Research

COVID-19 Travel Tests Investigation

Unavailable and inaccessible.

Real estate investment trusts (“REITs”) are companies that own and operate real estate or real estate debt to generate income. The majority of REITs focus on a particular type of real estate, such as healthcare, retail, or industrial properties.

REITs can be further divided into private and public REITs. Both types of REITs are registered with the SEC and file regular reports. However, public REITs are listed on an exchange (such as the NYSE or NASDAQ) and can be traded like stocks whereas private REITs are not. Investing in a private REIT comes with different risks than investing in a publicly traded REIT1, and the NAV of a private REIT is heavily dependent on assumptions and valuation methodology set by its advisors as opposed to market dynamics. Both public and private REITs commonly employ leverage, which entails borrowing funds to acquire assets beyond the capital raised. Consequently, a REIT’s NAV is calculated as the difference between the value of its assets and the value of its liabilities.

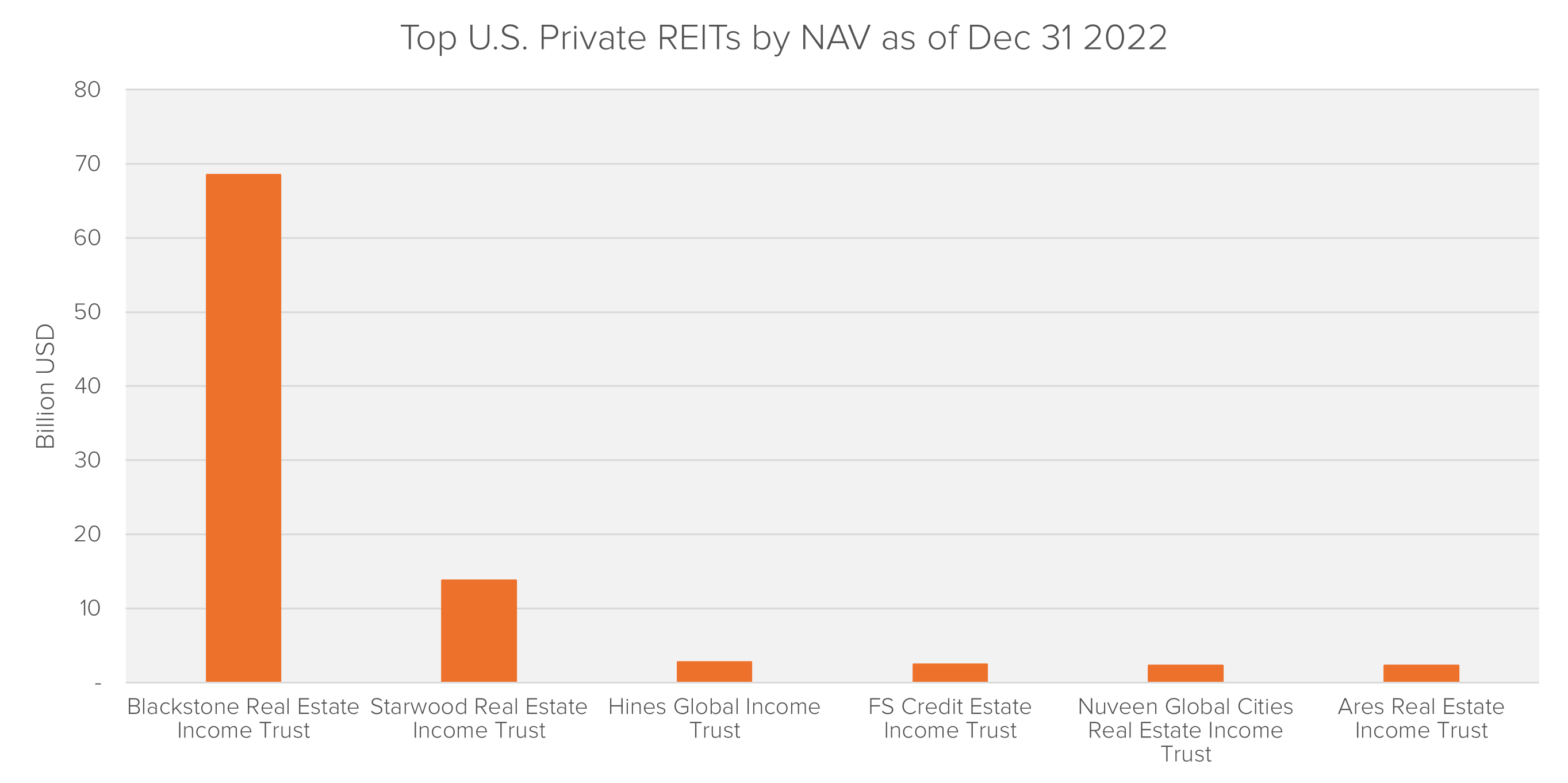

According to the National Association of REITs (“NAREIT”), US REITs own over $4.5 trillion in gross assets, of which approximately $3 trillion are owned by public REITs. As of the end of 2022, US public REITs have a total market capitalization of over $1.3 trillion2. Blackstone Real Estate Income Trust (“BREIT”) is by far the largest private REIT, with an NAV of $69.7 billion as of March 31, 2023.

Private v. Public REITs

Private v. Public REITsCompared to public REITs, private REITs typically charge higher fees and are less liquid. The table below details the key differences between public and private REITs.

| Investment Characteristic | Publicly Traded REITs | Non-traded REITs |

| Liquidity | Shares are publicly traded on major stock exchanges, primarily on the NYSE. | Share redemption programs differ among companies and have certain limitations. Typically, there is a minimum holding period for investments. Investors' exit strategies usually involve either mandatory liquidation after a specified period, such as 10 years, or the listing of the stock on a national stock exchange. |

| Transaction costs | Brokerage costs – as for any other listed equity. | Usually, broker-dealer commissions and other upfront costs amount to approximately 10-15 percent of the investment. Ongoing management fees and expenses are common, and there may also be back-end fees involved. |

| Management | Typically self-advised and self-managed. | Typically externally advised and managed. |

| Minimum Investment Amount | One share. | Typically above $1,000-$2,000. |

| Performance Measure | There are numerous independent performance benchmarks available to track the listed REIT industry. Additionally, the public has access to a wide range of analyst reports. | No independent source of performance data. |

Since its inception in 2017, BREIT has dominated the U.S. private REIT market. In 2022 alone, BREIT raised over $20.8 billion in new capital commitments, invested in $35 billion worth of new opportunities and generated over $1.5 billion in fees for its external adviser Blackstone, a publicly listed company.

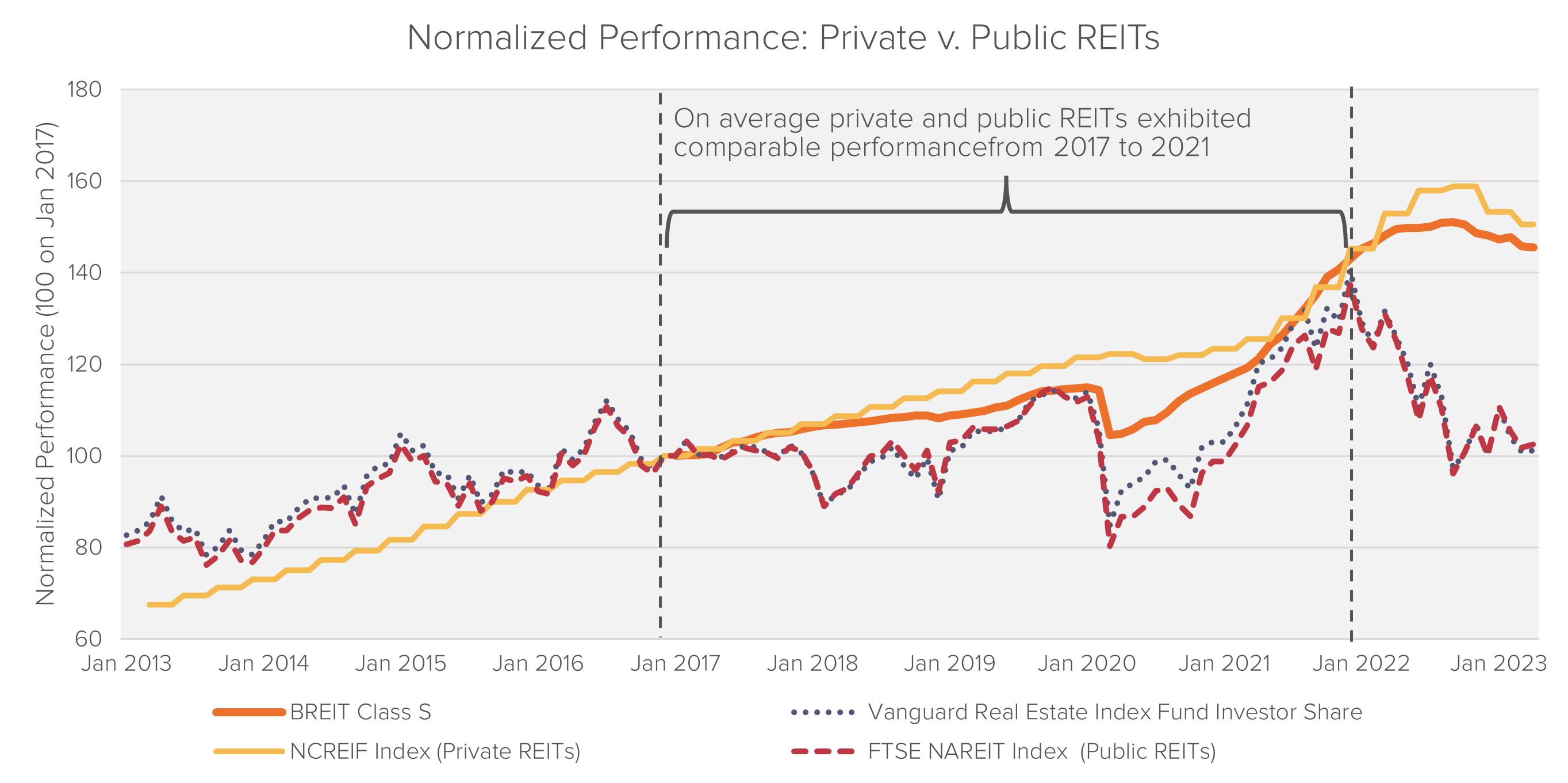

U.S. REITs have seen substantial returns since 2010 due to declining interest rates and a low-interest rate environment. Since inception, BREIT’s performance aligned with public REITs, until 2022 when it’s annual growth in NAV per share outperformed average public REITs’ price return by 30-40%.

Since December 2022, Blackstone consistently defended the valuation of its NAV by highlighting that the public REIT market represents only 8% of the commercial real estate market, and is not representative of the assets held by BREIT. In particular, they point out that BREIT invested in residential properties located in high-growth areas and implemented strategies to hedge against inflation, which allowed it to outperform the market, and that public REITs may be undervalued. This, however, did not prevent investors from initiating unprecedented redemption requests.

Since December 2022, Blackstone consistently defended the valuation of its NAV by highlighting that the public REIT market represents only 8% of the commercial real estate market, and is not representative of the assets held by BREIT. In particular, they point out that BREIT invested in residential properties located in high-growth areas and implemented strategies to hedge against inflation, which allowed it to outperform the market, and that public REITs may be undervalued. This, however, did not prevent investors from initiating unprecedented redemption requests.

Like other private REITs, BREIT possesses the freedom to undertake risks that are typically not accessible to retail mutual funds. This is evident in the extensive risk factors outlined in BREIT’s prospectus, which spans a remarkable 90 pages3. In contrast, the largest actively managed real estate mutual fund, Cohen & Steers Real Estate Securities (CSEIX), merely features five pages of risk factors in its prospectus4.

The significant disparity between BREIT’s NAV per share and that of comparable public REITs can be attributed to two major inherent issues: the lack of liquidity and transparency in share value.

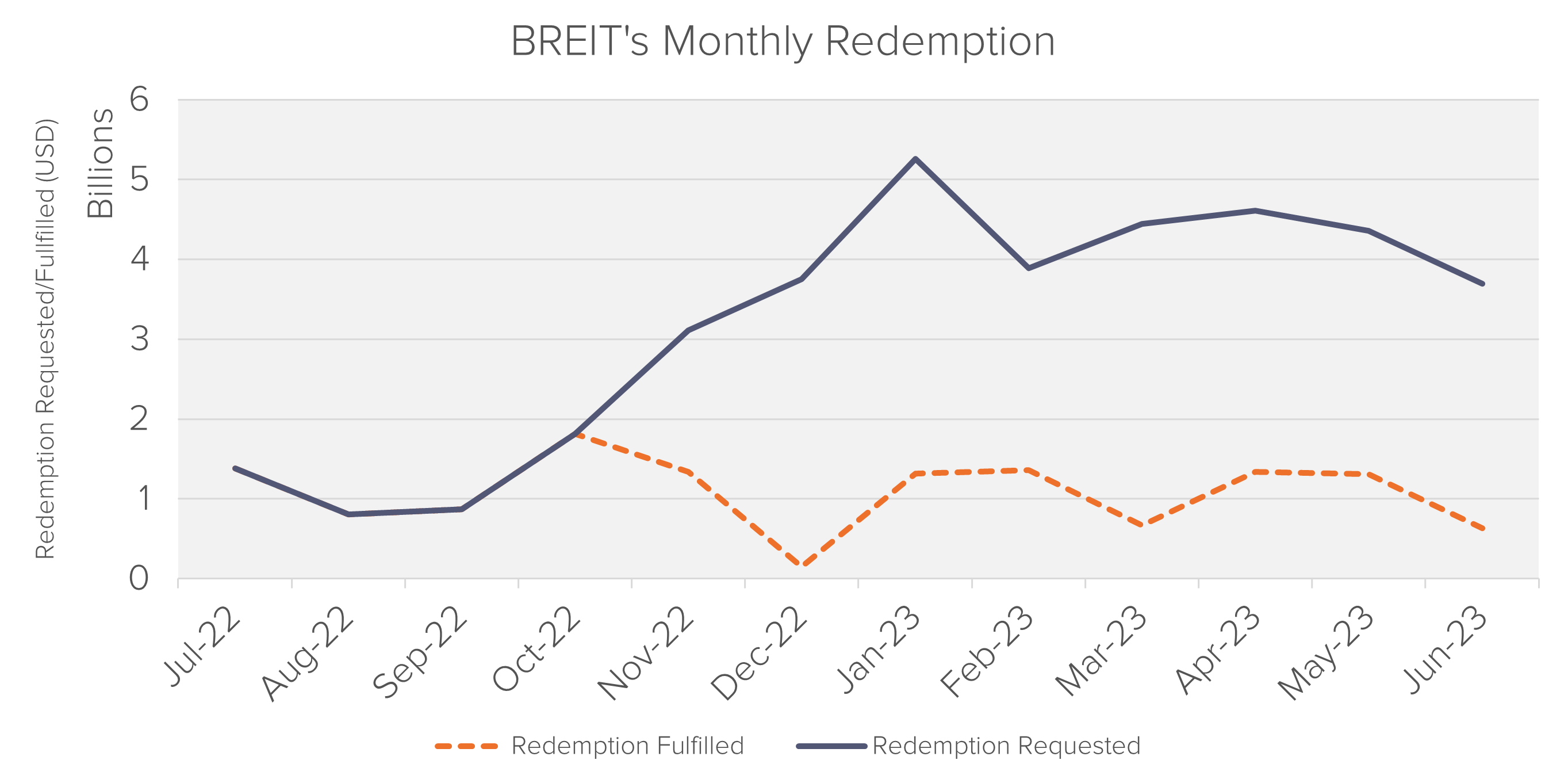

Investor interest in BREIT soared partly because of its relatively frequent monthly redemption option. Although BREIT has the right to restrict redemptions to 2% of NAV per month and 5% of NAV per quarter, it refrained from implementing these limitations until December 2022 when it halted redemptions for seven consecutive months. As of March 2023, the cumulative value of unmet redemption requests could have reached as high as $10-20 billions5.

In private REITs, the valuation of real estate assets is often determined using a Discounted Cash Flow (DCF) model. Such valuations are typically “not governed by governmental or independent securities, financial or accounting rules or standards.”6 BREIT, for instance, relies on this approach, wherein its adviser makes assumptions about discount rates, exit capitalization rates7, Net Operating Income (NOI) growth rates8 and average holding period to estimate the NAVs of various types of holdings. From BREIT’s limited disclosures in its monthly form 424(b)(3), it appears that the only objective input in its DCF model is the current NOI.

| BREIT NAV Calculation Inputs | Disclosed? | Objective? |

| Discount Rates | Yes | No |

| Exit Capitalization Rates | Yes | No |

| NOI Growth Rate | No | No |

| Asset Holding Period | No | No |

| Current NOI | Yes | Yes |

To bolster the defense of BREIT’s NAV per share, it would be logical to provide a comprehensive explanation of the selection process for each input in the DCF model. However, Blackstone has opted for limited transparency by refraining from disclosing detailed information, simply stating that the assumptions used are conservative in comparison to those employed by other private REITs.

The compensation paid to Blackstone (BREIT’s affiliated adviser) is divided into two types of fees: management fees, and performance participation fee9. Both fees depend directly, and exclusively on NAV. In particular, the former is computed as 1.25% of NAV, while the latter is computed as “12.5% of the annual Total Return, subject to a 5% annual Hurdle Amount and a High Water Mark, with a Catch-Up”10.

Blackstone’s choices of assumptions (which are neither audited nor governed by accounting standards) determine not only the sale and repurchase price of BREIT, but also its own compensation, creating a text-book example of conflict of interests.

To the extent that it emerges that Blackstone inflated BREIT’s NAV (or growth in NAV), BREIT’s shareholders will likely consider legal actions to seek compensation for their losses.

According to BREIT’s monthly form 424(b)(3), its NAV is highly sensitive to small changes in the assumptions applied in the DCF model. For example, as of December 31, 2022, a 25bps increase in the exit capitalization rate would decrease the NAV by 2.8% (or approximately $2 billion)11.

Our initial analysis indicates that even slight adjustments to more than one assumption outlined in Section 2.2 could significantly impact BREIT’s NAV. Some market participants suggest that the published NAV of BREIT as of December 31, 2022 may be more than double of its true value12. BREIT investors may wish to recoup any overpayment made in relation to their share purchases and/or the overpayment in management fees deriving from an inflated NAV. The table below shows the potential extent to which BREIT’s shareholders may have overpaid in management fees alone in 2022:

| Assumption of Over-valuation | Potential Overpayment in Management Fees in 2022 (USD) |

| 10% | 75 mil |

| 20% | 140 mil |

| 30% | 190 mil |

Blackstone’s earnings greatly rely on the management and performance fees generated by BREIT. Therefore, any misconduct by Blackstone in the calculation of BREIT’s NAV is expected to have a profound impact on Blackstone’s future earnings.

Furthermore, the recent UC Investments deal raises doubts about whether Blackstone’s actions are aligned with the long-term benefit of its shareholders. In this transaction, Blackstone provided a guarantee, backed by its own $1 billion holdings in BREIT, ensuring that UC Investments would receive a minimum annual return of 11.25% for a fixed term of six years on their $400 million purchase of BREIT’s Class I shares13.

1 https://www.sec.gov/resources-investors/investor-alerts-bulletins/non-traded-reits

2 https://www.reit.com/data-research/data/reits-numbers

3 https://www.sec.gov/Archives/edgar/data/1662972/000119312516701077/d57958d424b3.htm

4 https://connect.rightprospectus.com/cohenandsteers/TADF/191912104/P?site=MF

5 Note that BREIT does not report the amount of cancelled redemption requests each month.

6 https://www.sec.gov/Archives/edgar/data/1662972/000119312516701077/d57958d424b3.htm

7 The exit capitalization rate is the rate used to estimate the resale value of a property at the end of the holding period.

8 NOI determines the revenue and profitability of real estate property after subtracting necessary operating expenses.

9 Note that the management fees paid in BREIT shares are not subject to any redemption limitations.

10 For further details, see https://www.sec.gov/Archives/edgar/data/1662972/000119312516701077/d57958d424b3.htm

11 https://www.sec.gov/ix?doc=/Archives/edgar/data/0001662972/000166297223000030/breit-20221231.htm

12 https://chiltonreit.com/2023/04/01/arbitrage-opportunity-available-in-public-reits-april-2023/

13 https://www.sec.gov/Archives/edgar/data/1662972/000166297223000005/breitnavdecember2022.htm

Robert Chang, Head of Fideres’s Securities Litigation practice, is a financial market expert with extensive and broad-ranging experience in the areas of securities, commodities, derivatives and structured finance.

Since joining Fideres in 2014, Robert has been instrumental in helping institutional and retail investors to recover billions for his consulting and expert testifying work in over 30 landmark financial market investigations and litigations. His most recent successes include a $508 million partial settlement in the ISDAfix interest rate benchmark class action and a €1.4 billion settlement of securities fraud claims against Steinhoff International Holdings NV (second largest against a European issuer accused of securities fraud).

Robert’s team help law firms, regulators and investors across the globe in litigations and other disputes, from the initial claim filing, through dismissal, discovery, expert testimony and settlement. On his team, Robert is often the main architect for groundbreaking analyses and models used in key filings and testimonies.

Robert completed his MSc in Risk Management and Financial Engineering at Imperial College with distinction. Prior to this, he obtained a BSc Economics degree with distinction from Shanghai University of Finance and Economics.

Unavailable and inaccessible.

Fideres replicates ESMA’s study on closet indexers.

Fideres investigates algorithmic mortgage discrimination in the US.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330