Research

Underwriting In US Bond Markets

Why the status quo poses risks to competition.

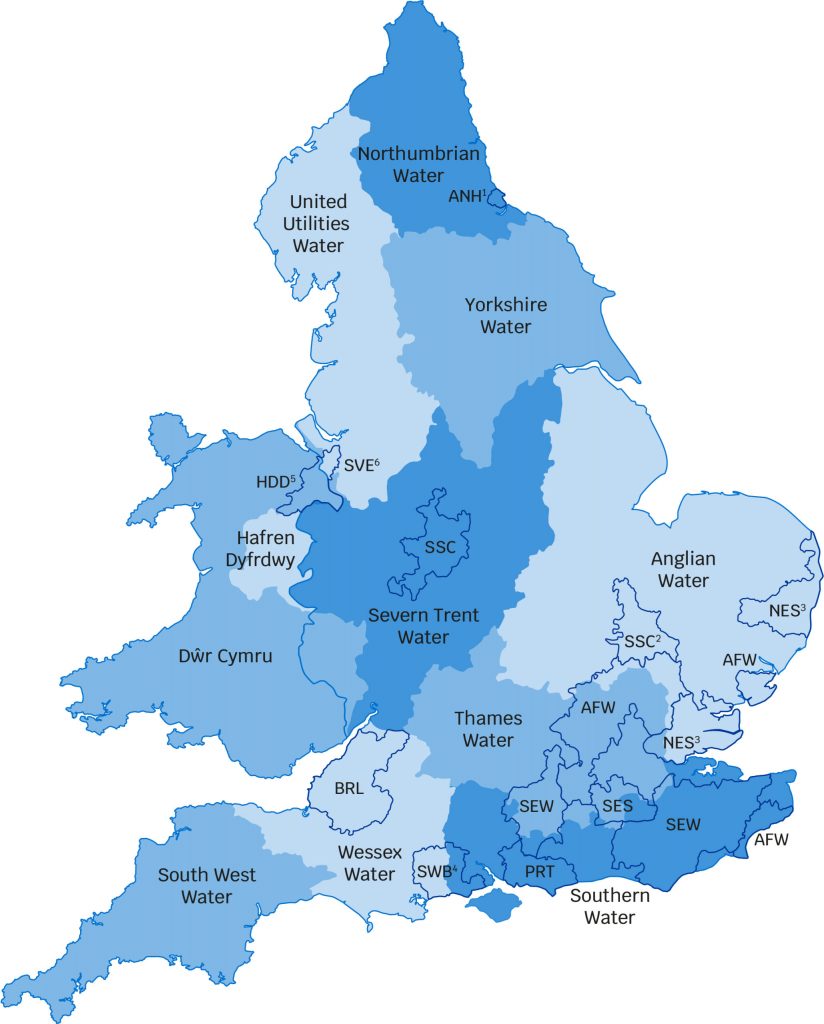

Wastewater companies in the UK are regulated monopolies. They face price controls that prevent them exploiting their dominant position to overcharge purchasers for the water they provide. They also face regulations on the quality of the service they must provide.

Price controls are set by Ofwat, the water regulator, and may be appealed to the CMA.1 In such cases the CMA has to promote the interests of consumers by considering the long-term resilience of water infrastructure and ensure the financeability of the water companies. This means that in setting the price cap they must provide the water companies with enough money for them to cover their current running costs and pay for improvements for the future, including by providing investors with a reasonable rate of return. For example, in its most recent decision, the CMA considered that its price cap would allow sufficient investment to ensure bill payers receive a sustainable quality of service.

Water company boards certify every year that they have the funding, management resources and systems and controls in place to fulfil their regulated activities, including to meet their environmental obligations. They must notify Ofwat if they are aware of anything that may materially affect their ability to fulfil those duties. Ofwat and CMA therefore use this to determine the regulated price.

One of the obligations that the water companies must fulfil relates to preventing the discharge of raw sewage into rivers and coastal waters. In particular, any release of raw sewage into rivers and coastal waters through storm overflows is supposed to take place only after exceptional weather and according to conditions in the permits issued by the Environmental Agency.

However recent investigations by the Environment Agency (with Ofwat) led it to conclude that: “Our initial analysis of the information collected to date has confirmed that there may have been widespread and serious non-compliance with the relevant regulations.”

As a result, in May 2022, the Environment Agency launched a two year criminal investigation into all ten English water companies, covering 2,200 water treatment plants. This will determine whether the firms breached legal regulations about when and how frequently they are allowed to release raw sewage into waterways. Such breaching of the legal regulations may amount to illegal dumping of raw sewage, and criminal penalties apply.

However, breaches have already been identified. For example, in 2021, Southern Water was fined a record £90m for widespread pollution after pleading guilty to 6,971 unpermitted raw sewage discharges that resulted in billions of litres of raw sewage entering waterways and coastal waters off Hampshire and Kent.2 Indeed Ofwat report that over the last five years, it has imposed penalties and payments of over £250 million on the water companies.3

Nevertheless, campaigners have argued that Ofwat has failed to enforce the regulatory requirements. For example, the environmental campaign group Wild Justice have sought a judicial review of Ofwat’s failure to monitor and take enforcement action against water companies that discharge raw sewage into waterways.

This is all certainly disturbing, but what, one might ask, does it have to do with competition law?

Our answer is that these wastewater companies each hold monopoly market power, and hence dominant positions in which no rival is legally permitted to enter and compete. However, they find that the price cap prevents them from exploiting that market power by increasing prices to monopoly levels.

In these circumstances, we suggest that they have instead elected to exploitatively abuse their dominant position, not by setting excessive prices, but providing an excessively low quality of service. Specifically, they may have underinvested in the service, and particularly in relation to sewage networks.

This would therefore form a perfect example of what has been highlighted by Simon Holmes as an opportunity to use competition law “as a sword” to protect the environment (see Holmes & Meagher, 2022).4 For example, research by the Financial Times (FT) found recently that after privatization there was an initial increase in investment to meet European water quality directives, but since then the FT found that “water and sewage companies have slashed investment in critical infrastructure by up to a fifth in the 30 years since they were privatised, according to new research that will stoke criticism over pollution and service failures. Total spending on important infrastructure, which hit a post-privatisation peak of £5.7 billion a year between 1991 and 1999, fell by 15 per cent to £4.8 billion between 2020 and 2021, according to a Financial Times analysis of the accounts of the ten largest providers in England and Wales. The decline was most extreme for wastewater and sewage networks.”

Over the same period, the companies — which were privatised with no debt and handed £1.5 billion — have borrowed £53 billion, the equivalent of around £2,000 per household. However much of that has been used not for new investment but to pay £72 billion in dividends.

Separate FOI research by the Windrush Against Sewage Pollution campaign group and obtained from the regulator, Ofwat, found that investment on wastewater networks has fallen by almost a fifth since the 1990s, from £2.9 billion a year in the 1990s to £2.4 billion.

Combining this evidence on the choice made to reduce investment with the Environment Agencies’s initial conclusion that there have been widespread and serious breaches of quality regulations leads us to conclude that while prices have been capped, the quality-adjusted price has not. While there are quality regulations, they have been repeatedly breached. In particular, the Environment Agency find large numbers of pollution incidents in which firms breached their regulatory permits every year (and it is reported that nearly a quarter of discharges are not monitored and hence not reported).5 These quality regulations nevertheless provide a helpful benchmark on what a fair quality-adjusted price would be. The fact that the water companies have failed to meet what are obligatory minimum standards and not simply aspirational targets, suggests there would be a reasonable case that the firms may have exploited their dominance.

As in other markets, it is true that having defined a minimum regulatory standard, the regulator has tools other than competition law that it can use to enforce those standards (Ofwat does have concurrent powers under the competition act, and hence in theory the ability to investigate exploitative abuse of dominance). However, regardless of one’s view on whether Ofwat has played a part in permitting this through lax enforcement (as alleged by others), it would appear from the existing fines, the ongoing criminal investigations, and the initial findings, that the established rules on what is excessively poor quality may have been repeatedly breached. As such, the conduct would, we argue, constitute an abuse of a dominant position and hence a breach of competition law.

Non-price exploitative abuse is explicitly envisaged within Article 102(a) TFEU which prohibits all “unfair purchase or selling prices or other unfair trading conditions” of a dominant company. As Holmes & Meagher (2022) note, “although, in the past, exploitative cases have tended to relate to pricing practices, there is nothing in Article 102 to suggest that that should be the case, quite the contrary: it explicitly refers to “other” unfair trading terms.”

This is most recently seen in the claim against Facebook in the CAT, and indeed the views of the CAT itself, who have already noted in Preventx,6 that: “To illustrate the broad range of potentially abusive trading conditions, [counsel for the Claimant] referred also to the decision of the German national competition authority (the Federal Cartel Office or “FCO”) in Facebook, 6 February 2019, finding that Facebook had abused a dominant position by failing to give its consumer users a genuine choice over whether Facebook could engage in unlimited collection of their personal data from non-Facebook accounts. That decision is under appeal, but the Federal Supreme Court has recently (23 June 2020) reversed a lower court’s suspension of the decision pending the appeal, indicating that the Supreme Court regarded the FCO decision as well supported.”

An important question is whether the abuse is facilitated by, or coincident with the water companies undoubted dominance. Here we would argue that the poor quality and under-investment by these profit-maximising firms would have been unsustainable if there had been effective competitive constraints on their behaviour.

Such effective competition is not straightforward to picture in a natural monopoly such as this. However, the regulated prices and quality standards are in place to ensure that the service is provided at a price and level of quality that bears a reasonable relation to its economic value, and that is precisely the applicable test on excessive pricing cases.7

This leads us to conclude that setting excessively poor quality through underinvestment, and hence excessively high quality-adjusted prices may not have been possible, either in a competitive market, or in a regulated market that effectively enforced the regulations that seek to ensure that despite being a natural monopoly, consumers are nevertheless protected from monopoly outcomes.

To quantify the harm from this exploitation of monopoly market power requires us to put a value on the harm to users from the breaches of regulations that have occurred.

One possibility is to quantify the harm to citizens through non-price aspects of the service. However, an alternative is to note that water rate payers are purchasing what they understand to be a regulatory-compliant, high-quality service. They are unable to switch if they are unhappy with the price or quality of the service, but the price they pay is capped, and that price is intended to be sufficient to cover the costs of providing a service that meets minimum quality standards, both in terms of reliability, efficiency, and environmental impact. Purchasers can therefore expect to be protected from exploitation, both via excessive prices and via the provision of excessively bad services, which can also be interpreted as excessively high quality-adjusted prices.

However, as set out above, while the firms are complying with the price cap, they are not providing the quality of service that they are required to. As such, we argue they may be effectively cutting corners and setting an excessively high quality-adjusted price for all water rate payers.

Using industry data our preliminary estimate is that there is a reasonable case to be made under competition law that users may have been overcharged by approximately £163 million over the last 6 years.

To be conservative we deducted any incentive payments that have been returned to consumers when the firms have failed to hit their targets. However, these targets were voluntary until 2020, and so few firms did so. Then from 2020/21 onwards these were set with the firms themselves (the firms were also able to influence the incentive for achieving or failing to meet their target). We suggest that firms were therefore able to frequently breach their regulatory permits without incurring any incentive penalty. Nevertheless, where firms did make deductions from their bills to reflect their failure to meet their targets, we have deducted these payments from our estimate to reflect the risk that this might be considered to be double-counting harm to customers.

We have also estimated the extent to which the firms have charged households for the disposal of sewage that was in fact discharged into the country’s rivers and onto its beaches.

We recognize here that some of these discharges did not breach the firms’ regulatory permits, and so are unlikely to represent an exploitative abuse of dominance. However, we understand that the firms have nevertheless charged consumers for the volume of service8, when in fact they did not dispose of some of that sewage, they dumped it. Whether or not this dumping of the sewage was in breach of their permits, we argue that consumers were therefore charged for a service that was not provided.

We believe this raises serious consumer protection concerns that we believe the CMA should investigate. Unfortunately, users are not currently empowered to launch class action complaints to claim compensation for damages incurred from this type of harm. We would therefore urge legislators to look again at the rules in order to facilitate such actions.

Our preliminary estimate of the harm from charges for undelivered sewage disposal services is more than £1.1 billion.

Over the past six years, we argue that the privatised water companies’ inadequate capital investment appears to have resulted in more than 120 million cubic metres of raw sewage being discharged each year onto our beaches and into our rivers. Enough to fill the Royal Albert Hall four times a day each year. These spillages ran for a combined 14,000 hours (the equivalent of there being an ongoing spillage every weekend of those six years). Of these discharges, approximately 10,300 are classed as pollution incidents that breach the minimum standards set out in the firm’s regulatory permits.

Our preliminary investigation suggests that water firms in England and Wales have, for more than 6 years, potentially engaged in an exploitative abuse of their dominant positions. This may have caused direct harm to those using the beaches and rivers upon which the sewage was spilt, however it also amounts to an excessive quality-adjusted price that has been charged to water rate payers across the country. We estimate this overcharge at approximately £163 million.

Furthermore, we have also estimated the extent to which these same firms have charged water rate payers for the permitted and non-permitted disposal of sewage that was not safely disposed of, but instead discharged into the country’s rivers and onto its beaches. While such conduct may not be challenged under competition rules, we estimate this overcharge at more than £1.1 billion.

1 See for instance the March 2020 appeal by 4 of the water companies: CMA issues final decision on water price controls – GOV.UK (www.gov.uk)

2 Southern Water fined record £90m for dumping raw sewage – BBC News and Bill for sewage breaches not yet known | Environment Analyst UK (environment-analyst.com)

4 See Holmes, S. and Meagher, M. “A Sustainable Future: How Can Control of Monopoly Power Play a Part?” May 3, 2022. http://dx.doi.org/10.2139/ssrn.4099796

5 While discharges are permitted in certain circumstances such as storms, these pollution incidents are only identified where the discharge did not happen in such conditions. See section four: Water and sewerage companies in England: environmental performance report 2021. Reports also suggest that monitoring of discharges is failing: Raw deal: discontent is rising as water companies pump sewage into UK waters (The Guardian)

6 Preventx v Royal Mail [2020] EWHC 2276 (Ch)

7 United Brands, ECJ, Case 27/76, paragraph 250

8 Households are charged a fixed standing charge and a volumetric charge based on a per cubic metre fee. This is measured or estimated depending on whether a water metre is installed or not.

Chris joined Fideres in 2021. Chris holds a PhD, an MA and BA in Economics from the University of East Anglia. At Fideres Chris has provided expert economic advice on class action complaints against Amazon, Facebook and Apple. He has written expert reports, developed models to quantify damages, and developed analysis of market definition and abuse of dominance (monopolisation) in digital aftermarkets and multi-sided platforms.

Before joining Fideres, Chris spent 7 years as a Competition Expert for the OECD where he led the economic thinking on antitrust in digital markets, as well the role for competition law in delivering inclusivity. He published numerous papers and led a working party of the OECD Competition Committee in developing new international standards on competitive neutrality and competitive assessment in light of the digitalisation of the economy.

Chris has advised the UK Government’s Department of Trade & Industry on the benefits of competition policy, and the UK Competition Commission (predecessor to the Competition and Markets Authority) on digital mergers, retail market investigations and competition cases. He was an advisor to the Co-operation and Competition Panel on mergers, market studies and antitrust in publicly-funded healthcare markets, and later became Director of Competition Economics at the UK Healthcare Regulator. Chris is a founding member of the Centre for Competition Policy of the University of East Anglia. He remains an associate of the Centre, a member of various advisory boards at non-profit making organisations, and peer reviews papers for the Journal of Competition Law and Economics & the Journal of Antitrust Enforcement.

Why the status quo poses risks to competition.

Has enough been done to prevent future FX scandals?

Fideres investigates algorithmic mortgage discrimination in the US.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330