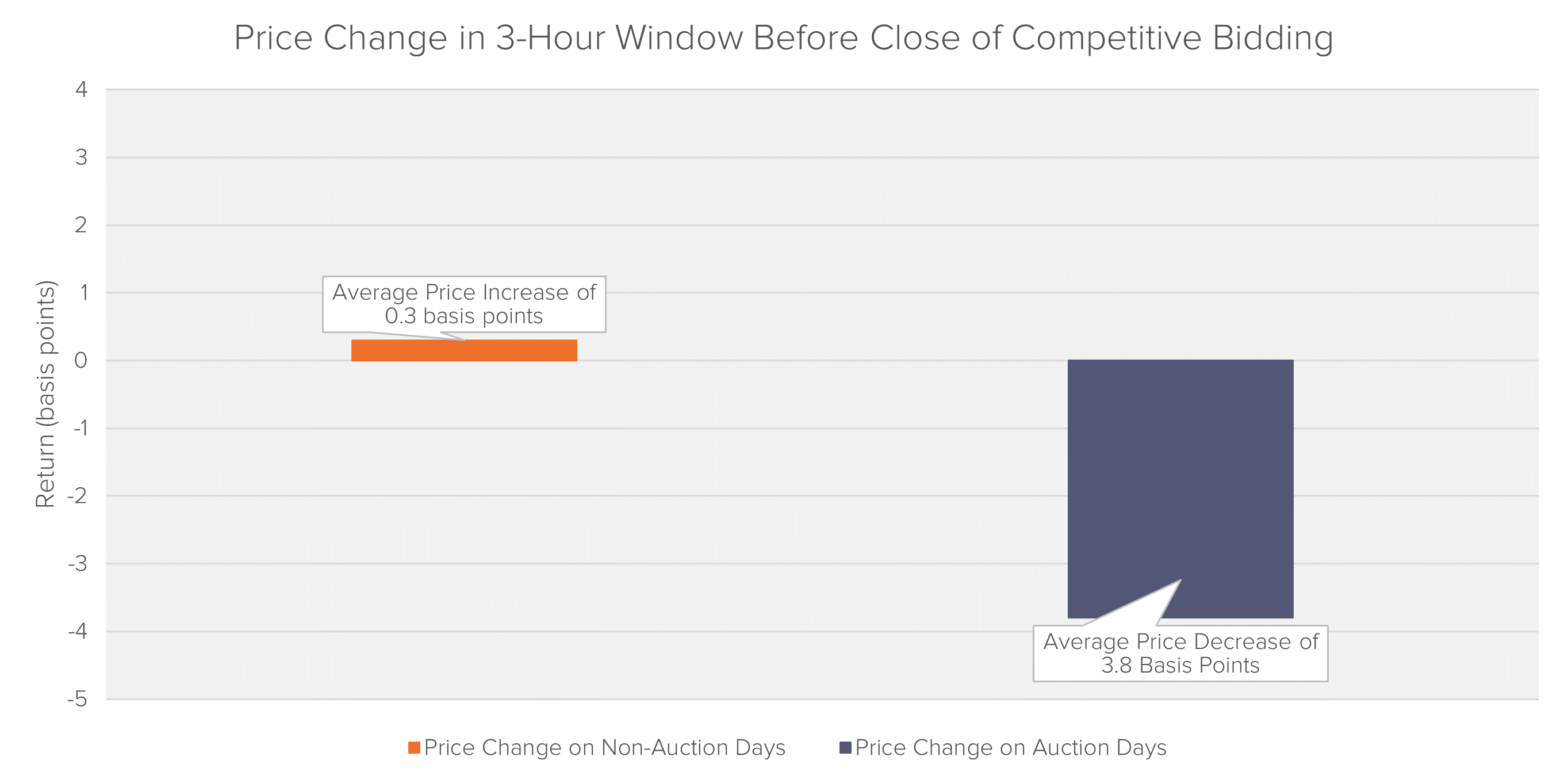

Recent weeks have seen approximately 30 class actions filed in the US alleging manipulation of the auction facility used to issue new US Treasury securities. The implications of these allegations are widespread and the parties damaged range from investors who sold Treasuries right through to the US Treasury and US taxpayers themselves. Fideres has conducted extensive quantitative analysis of these allegations and this research alert provides an overview of the allegations and our findings to date as well as considering whether or not similar activity could have taken place in Europe.

The current allegations are focused on the activity of the Treasury auctions’ primary dealers. Specifically, it is alleged that the primary dealers coordinated their auction bids1 to obtain an artificially high yield on newly issued Treasury securities. This has the impact of increasing the coupon payable on these securities, thereby benefitting those purchasing the securities and increasing the funding costs of the US Treasury.

Fideres Found That:

Fideres Found That:While the current allegations are limited to US Treasury auctions, there is nothing to suggest that similar behaviour could not be taking place in the markets for European Treasuries.

In fact, government bonds in the UK, Germany, Italy and France, to name but a few, are all issued via auction. Therefore, similar incentives may exist for bidders in these auctions.

As such, Fideres estimates that it may only be a matter of time before regulators in Europe open investigations into this matter.

1 More information on the auction mechanism for issuing new US Treasury securities can be found HERE.

In 2009, Alberto co-founded Fideres. As a partner, Alberto has mainly focused on developing market analyses and novel methodologies aimed at identifying anomalous or illicit behaviors such as: market manipulation, benchmark fixing manipulation, product mis-selling, anti-competitive conduct and discrimination conduct.

Since 2014 Alberto is the managing partner of Fideres Inc USA, Fideres’s US arm. Alberto has acted in an expert witness capacity in disputes involving banks and brokers, on one side, and institutional investors or consumers, on the other side. Examples of such disputes include mis-selling claims on complex financial derivative products and hedging solutions, LIBOR manipulation and fraud claims.

From 2005 to 2009, Alberto was head of Structured Products at the Royal Bank of Scotland in London, leading a team responsible for the structuring of synthetic credit derivatives products and customer driven solutions. In this capacity Alberto oversaw the development and execution of structured products such as CLOs, CDOs, credit default swaps, total return swaps.

From 2004 to 2005, Alberto led the Fixed Income team as Director, Head of Structuring at ABN AMRO. In this role, Alberto was responsible for the delivery of credit related solutions to institutional clients, for developing and executing regulatory capital and balance sheet solutions for global financial institutions, and for developing fund structure for the commercialization to private investors of structured products utilizing fund and insurance products platforms.

From 1997 to 2004, Alberto was at the UBS Limited as Fixed Income. Between 2003 and 2004 Alberto was Global Head of Structuring. In this role, Alberto led a team responsible for the Interest Rates and Credit Derivative Structured Products Desk.

Alberto began his career in New York, where he joined Credit Agricole in 1996 as an Associate in the Structured Products team.

Alberto holds two engineering Masters Degrees: from Ecole Centrale Paris, France and the Polythecnic of Turin, Italy. Alberto is fluent in Italian, French and Spanish.

Is the focus on horizontal concentration between US wireless carrier networks misplaced?

Issues with Fund Valuations may yield to future litigation.

Dodd-Frank reforms fail to stop interest rate price fixing.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330