Research

Australian Gas Market – Troubles Ahead?

An investigation of the Australian natural gas market.

The damages analysis comprises three key steps:

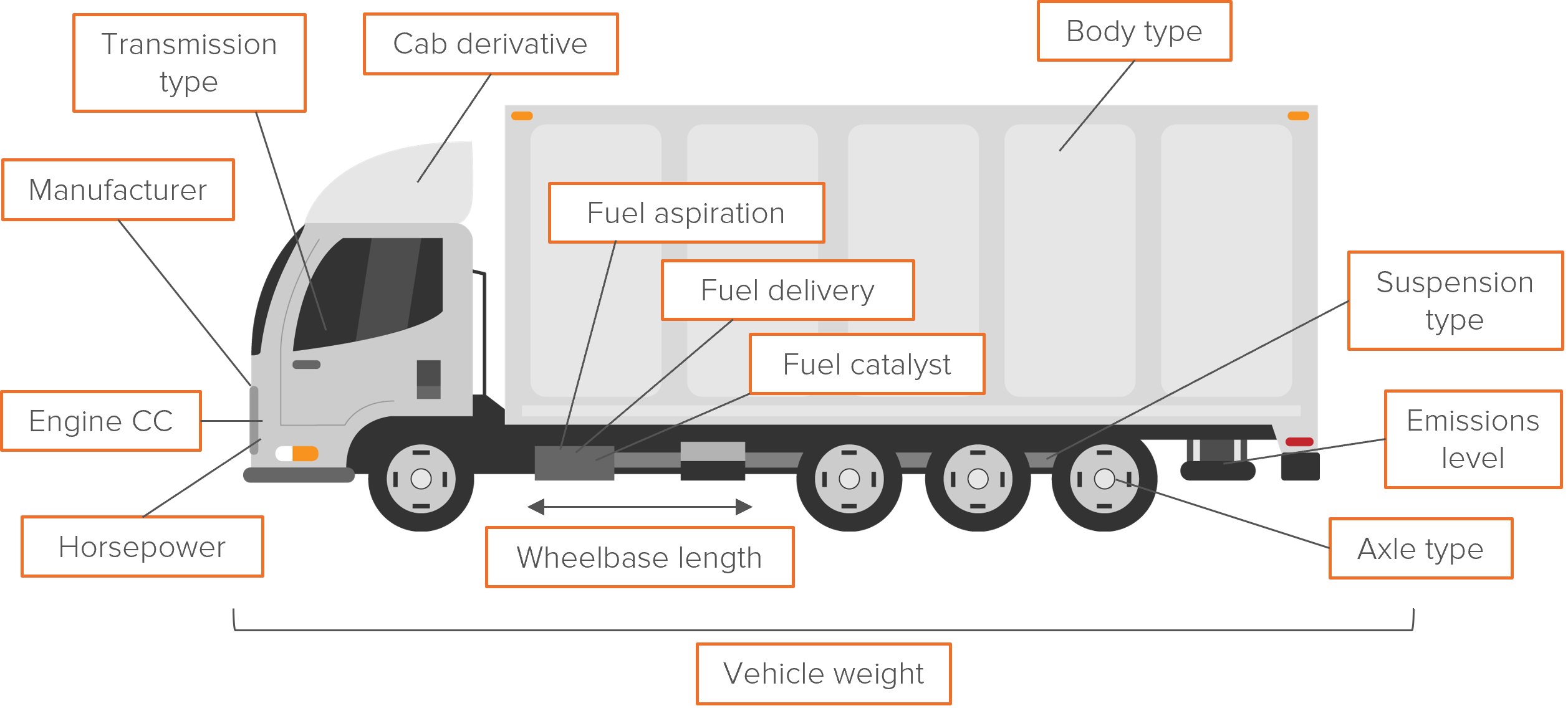

As outlined above, the damages analysis requires the calculation of but-for prices. Fideres has obtained access to a highly granular database of historical trucks prices which will allow us to calibrate the but-for pricing model. The data is broken down by the following specifications:

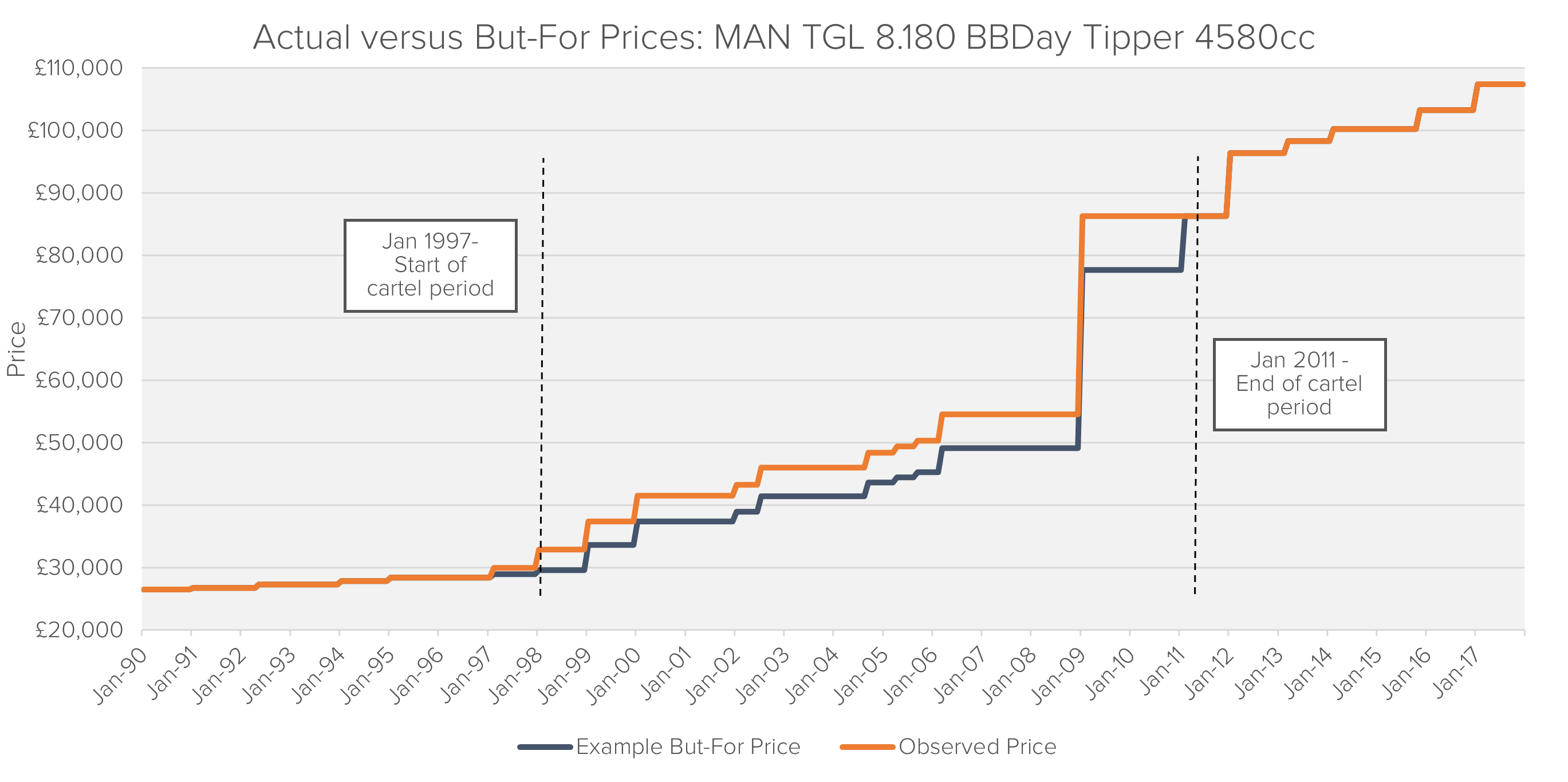

The dataset covers the period 1990 to 2017 and contains 30,200 historic Cost New Prices across over 3,000 distinct new Heavy Commercial Vehicle models in the over 6 tonne category. The major benefit of this dataset is that it includes a significant amount of pre- and post-cartel period data. The trucks cartel was in effect for the years 1997 to 2011. This means that we have seven years of pre-cartel prices and 6 years of post-cartel prices against which we can compare the observed and modelled cartel-period prices.

The high level of detail in the dataset not only allows us to model statistically robust but-for prices, but also enables us to calculate highly specific damages estimates which can be applied directly to the claimant’s exact fleet.

Using historical prices and truck specification data, we can estimate the effect of the cartel on the price of any truck. Regression analysis allows us to express the observed price (P) as a function of a number of factors which would affect price, such as the manufacturer, engine size, the costs of production, including a variable to indicate the years of the cartel, as follows:

P = α + β1 Engine_Size + β2_Manufacturer + … + β3_Production_Cost + β4_Cartel_Period + ε

Using the regression above, it is possible to estimate the impact of the cartel on the price of trucks during the cartel period. The effect of the cartel is then subtracted from the observed price in order to determine the but-for price. In the illustrative chart below, the difference between the actual price (in red) and the but-for price (in blue) represents the price effect of the cartel.

Damages can be direct (outright purchases) or indirect (e.g. leases). For outright purchases, the but-for price is subtracted from the actual price of each individual truck in the claimant’s fleet at the time that it was purchased in order to obtain a total overcharge. Direct damages are then calculated as the overcharge on each truck, multiplied by quantity purchased.

In the case of indirect purchases – e.g. financial lease, hire purchase or operational lease arrangements – interest and other payments are higher than they would have been since they are based on an inflated notional amount. Using the estimated but-for prices, each component of the lease payment can be recalculated based on this new, lower notional. Indirect damages are therefore the difference between the sum of original lease payments and the sum of lease payments based on the but-for price, multiplied by the number of lease agreements entered into. It is also possible that the claimant may have passed on some of the price increases to their own customers downstream. In this case, the extent of the pass-though can be calculated using regression analysis and subtracted from the final damages analysis.

Max joined Fideres in 2016. He has led the development and implementation of economic models for major collective actions in the US and the UK, contributing to litigation on a variety of topics. His reports and econometric work has been included in cases for conduct including, among others, the FX and LIBOR benchmark manipulation, digital market monopolisation by Apple and Amazon, and consumer claims against a cartel of US generic drug manufacturers, abuse of market power by large regional US hospital systems, restriction of the right to repair by John Deere, and the combined abuse of dominance by Visa and Mastercard in UK payment systems. Before joining Fideres, Max worked at the national laboratory in Los Alamos, New Mexico, as part of a team designing neural networks for applications in machine learning. Max holds an MSc in Economic History from the London School of Economics.

An investigation of the Australian natural gas market.

Trends in US antitrust litigation.

Why the status quo poses risks to competition.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330