Research

ETFs: Small Fees, Big Issues

Inefficiencies and potential competition issues.

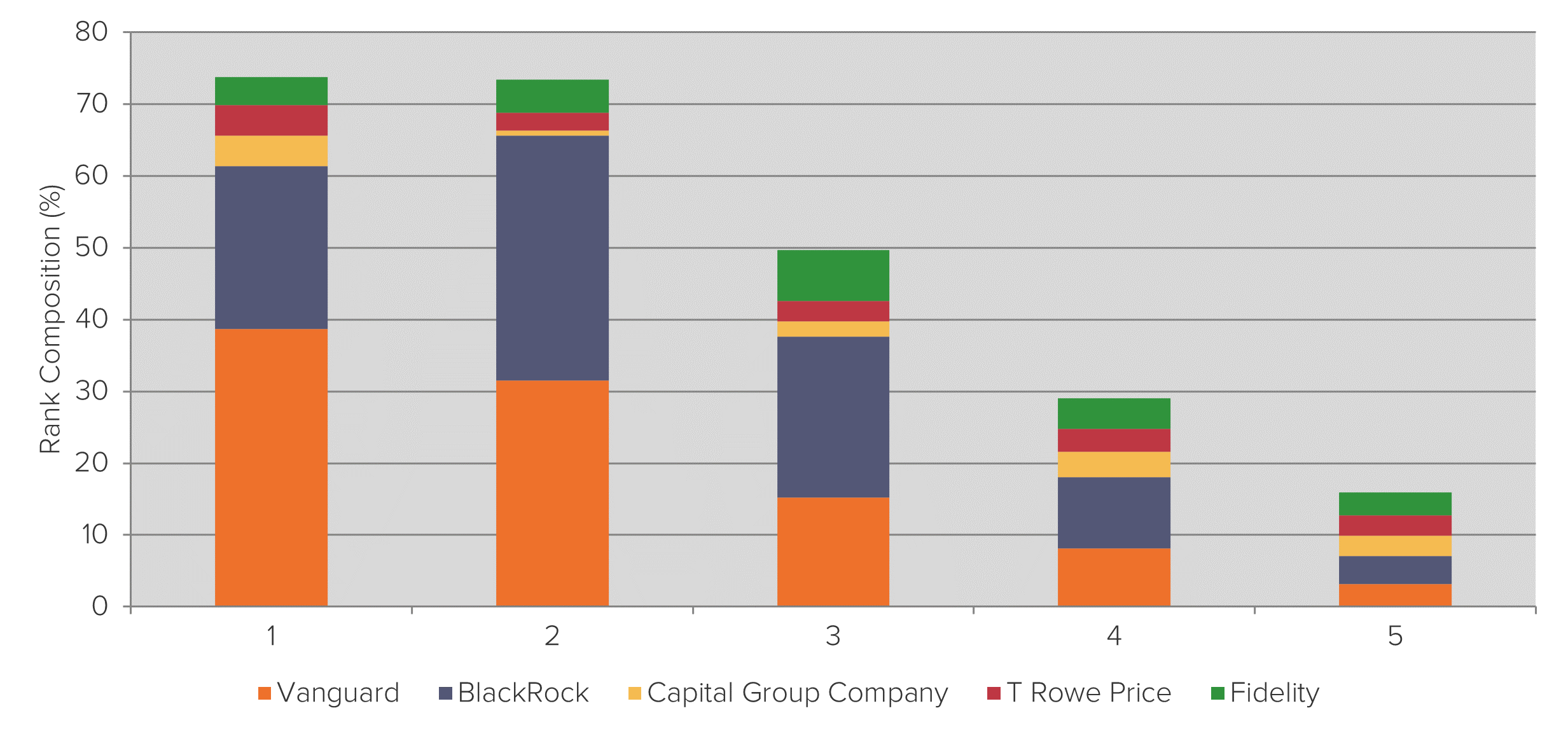

Fideres’s recent study of the U.S. equity stock market has shown that a small number of fund management companies are the top shareholders in an overwhelming majority of listed companies. For example, among companies listed in the Dow Jones US financials index, one of the same five fund managers are the largest shareholder over 70% of the time.

The level of shareholder concentration raises concerns about the level of effective competition that exists between the products and services offered by these companies.

Fideres’s analysis has also shown a high degree of concentration due to cross holding in a variety of other sectors. The effect is also likely to exist in other markets beyond the United States. An inhibiting effect on competition can emerge directly (e.g., through the exercise of voting rights) or indirectly, through the fiduciary responsibilities of corporate management. This may not in and of itself amount to an outright breach of antitrust laws. Of course, litigation is based on case-by-case evidence of collusive behavior.

Regardless, the incentives to non-competition that this market structure creates deserve further scrutiny. It seems likely that this form of indirect market concentration will come increasingly to the fore in new antitrust litigation. The US Justice Department has recently begun examining whether shareholder concentration played a role in the anti-competitive practices currently under investigation in the airline industry.

Sectors characterized by a high degree of market share concentration and ownership concentration are most likely to be suffering from an anti-competitive environment due to this effect.

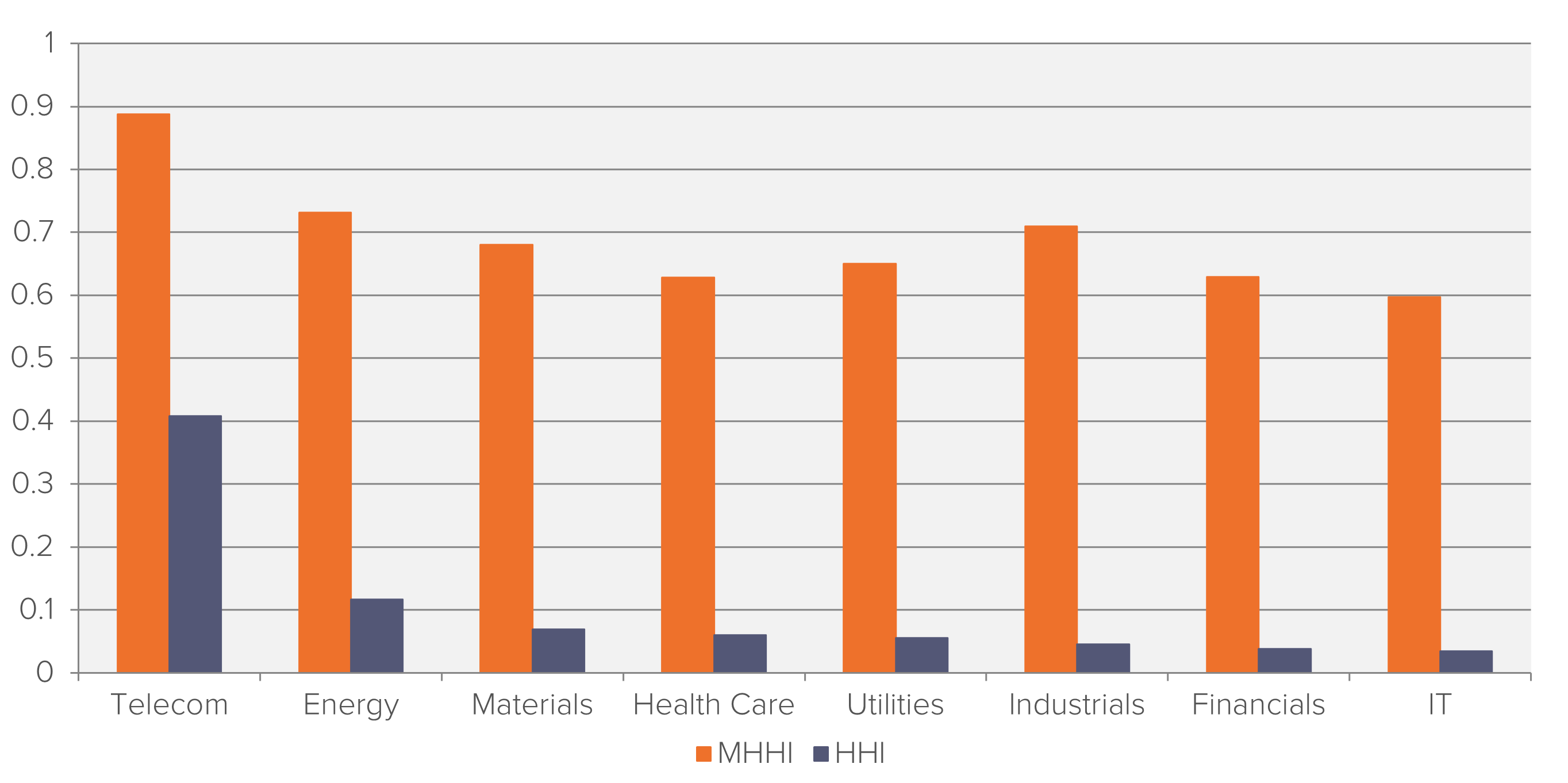

A Herfindahl-Hirschman Index (HHI) is widely used to gauge the degree of concentration within an industry. It assumes no common ownership.

The phenomenon of market concentration when companies are individually owned is a well-understood area of economic theory. But when potentially competing businesses have common shareholders, the magnitude of concentration becomes more insidious and difficult to quantify.

To measure it, Fideres has calculated a modified Herfindahl-Hirschman Index (MHHI) for each of the GICS sectors and subsectors represented in the S&P 500. MHHI quantifies concentration according to the degree to which companies in a sector are owned by the same shareholders. Both indexes give a sense of market concentration, but the difference between the two (ΔMHHI) can be taken as the degree to which concentration is the result of cross-holding.

MHHI exceeds HHI by a large margin, suggesting that within this sample a substantial amount of market concentration exists in the form of cross-holding.

The most overtly-concentrated sector in terms of HHI is telecommunication services, but industrials has much larger delta MHHI. The apparent diversity of this sector is belied by the hidden concentration in ownership.

In 2009, Alberto co-founded Fideres. As a partner, Alberto has mainly focused on developing market analyses and novel methodologies aimed at identifying anomalous or illicit behaviors such as: market manipulation, benchmark fixing manipulation, product mis-selling, anti-competitive conduct and discrimination conduct.

Since 2014 Alberto is the managing partner of Fideres Inc USA, Fideres’s US arm. Alberto has acted in an expert witness capacity in disputes involving banks and brokers, on one side, and institutional investors or consumers, on the other side. Examples of such disputes include mis-selling claims on complex financial derivative products and hedging solutions, LIBOR manipulation and fraud claims.

From 2005 to 2009, Alberto was head of Structured Products at the Royal Bank of Scotland in London, leading a team responsible for the structuring of synthetic credit derivatives products and customer driven solutions. In this capacity Alberto oversaw the development and execution of structured products such as CLOs, CDOs, credit default swaps, total return swaps.

From 2004 to 2005, Alberto led the Fixed Income team as Director, Head of Structuring at ABN AMRO. In this role, Alberto was responsible for the delivery of credit related solutions to institutional clients, for developing and executing regulatory capital and balance sheet solutions for global financial institutions, and for developing fund structure for the commercialization to private investors of structured products utilizing fund and insurance products platforms.

From 1997 to 2004, Alberto was at the UBS Limited as Fixed Income. Between 2003 and 2004 Alberto was Global Head of Structuring. In this role, Alberto led a team responsible for the Interest Rates and Credit Derivative Structured Products Desk.

Alberto began his career in New York, where he joined Credit Agricole in 1996 as an Associate in the Structured Products team.

Alberto holds two engineering Masters Degrees: from Ecole Centrale Paris, France and the Polythecnic of Turin, Italy. Alberto is fluent in Italian, French and Spanish.

Inefficiencies and potential competition issues.

FedEx and UPS general rate increases: Collusion or conscious parallelism? Fideres investigates competition issues in the United States courier mark...

Fideres launches online event study platform.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330