Research

New York Taxi Medallions

Another rough ride for financial institutions?

The global leveraged loan market size, as of December 2019, was estimated to be approximately USD 1.4 trillion1. The outstanding amount of leveraged loans has almost doubled since the Global Financial Crisis. Lending standards have eroded with the share of covenant-lite loans increasing and a deterioration in credit quality.

Since 2008, the outstanding amount of leveraged loans has grown by approximately 80%2. At the same time, the quality of the loans has steadily declined:

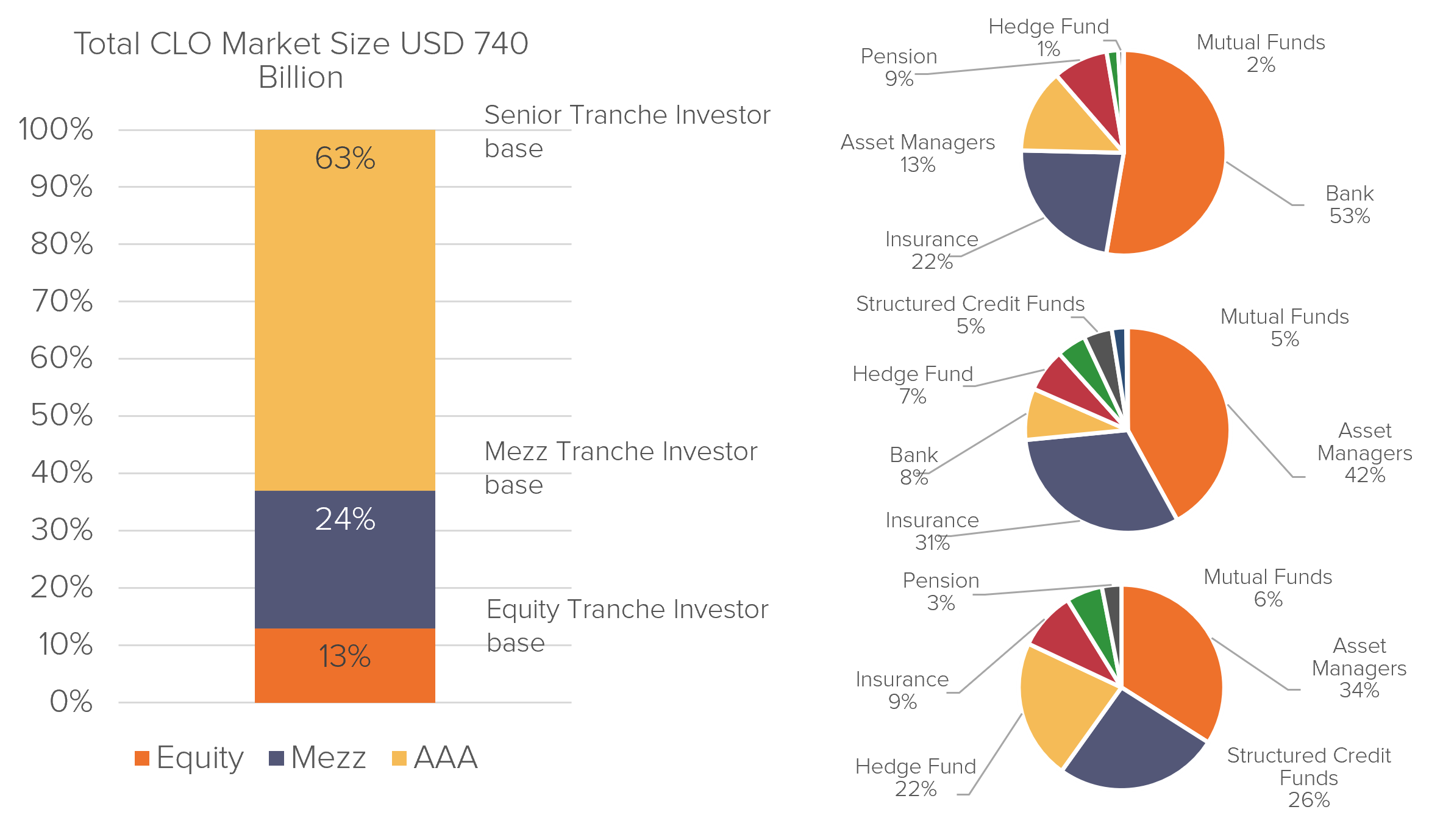

Depending on the tranche of bonds, there are different categories of investors involved in the CLO bond market:

In a recent report6, Fitch estimated that approximately 11.80% of loans held by CLOs are at high risk of default while 35.5% are classed as medium risk.

Leveraged loan default rates were relatively mild in the aftermath of the Global Financial Crisis as a result of the aggressive monetary easing central bank policies. Back in 2008, LIBOR represented 77% of the overall interest rate cost to borrowers. Now, that portion is only 32%. Therefore, even a reduction of interest rates will not make interest payments affordable to highly leveraged borrowers who are witnessing their revenues collapse.

As a result, we expect the current economic crisis to result in significantly higher default rates, and for a longer period of time, than what were observed during the Global Financial Crisis. Given the lower credit quality of the loans, and the prevalent covenant-lite nature of the loans originated in the last ten years, we also expect recovery rates to be significantly lower than historical ones.

Our scenario analysis assumes:

The table below summarises our expectations of losses for each tranche of CLO bonds.

| Loss Given Default = 40% | Loss Given Default = 50% | |||

| CLO Investor Tranches | Loss Amount (USD Billions) | Loss Rate | Loss Amount (USD Billions) | Loss Rate |

| Equity Tranche | 60 | 100% | 60 | 100% |

| BB Tranche Investors | 40 | 100% | 34 | 85% |

| BBB Tranche Investors | 12.8 | 32% | 0 | 0% |

| Total Loss for CLO Investors7 | 106.23 | 94 | ||

We expect to see the following litigation themes to emerge:

1 Differences in the criteria and thresholds applied by data providers to identify a leveraged loan leads to different estimates of the size and other characteristics of the market, even within the same jurisdiction; Source: https://www.fsb.org/wp-content/uploads/P191219.pdf

2 Bank of International Settlements, https://www.bis.org/publ/qtrpdf/r_qt1909.htm

3 S&P Leveraged Commentary & Data

4 Bank of England: https://www.bankofengland.co.uk/-/media/boe/files/financial-stability-report/2019/july-2019.pdf?la=en&hash=976688AB50462983447A8908BE079743A3E3905F

5 Bank of England: https://www.bankofengland.co.uk/-/media/boe/files/financial-stability-report/2019/july-2019.pdf?la=en&hash=976688AB50462983447A8908BE079743A3E3905F

6 Fitch Ratings: https://www.fitchratings.com/site/pr/10112736

7 We assume that USD 800bn across CLO tranches are outstanding; 1.6% average excess spread; typical CLO capital structure of 7.5% equity, 5% BB tranche and 5% BBB tranche and default rates jump to 15% in 2021 and 10.5% in 2021

8 Title IIIa of Regulation No 462/2013

9 Regulation No 462/2013 and Directive 2013/14/EU

In 2009, Alberto co-founded Fideres. As a partner, Alberto has mainly focused on developing market analyses and novel methodologies aimed at identifying anomalous or illicit behaviors such as: market manipulation, benchmark fixing manipulation, product mis-selling, anti-competitive conduct and discrimination conduct.

Since 2014 Alberto is the managing partner of Fideres Inc USA, Fideres’s US arm. Alberto has acted in an expert witness capacity in disputes involving banks and brokers, on one side, and institutional investors or consumers, on the other side. Examples of such disputes include mis-selling claims on complex financial derivative products and hedging solutions, LIBOR manipulation and fraud claims.

From 2005 to 2009, Alberto was head of Structured Products at the Royal Bank of Scotland in London, leading a team responsible for the structuring of synthetic credit derivatives products and customer driven solutions. In this capacity Alberto oversaw the development and execution of structured products such as CLOs, CDOs, credit default swaps, total return swaps.

From 2004 to 2005, Alberto led the Fixed Income team as Director, Head of Structuring at ABN AMRO. In this role, Alberto was responsible for the delivery of credit related solutions to institutional clients, for developing and executing regulatory capital and balance sheet solutions for global financial institutions, and for developing fund structure for the commercialization to private investors of structured products utilizing fund and insurance products platforms.

From 1997 to 2004, Alberto was at the UBS Limited as Fixed Income. Between 2003 and 2004 Alberto was Global Head of Structuring. In this role, Alberto led a team responsible for the Interest Rates and Credit Derivative Structured Products Desk.

Alberto began his career in New York, where he joined Credit Agricole in 1996 as an Associate in the Structured Products team.

Alberto holds two engineering Masters Degrees: from Ecole Centrale Paris, France and the Polythecnic of Turin, Italy. Alberto is fluent in Italian, French and Spanish.

Another rough ride for financial institutions?

Key Points Fideres’s original investigation uncovers widespread discriminatory conduct in the market for household gas/electricity – affect...

Fideres launches online event study platform.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330