Key Points

- Active share alone can give a biased view of funds’ activeness.

- Other metrics must be considered alongside active share to see the whole picture.

Background

The issue of fund managers merely tracking their benchmark index while charging fees to investors in line with actively managed funds has become the subject of interest over the past few years. Various academics, regulators and research firms have launched investigations to identify these so called ‘closet index funds’. One of the primary metrics used to uncover potential closet index funds is active share, a measure of the difference between a fund’s portfolio and the composition of its benchmark index. However, analysis conducted by Fideres suggests that active share alone is not a good measure of the index-tracking behavior of mutual funds.

Shortcomings of Active Share

This point is illustrated by the following three funds with the characteristics set out below:

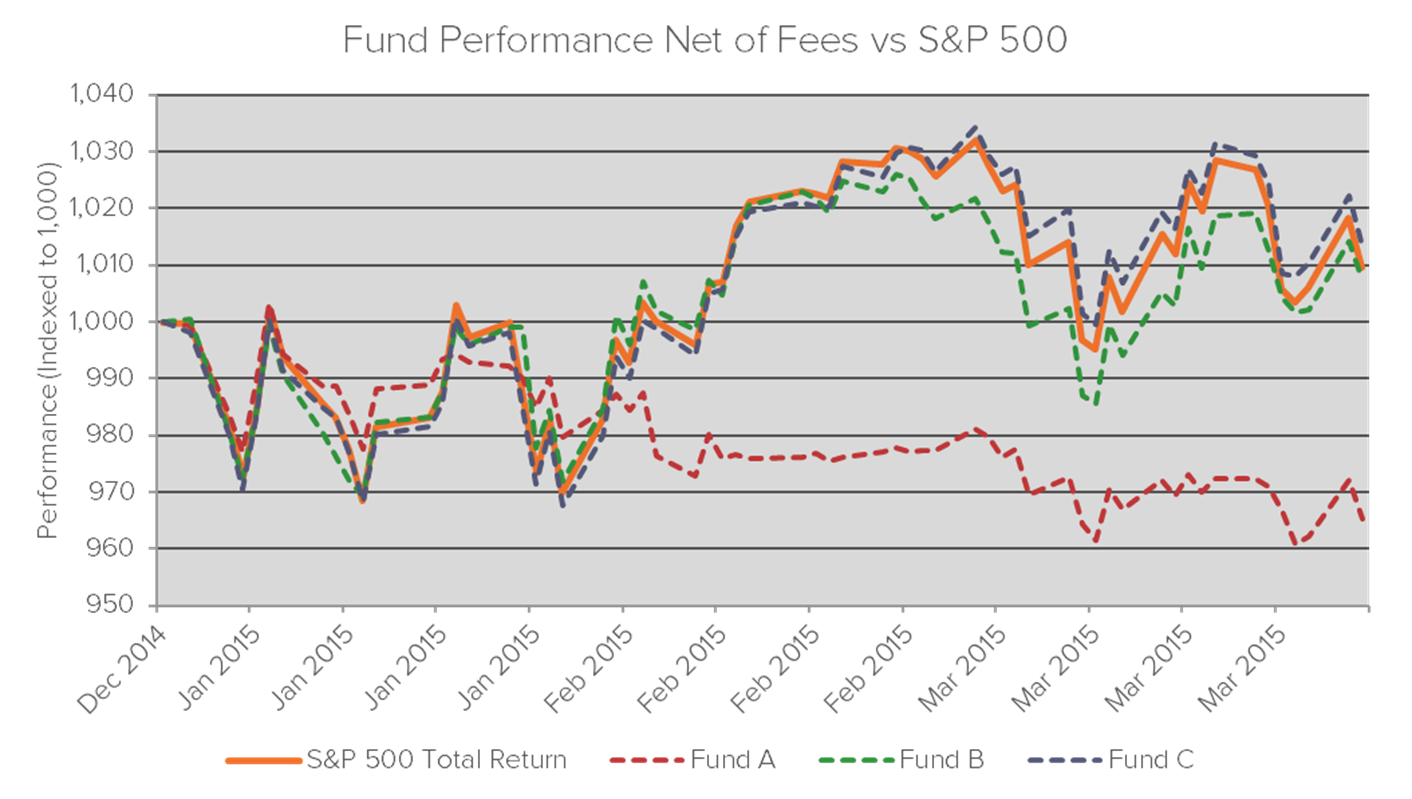

The active share1 was calculated as of January 1, 2015, and during Q1 2015 the funds performed as follows:

[wpdatatable id=51]

- Attempting to identify closet indexers on the basis of active share alone, Fund A would appear to be the obvious candidate with an active share of just 22%. However the ‘active portion’ of Fund A’s portfolio produced an unusually large tracking error of 7.81%, and resulted in the fund’s performance substantially deviating from the benchmark to the extent that it could not convincingly be considered a closet indexer.

- Fund B, on the other hand, had a relatively high active share of 75% (much higher than the 60% demarcation point stated in academic literature), but the active portion of its portfolio resulted in a relatively low tracking error, and the fund’s performance did not deviate far from the benchmark.

- Finally, Fund C has been identified as a closet indexer by Fideres on the basis of a number of complementary performance and composition metrics which, in addition to its low active share and tracking error, result in the fund ‘hugging’ the benchmark very closely.

Fideres’s Work

Considering active share alone is not sufficient to identify closet index funds, and it is necessary to analyze a range of additional performance metrics including tracking error and R-squared, among others, on a historical basis.

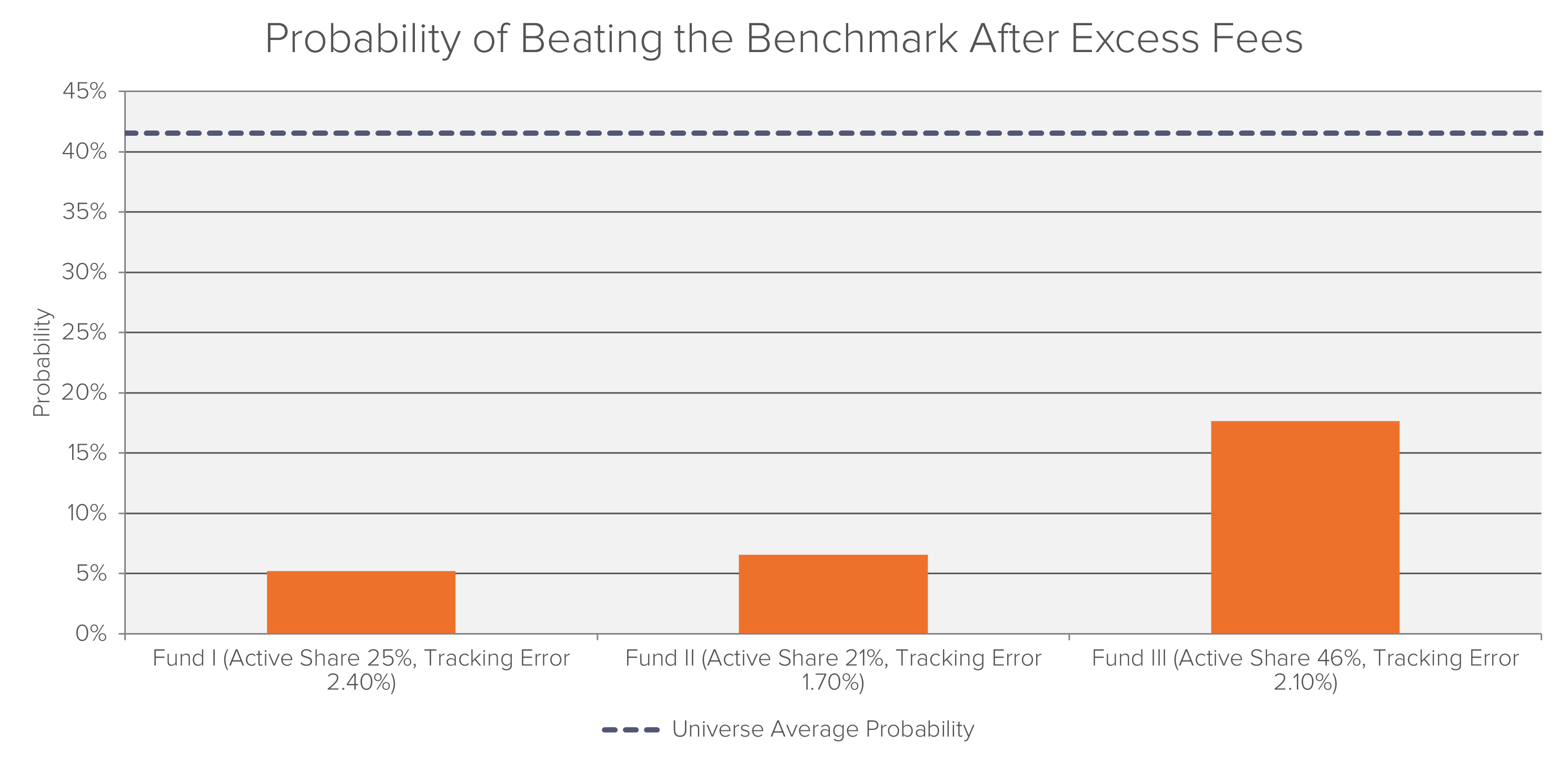

Fideres has developed a robust quantitative framework to identify closet index funds applying this approach. Part of this approach involves estimating the probability of a fund beating the benchmark after excess fees (over an actual index-tracking ETF) on the basis of the fund’s active share, tracking error, and portfolio holdings. When applied to a North American universe of funds, it can be seen that closet index funds are substantially less likely to beat the benchmark than actively-managed funds:

Sources

1 Active share calculated as of 1 January 2015; (annualised) tracking error of daily returns calculated for Q1 2015