Research

European Trucks Cartel

A preliminary damages model.

Options give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified strike price, prior to or on a specified expiration date (maturity). The price for buying an option is called the premium. The market for options, both in terms of premia and the traded value of contracts, has a volume of billions of dollars and continues to grow:

Option values are particularly sensitive to changes in market conditions. Sophisticated pricing models have to be used to quantifying these effects. The following inputs, ordered by importance for the vast majority of option contracts, are most relevant: underlying stock’s price, market’s expectation of future volatility (so-called implied volatility), underlying’s historical volatility, time to maturity, interest rates and dividends.

New market information can materially affect these factors, especially the stock’s price and the implied volatility. The table below provides an example of how small changes in share prices and implied volatilities have large impacts on the price of put and call options.1 These figures refer to an option with a maturity of six months and strike price of $100.

| Share Price | Implied Volatility | Call Option Price | Put Option Price |

| $ 100 | 20% | $ 6.63 | $ 5.08 |

| $ 110 | 20% | $ 13.70 (+107%) | $ 1.72 (-66%) |

| $ 90 | 20% | $ 2.22 (-66%) | $ 10.24 (+102%) |

| $ 100 | 30% | $ 9.39 (+42%) | $ 7.84 (+54%) |

Both sellers and buyers of options can suffer damages in securities fraud cases. Total option premia of large companies amount to hundreds of millions of dollars. This table summarizes option premia and trading volumes for selected companies that are currently defendants in 10b-5 class actions:

| Company | Case | End of class period (month) | Transactions in month at end of class period (thousands)2 | Total premiums in month at end of class period |

| ($ billions)3 | ||||

| Violation of Own Data Privacy Policies | July | 1,361 | 5 | |

| 2018 | ||||

| Goldman Sachs | Misleading Publication of Financial Condition | April | 1,316 | 4.72 |

| 2010 | ||||

| Tesla | Misleading "Funding Secured" Tweet | August | 1,204 | 4.32 |

| 2018 | ||||

| Misleading Statements About Business Prospects | July | 648 | 2.32 | |

| 2015 | ||||

| Alibaba | Dubious or Illegal Business Practices | January | 603 | 2.16 |

| 2015 | ||||

| Exxon Mobil | False Reports on Climate Change Recognition | January | 212 | 0.76 |

| 2017 | ||||

| Johnson & Johnson | Asbestos in Baby Powder | December | 191 | 0.69 |

| 2018 |

Note that these figures are based on an average premium of $432 per contract and an average of 8.3 contracts per transaction, drawn from the December 2018 Options Clearing Corporation report.

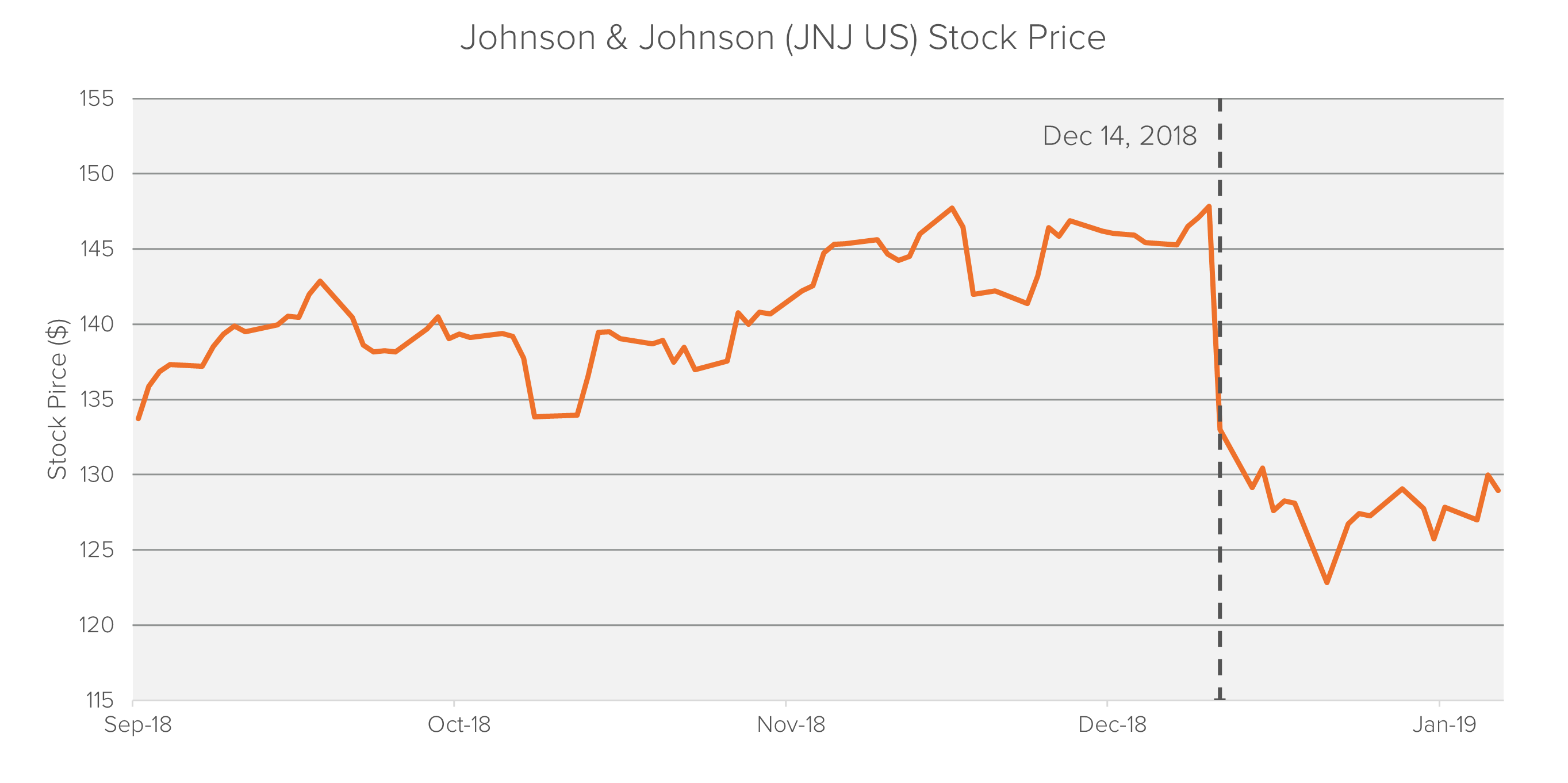

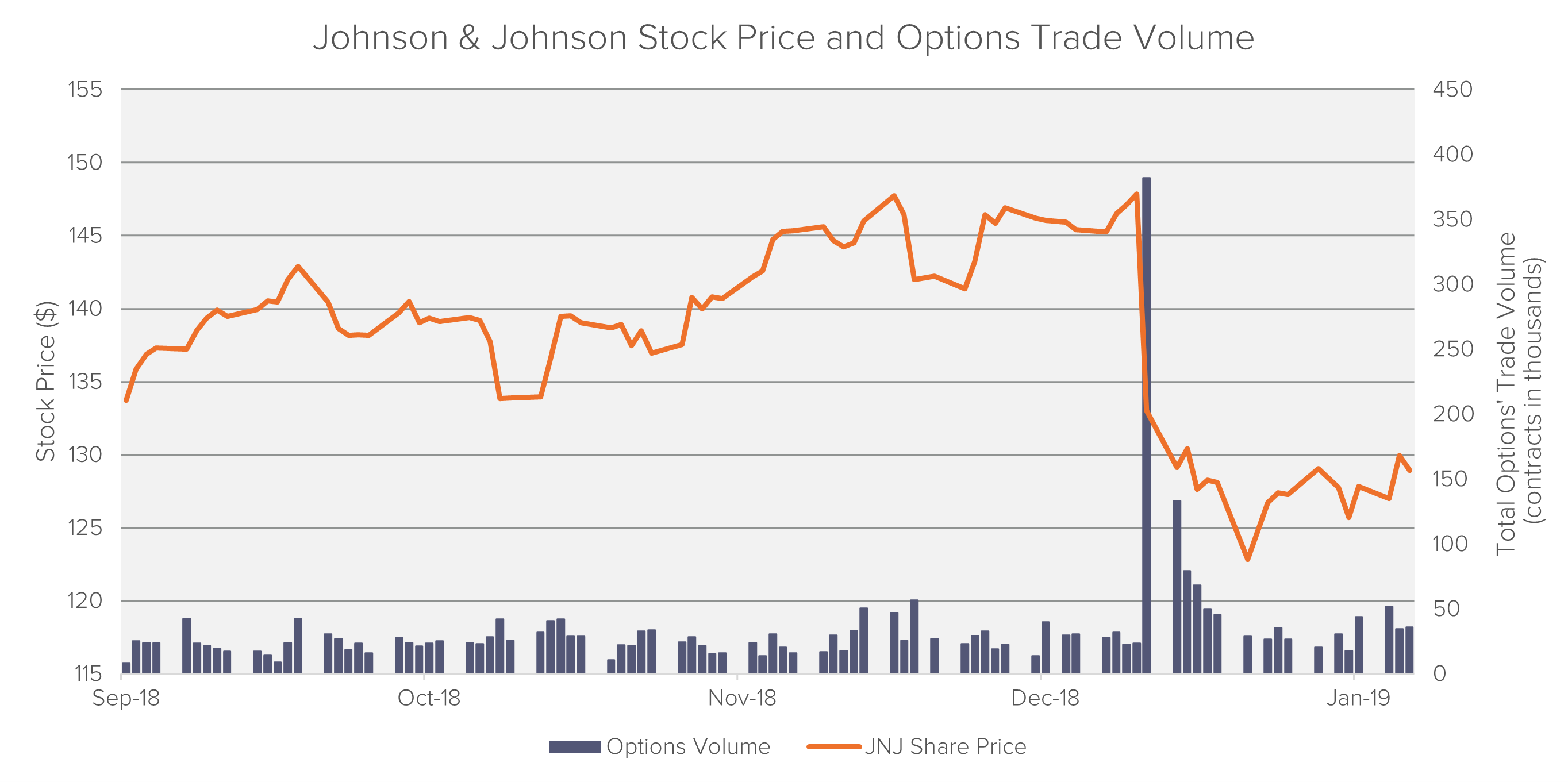

This example shows the effect on option positions particularly clearly. In December 2018, Reuters reported that “Johnson & Johnson knew about asbestos in its baby powder for decades”.4 JNJ share price dropped precipitously as soon as the news broke:

Option positions were heavily affected by this decline in share price.

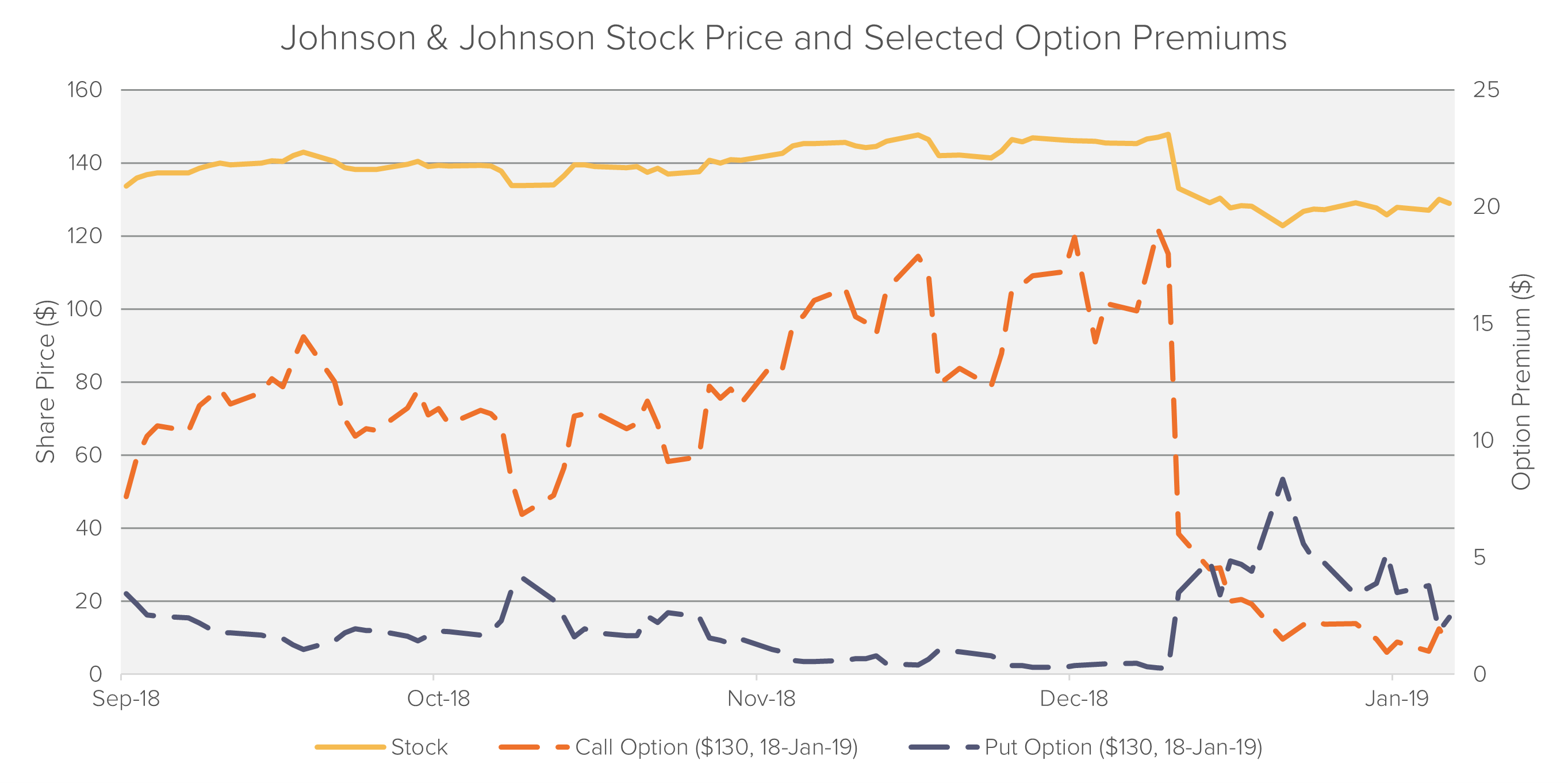

Bloomberg lists 7760 different available/traded option contracts for Johnson & Johnson in December 2018. The following chart shows the price changes for two exemplary options that are both liquidly traded and significantly affected by the observed price drop in the stock:

Source: Bloomberg, Fideres’s Analysis

Source: Bloomberg, Fideres’s AnalysisAs illustrated, the call option lost approximately 75% (or $12) of its value per contract on December 14, 2018. The put option gained 1300% ($3.25) per contract that day. Premiums of put options and call options react inversely to changes in the share price, but from a perspective of trading strategies, a clients’ option portfolio is often either “long” or “short” on the underlying. Furthermore, as elaborated on in section 3, other market factors influence options values.

In addition to the 7760 different option contracts in December, further option premiums are affected by the event on December 14, since the class-period is longer than only a few weeks and the underlying equity’s price behavior was artificially distorted for a longer period.

Due to the non-linear, rather complicated scaling behavior of value changes in option positions, damages have to be calculated for specific option portfolios (or the portfolio of all open option contracts).

Damages on stock positions are calculated using event studies and by determining the share prices in a “but-for” world, where the relevant information was reflected in a timely manner. Option pricing models can be adapted to the event study framework and used to estimate damages on option positions in 10b5 claims. The following chart shows the calculation of “but-for” prices for the mentioned JNJ options (section 5) and the underlying stock:

The estimated “but-for” prices for options can be used to calculate damages incurred on portfolios that comprise of options and/or equity positions. Given the large volume of option positions, this approach significantly increases and better reflects the overall damages in 10b-5 cases.

1 Strike price of $ 100, maturity 6 month

2 According to the CBOE (http://www.cboe.com/data/historical-options-data/equity-option-volume)

3 Assumptions according to OCC report December 2018 applied: average premium per contract: $432, average contracts per transaction: 8.3 (https://www.theocc.com/webapps/monthly-volume-reports?reportClass=equity)

4 https://www.reuters.com/investigates/special-report/johnsonandjohnson-cancer

Steffen is a founding partner of Fideres with over 21 years’ experience in structured products and complex derivatives across all major asset classes. Steffen is responsible for the quantitative analysis of consulting mandates and has handled various complex benchmark manipulation cases, including LIBOR and ISDAfix, and cases relating to the mis-selling of structured product and derivatives. Prior to founding Fideres, he held a senior position at The Royal Bank of Scotland were he moved to after working for 5 years at Deutsche Bank. Steffen holds a master-level degree in Mathematics from the University of Erlangen, the Certificate of Advanced Studies in Mathematics (Part III) from the University of Cambridge and an MSc in Financial Engineering and Quantitative Analysis from the ICMA Centre at the University of Reading.

A preliminary damages model.

No – It was the picture of fairness.

Fideres Study Finds Ofcom May Have Allowed Voice-Only Landline Providers to Overcharge Elderly Consumers.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330