Research

FedEx And UPS: Who’s Got The Better Package?

FedEx and UPS general rate increases: Collusion or conscious parallelism? Fideres investigates competition issues in the United States courier mark...

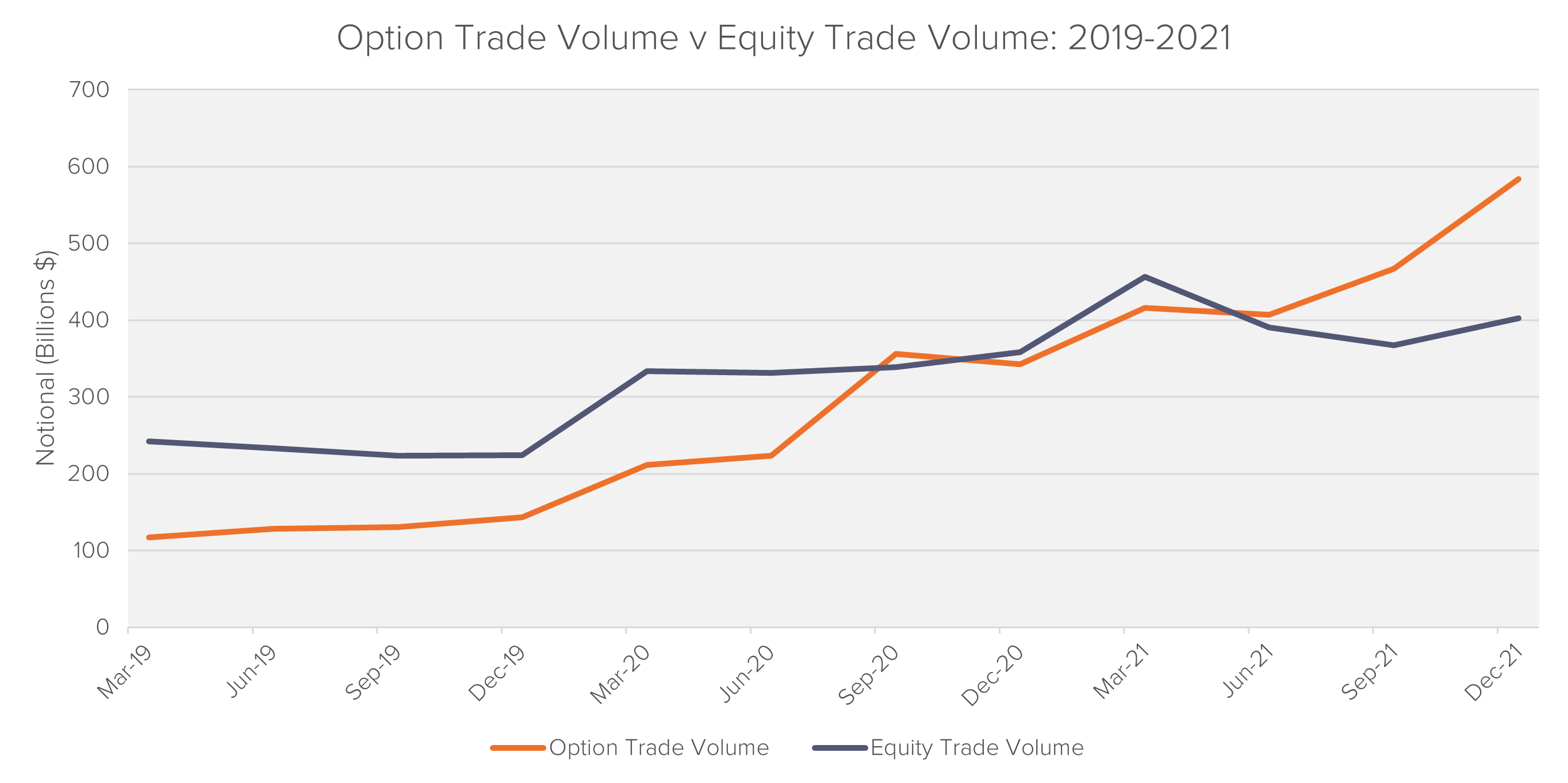

Equity options are contracts that give one party the right (but not the obligation) to buy or sell a certain number of shares at a pre-agreed price (exercise price) before a certain date (maturity date). Equity options are frequently traded – with hundreds of millions of contracts being traded every month – and have substantially grown in popularity in the last few years, with the number of contracts traded almost doubling over the last three years.

Equity options are an example of a “derivative” contract, as their value is derived from that of the stocks they refer to. Consequently, any piece of news or withheld information that has an impact on a stock’s price will also affect the price of its associated options, potentially harming option holders. The options market has been growing steadily in size over the last few years. In 2021, the volume of options publicly traded on US stocks exceeded 40 million contracts.

Fideres reviewed a sample of publicly available settlement plans from the last 20 years and found that option holders are rarely mentioned in class definitions. When reviewing these cases, we discovered two key distinct methodologies that were employed when trying to assess the losses option holders faced in relation to securities fraud.

Under this methodology, inflation can be calculated based on the raw price drop of the option in question in relation to misinformation disclosures. The recognized loss for options from a given disclosure date can then be simply computed as the difference between the option’s price before the disclosure and the price after it. Experts used this methodology when assessing damages to call option holders in the 2009 Bank of America case surrounding the bank’s merger with Merrill Lynch.

This methodology requires the use of a specified option pricing model to compute two option prices – an “actual” price computed using observed stock prices, and a counterfactual price, computed with the same model, but using the counterfactual stock price. Damages can then be calculated as the difference between these two option prices.

Unlike the methodology involving raw option price drops this procedure allows experts to isolate the impact caused by a change in underlying stock price separately from changes caused by trading noise, time value decay, or other disclosures. We were able to see this procedure in practice when reviewing the 2005 AIG accounting scandal. This approach, however, assumes the stock price to be the only relevant variable in option pricing. As shown in the next section, this can be a grave mistake, potentially misclassifying damages for option holders.

In both approaches to damages assessment, experts have attempted to account for price changes when developing their methodology; however, they disregarded a major determinant of option prices: implied volatility (IV). Implied volatility is a measure of the uncertainty of a stock’s future price, measuring the likelihood of the range of the possible future prices. IV has a positive impact on options prices, as a wider range of potential future prices increases the potential upside of the contract, without affecting its potential downside, as option holders will only exercise options that are favorable to them.

Ignoring implied volatility can have grave consequences when determining the magnitude and directionality of damages for option holders, which may lead to challenges during class certification. To illustrate this point, we briefly analyze the movement of option prices following an announcement by Twitter from April 2022 and the impact this announcement had on option holders.

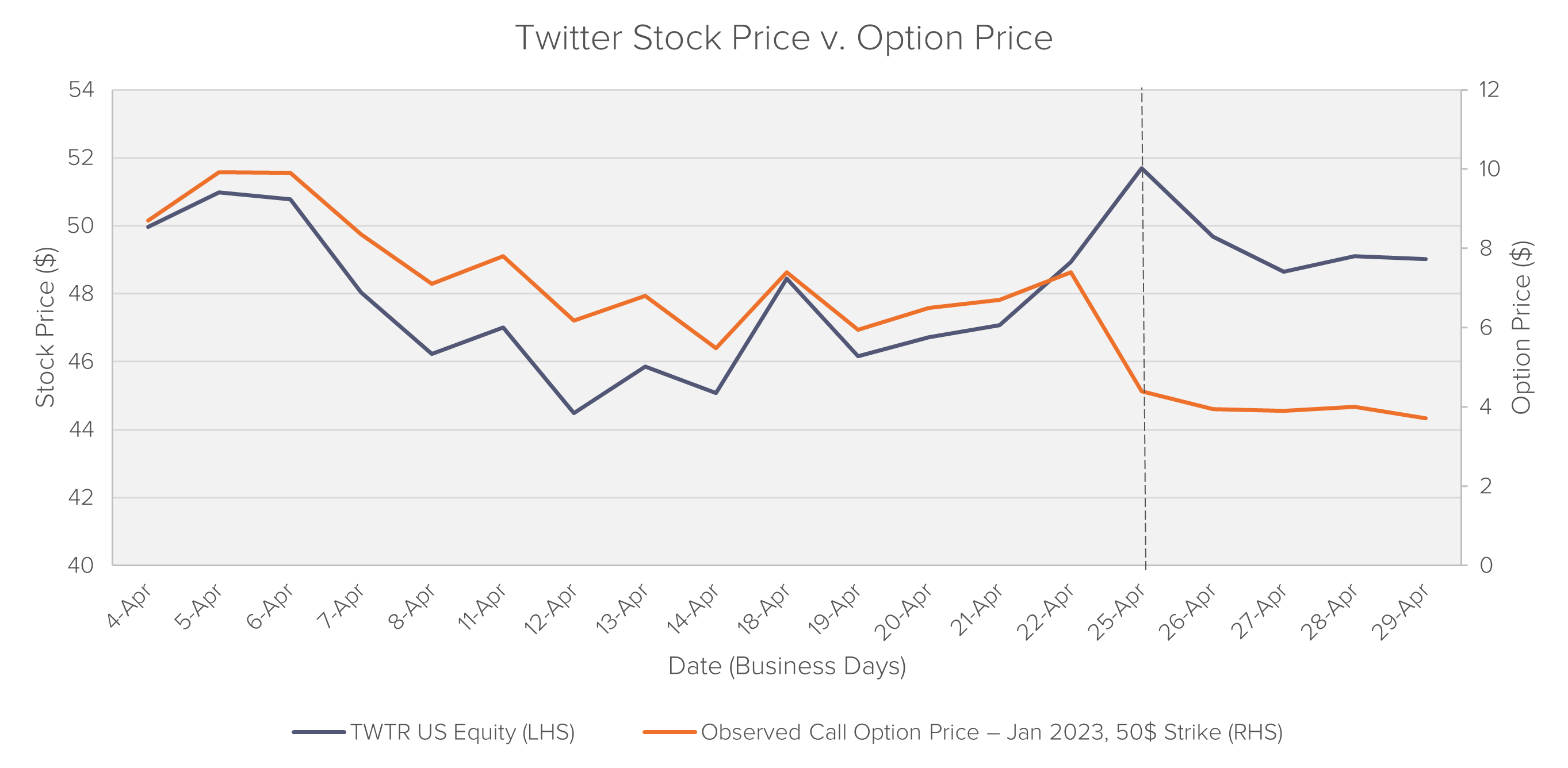

On April 25, 2022, the board of Twitter approved of an acquisition offer by Elon Musk to take the company private. In the aftermath of the announcement, Twitter’s share price rallied due to resulting investor excitement. All else equal, this price spike should have caused the value of call options (options to buy) to increase – as the same option now allows the holder to buy something more expensive. However, as shown in the chart below, call options prices decreased instead.

Although a higher stock price can potentially cause an increase in call options prices, in the case of Twitter this impact is more than offset by a large decrease in implied volatility, making the price of the call options fall. The dip in option prices reflects the lack of potential for much higher future upside for stock prices should the company be taken private at the announced price of $54.20.

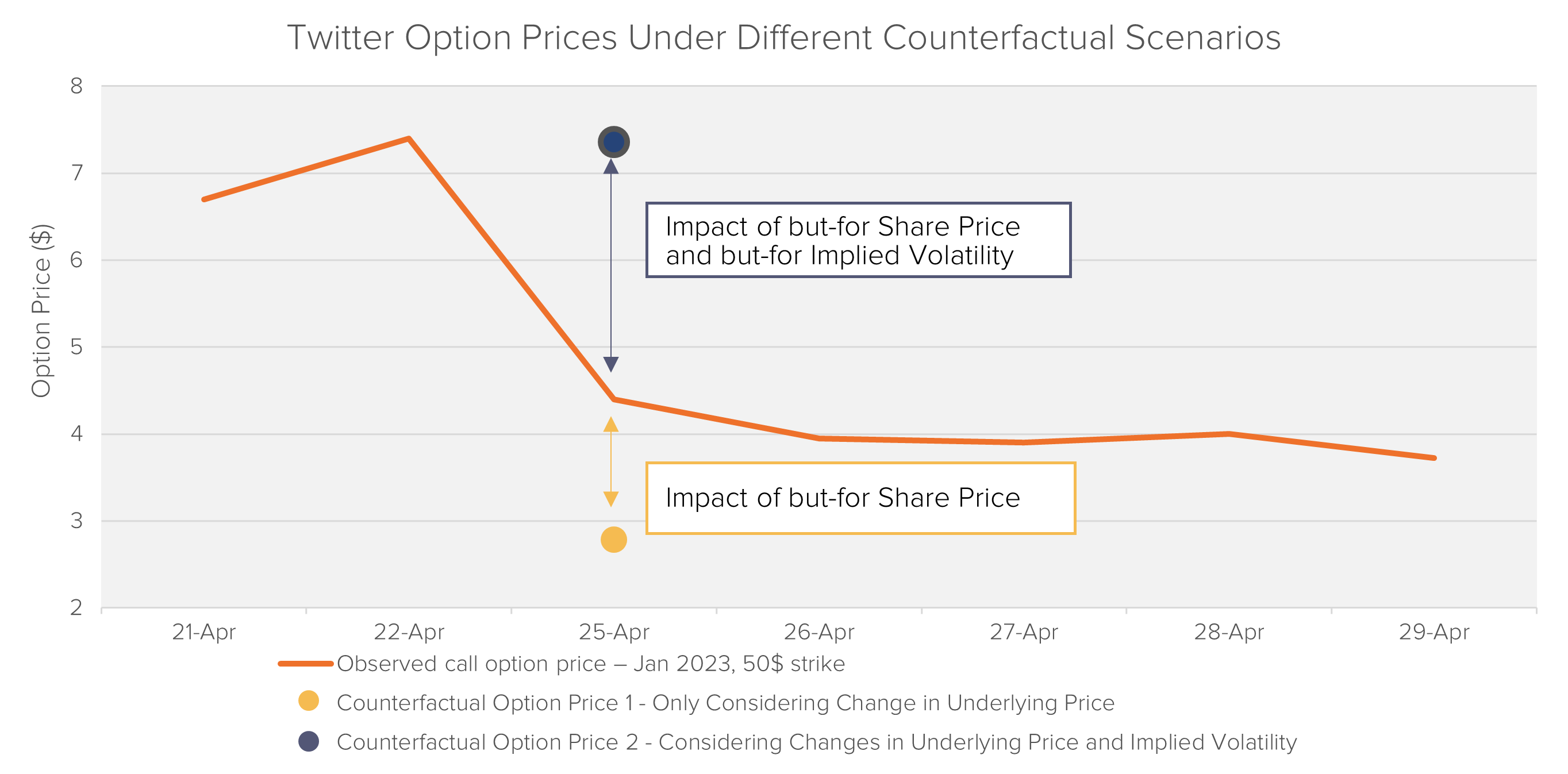

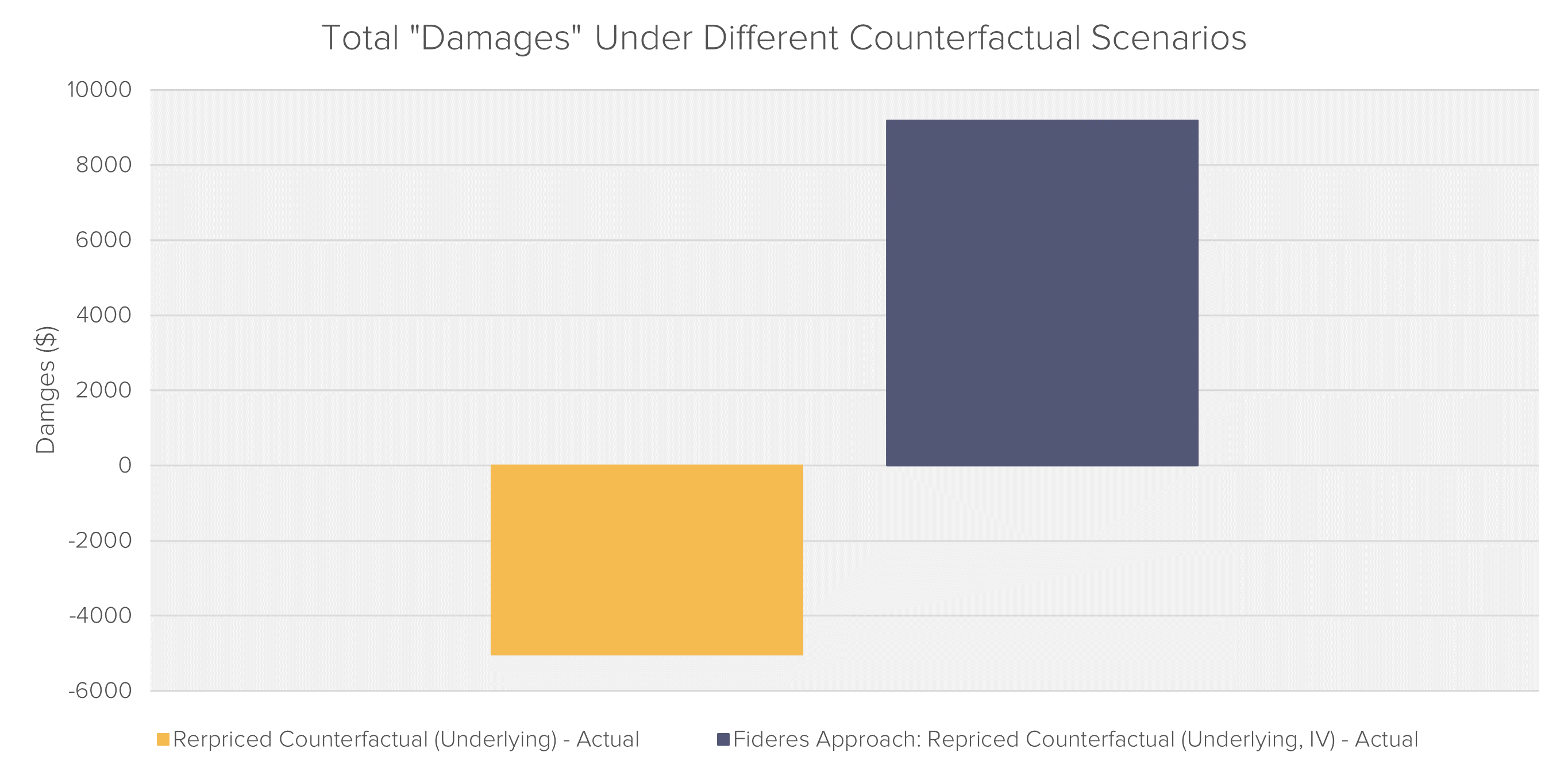

Consequently, for the purpose of estimating option damages, restricting analysis to the underlying share price impact may paint a misleading picture. As an example, if the statements of April 25th were found to be inaccurate, a quantum approach that focuses exclusively on the change in share price might conclude that call option prices were inflated by the statement and therefore buyers of call options were harmed, while sellers of call options had gained. In fact, when taking implied volatility into account it becomes clear that the opposite is true – call option prices were deflated, and sellers of call options were harmed while buyers gained.1 This is because the deflationary effect caused by the decrease in IV significantly outweighed the inflationary effects of the stock price change.

In conjunction with renowned option pricing expert Prof. Steve Heston, Fideres has developed a sound approach to estimate option damages, which is grounded in well-established academic literature The procedure accounts for both the impact of but-for stock prices as well as an estimate of but-for implied volatilities.

If you’d like to know more about our methodology and experience don’t hesitate to reach out to us – we will be happy to provide you with more information.

1 This is a simplified example for illustrative purposes only. No event study has been run to prove Twitter option or common stock holders were damaged by Twitter’s April 2022 acquisition announcement.

Michele joined Fideres in 2018, and is currently leading our financial litigation practice. Michele has worked on a number of financial projects, spanning from pre-filing to class certification and settlement allocation. His field of experience encompasses cases on benchmark manipulation, order-book spoofing, bid-ask spread inflation, commodity manipulation and cryptocurrency manipulation among others.

FedEx and UPS general rate increases: Collusion or conscious parallelism? Fideres investigates competition issues in the United States courier mark...

Could highly concentrated holdings lead to anticompetitive behavior?

Damages in 10b-5 claims.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330