Research

COVID-19 Travel Tests Investigation

Unavailable and inaccessible.

LME is the world’s major trading place for industrial metals, including copper. Copper is traded on all of LME’s three trading platforms:

The daily Ring trading windows for copper are as follows:

| Ring Session | London Time (pm) |

| First ring session | 12:00 - 12:05 |

| Second ring session (official price fixing) | 12:30 - 12:35 |

| Third ring session | 15:10 - 15:15 |

| Fourth ring session | 15:50 - 15:55 |

For each metal, including copper, the LME publishes various official prices:

For purposes of this memo and our analysis, we will refer to the various LME Official Prices and the LME Official Settlement Price together as the Official Price.

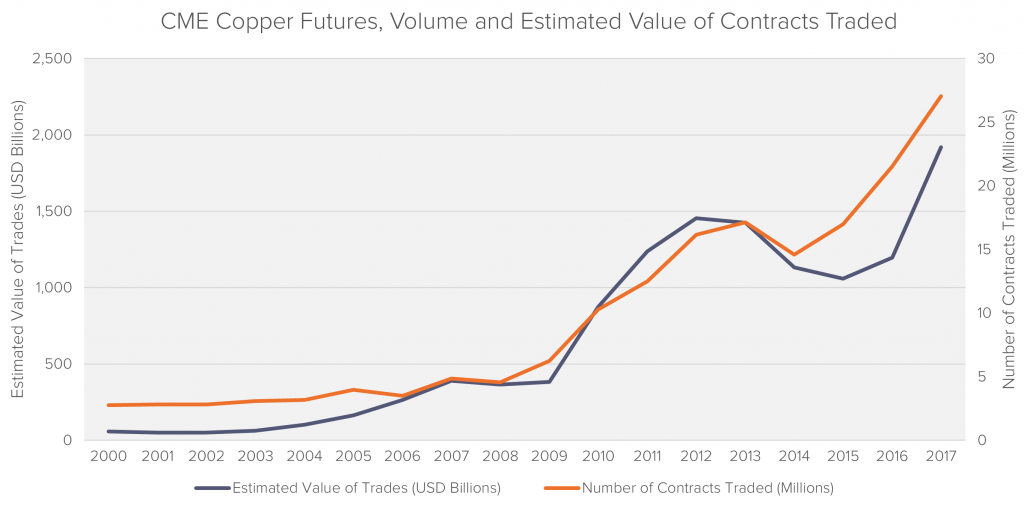

The Official Price is an important benchmark for transactions involving physical copper and copper derivatives including exchange traded futures. The following chart shows annual trading volume of CME copper futures, which has increased significantly since 2000 and reached almost USD 2 trillion in 2017.

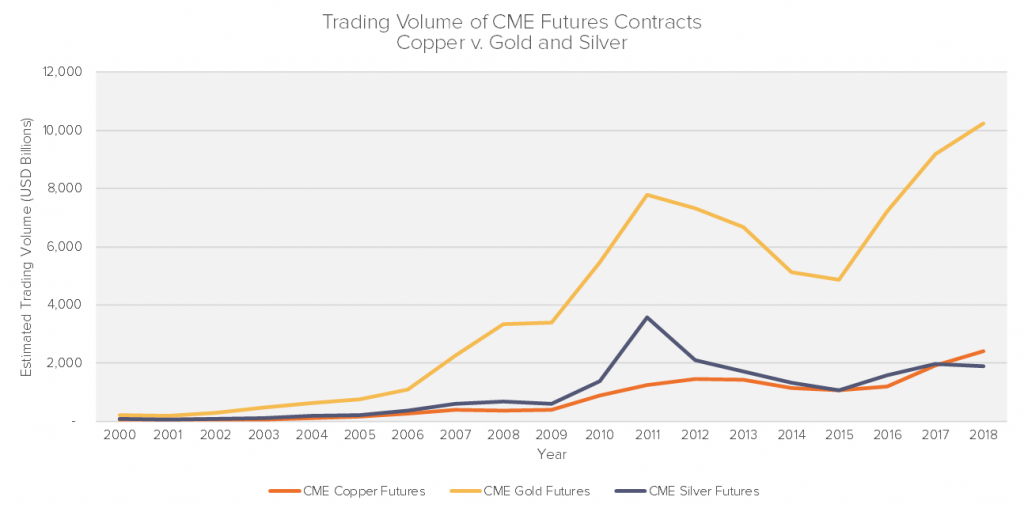

In terms of CME futures, the copper market is as large as the silver market and approx. one fourth of the gold market.

Copper market participants include producers, fabricators, consumers, financial institutions, hedge funds and individual traders. Most of the products traded by these market participants are either directly or indirectly affected by the Official Price.

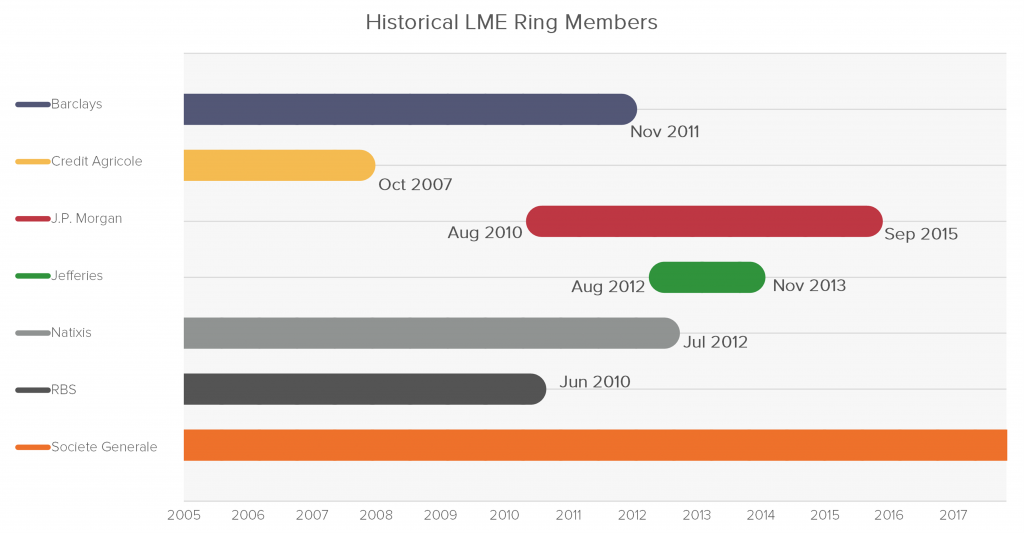

The list of LME ring members (also called “category 1” members) has changed frequently over time. In addition to various specialized brokers, the following dealers were ring members for at least part of the Analysis Period: Barclays (Feb 2005 – Nov 2011), Credit Agricole, (Feb 2005 – Oct 2007), J.P. Morgan (Aug 10 – Sep 2015), Jefferies (Aug 2012 – Nov 2013), Natixis (Feb 2005 to Jul 2012), RBS (Feb 2005 to Jun 2010), and Societe Generale (Feb 2005 to Nov 2017).

Some of these brokers have ceased being a ring member or are now category 2-5 members which lowers their compliance burden. Category 2-5 members are not allowed to trade in the Ring by open outcry and instead route their orders through one of the category 1 ring members.

We note that some of the world’s largest commodity traders, such BHP Billiton and Glencore, are category 5 members which are not regulated.

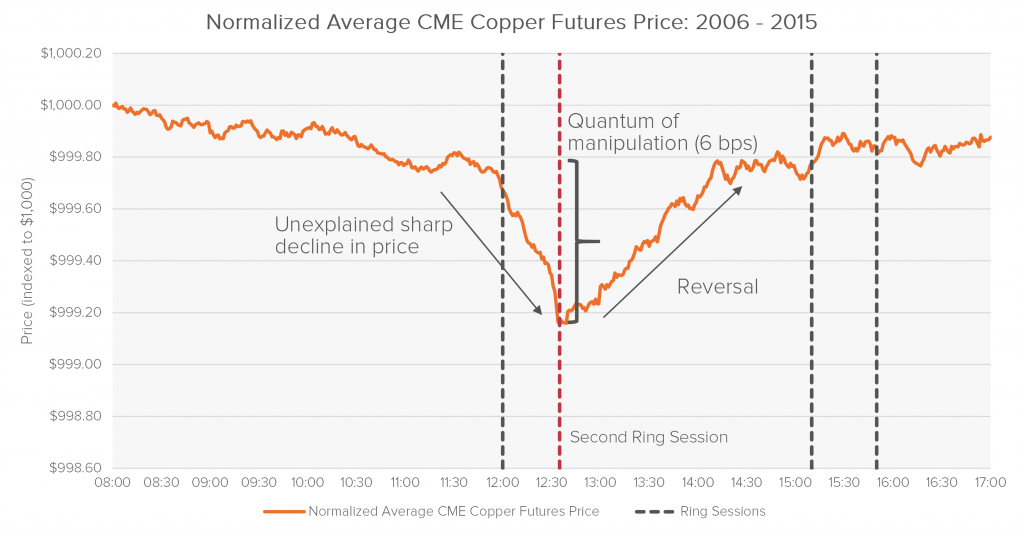

Fideres investigated the average intraday price movements of CME copper futures and found that copper prices have on average decreased sharply during the 30-minute window leading up to the close of the second Ring session.

As shown in the chart below, this sharp average downward movement is unique to the second Ring session, at the end of which the Official Price is determined.

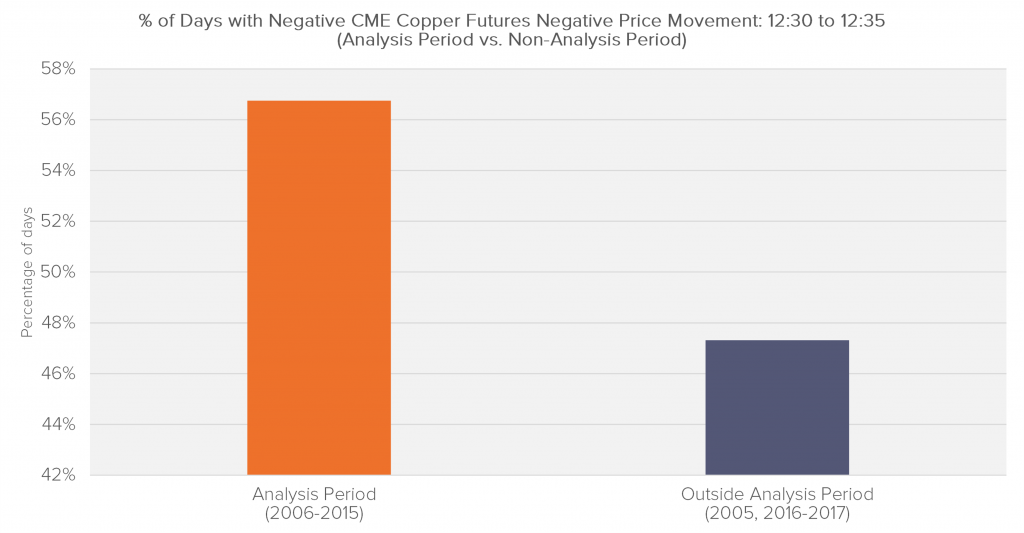

The chart below shows that, during the five minutes prior to the determination of the Official Price (i.e. between 12.30pm and 12.35pm), copper prices decrease more days during the Analysis Period than outside of the Analysis Period.

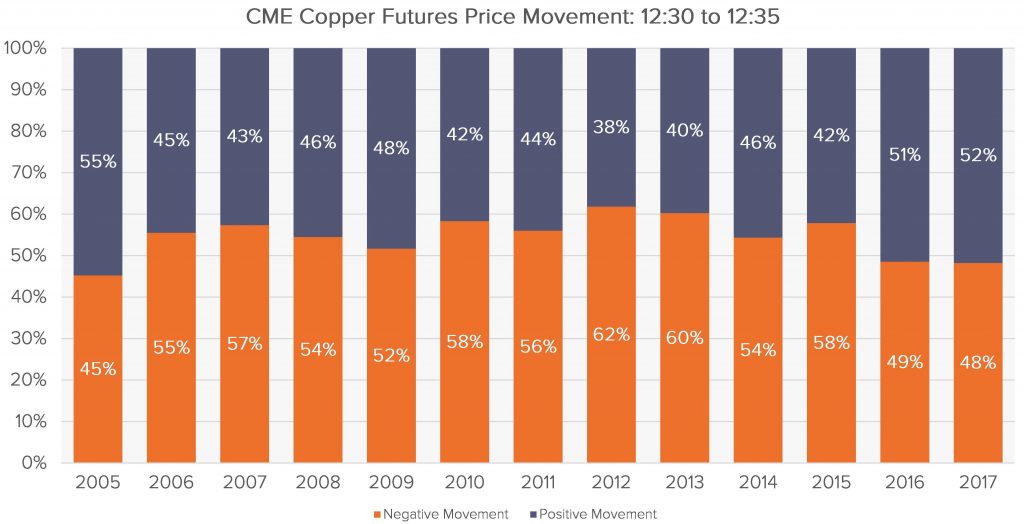

This is also confirmed if we look at the percentage of days with positive and negative movement by year.

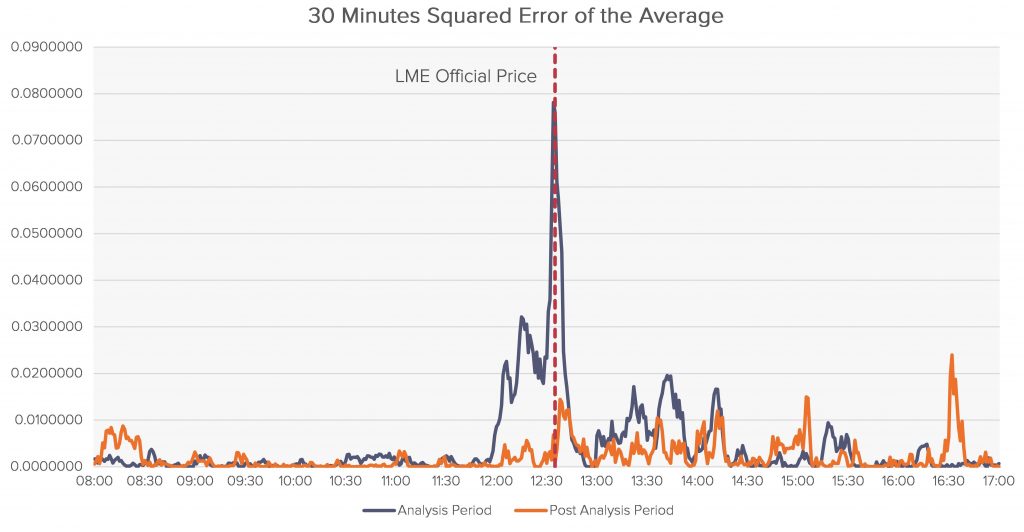

The chart below exhibits the 30 minutes Squared Error of the Average for the Analysis Period and Post Analysis Period. As it is possible to see, the pattern is different between the two periods.

The spike of the squared error of the average during the Analysis Period concurrently to the LME Official Price fix is bigger in magnitude than Post Analysis Period.

A recent UK lawsuit4 revealed how Barclays has managed to manipulate the LME Closing Price5 in order to increase the Futures margin paid by their client. Specifically, it is alleged that Barclays sought to manipulate the LME Closing Price by repeatedly bidding large sums for copper positions right before close of trading.

The results shown in the previous sections are potentially a sign of banks conducting similar unlawful practice in order to manipulate the LME Official Price. In fact, the LME Official Price is more vulnerable to manipulation due to the fact that it is based on the last bid and offer made in the second morning Ring trading session.

Fideres has identified 27 LME fines related to manipulative copper trading in the Ring. Despite these fines, LME has failed to take decisive action to prevent the market from being distorted by manipulative trades.

1 https://www.lme.com/Metals/Non-ferrous/Copper/LMEminis

2 https://www.lme.com/Metals/Non-ferrous/Copper/Monthly-Average-Futures

3 https://www.sec.gov/Archives/edgar/data/70858/000119312511076516/dfwp.htm

5 LME Closing Prices are determined by the Pricing Committee across all prompt dates using trades, bids and offers (including indicative trades) transacted throughout the day. Closing Prices are used by LME Clear and LME members to calculate margins.

Robert Chang, Head of Fideres’s Securities Litigation practice, is a financial market expert with extensive and broad-ranging experience in the areas of securities, commodities, derivatives and structured finance.

Since joining Fideres in 2014, Robert has been instrumental in helping institutional and retail investors to recover billions for his consulting and expert testifying work in over 30 landmark financial market investigations and litigations. His most recent successes include a $508 million partial settlement in the ISDAfix interest rate benchmark class action and a €1.4 billion settlement of securities fraud claims against Steinhoff International Holdings NV (second largest against a European issuer accused of securities fraud).

Robert’s team help law firms, regulators and investors across the globe in litigations and other disputes, from the initial claim filing, through dismissal, discovery, expert testimony and settlement. On his team, Robert is often the main architect for groundbreaking analyses and models used in key filings and testimonies.

Robert completed his MSc in Risk Management and Financial Engineering at Imperial College with distinction. Prior to this, he obtained a BSc Economics degree with distinction from Shanghai University of Finance and Economics.

Unavailable and inaccessible.

Fideres investigates competition issues in academic journal markets.

Evidence of collusive behaviour in academic publishing.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330