Research

NAVgate In The Private REIT Space

Issues with Fund Valuations may yield to future litigation.

Title insurance protects homebuyers against disputes arising over ownership of property. Title insurers use records and public documents to verify that sellers are the legal property owners and collect a fee in exchange for an obligation to pay costs should a dispute arise. In 2017, the total amount of title insurance premiums paid in the US was approximately $15 billion.

There are two types of title insurance: the lender’s policy (which protects the lender up to the loan amount), and the owner’s policy (which protects the property buyer up to the property price). In most cases, the buyer pays for both policies.

Although it is possible for consumers to purchase title insurance directly on the open market, most homebuyers have title insurance selected for them by their real estate agents or mortgage brokers.

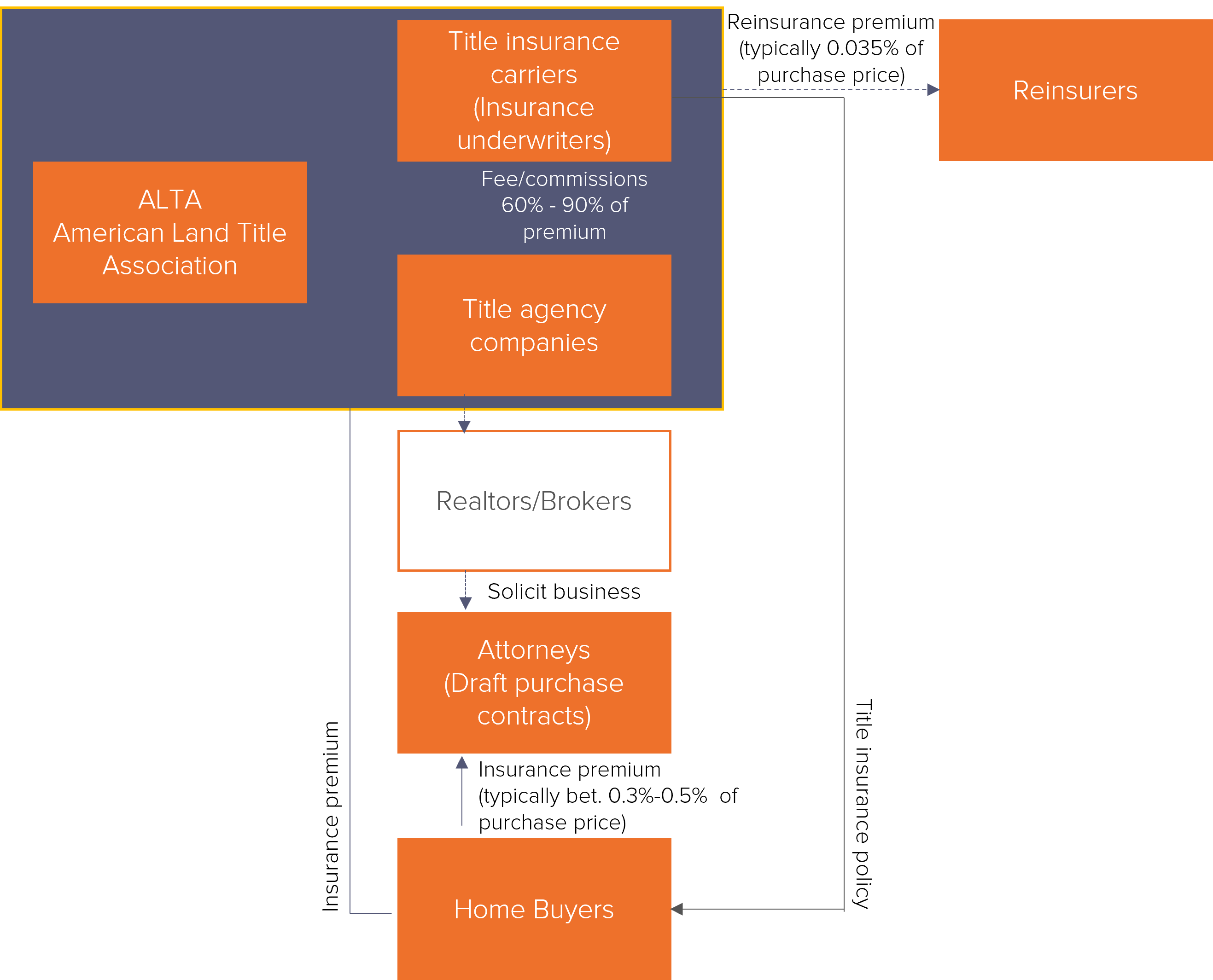

The transaction process may vary from state to state. The chart below provides an overview of the industry structure, its main players, and financial flows:

Title insurance is regulated at a state level, and the terms and conditions of regulations vary across states. For around forty states, regulations require charging a state mandated minimum premium. In certain states, for example, New Jersey, rates are proposed by trade organizations and implemented upon approval by local authorities. In more than seven states, however, rates remain unregulated.

The McCarran Fergusson Act is a federal law that exempts the business of insurance from most federal regulation, including federal antitrust actions to a large extent. Additionally, some federal appellate circuits also consider the “filed rate” doctrine as a successful defense to antitrust liability in title insurance cases. Keeping the above immunity challenges in mind, we focus our analysis on states where premiums are unregulated, and insurers could exploit their market position without intervention to set unreasonably high rates.

Plus factors are economic circumstances that facilitate collusion. While they do not directly imply collusion, the presence of plus factors allows the easier formation and maintenance of a cartel. Fideres has identified the following plus factors in the title insurance market:

The market is highly concentrated with the four largest firms accounting for 85% of new premiums written. Market HHI is 2,174 (defined as a moderately concentrated market in terms of the DOJ Horizontal Merger Guidelines).

Title insurance prices seem to be notoriously high and somewhat uniform in the observed sample of regulated and unregulated states. In many cases, agents representing multiple underwriters quote the same premium for all of them. For example, the same premium of $2,350 is quoted for a $500,000 home in Illinois by an agent representing five major underwriters.

High access costs for title status databases (title plants) from incumbent title insurers, arrangements between insurers and real estate brokerage service providers, reverse competition in kickbacks, and title agent fees, present significant barriers for new market entrants.

Increasing vertical integration and acquisitions of title agents within the industry has resulted in fewer firms competing at all levels, facilitating price collusion.

Similar to the structure in regulated states where official authorities are responsible for publishing the coordinated rates, it is likely that title insurance companies in unregulated states use downstream channels such as title agency companies to coordinate their prices.

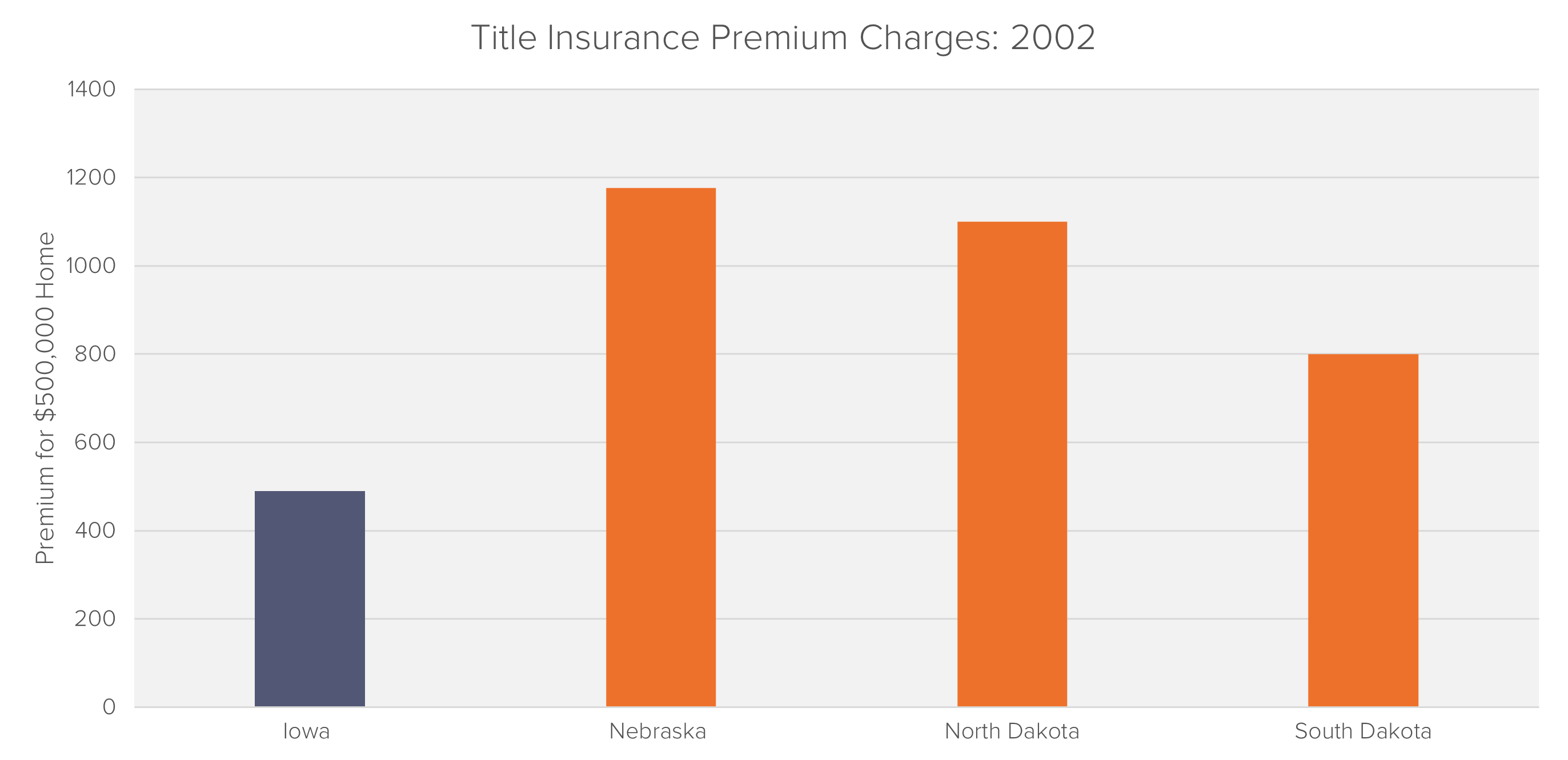

Most of the developed world uses a land registration system called Torrens title, in which the state keeps a definitive record of land ownership and there is no need for title insurance as such. It is worth highlighting that Iowa, for example, has introduced a state-run title insurance system. Iowa Title Guaranty is the only entity authorized to do business in Iowa. Instead of having title insurance agents, Iowa certifies an abstractor to perform the records search, a private practice attorney then reviews it and issues an opinion – the abstract is then updated and loan completed. Iowa Guaranty passes on the charges to attorneys and abstractors, but no money goes back to the lender, eliminating the kickback problems. Any excess revenue beyond operating expenses is given to affordable housing initiatives in Iowa. The introduction of the Iowa state run scheme in 1987 has resulted in a reduction in premium costs:

Consumers based in states where title insurance premiums are not subject to a mandated minimum level might have paid inflated prices as a result of anti-competitive conduct by incumbent title insurance.

Based on the sample of regulated states and corresponding rates chosen, some preliminary findings are:

In 2009, Alberto co-founded Fideres. As a partner, Alberto has mainly focused on developing market analyses and novel methodologies aimed at identifying anomalous or illicit behaviors such as: market manipulation, benchmark fixing manipulation, product mis-selling, anti-competitive conduct and discrimination conduct.

Since 2014 Alberto is the managing partner of Fideres Inc USA, Fideres’s US arm. Alberto has acted in an expert witness capacity in disputes involving banks and brokers, on one side, and institutional investors or consumers, on the other side. Examples of such disputes include mis-selling claims on complex financial derivative products and hedging solutions, LIBOR manipulation and fraud claims.

From 2005 to 2009, Alberto was head of Structured Products at the Royal Bank of Scotland in London, leading a team responsible for the structuring of synthetic credit derivatives products and customer driven solutions. In this capacity Alberto oversaw the development and execution of structured products such as CLOs, CDOs, credit default swaps, total return swaps.

From 2004 to 2005, Alberto led the Fixed Income team as Director, Head of Structuring at ABN AMRO. In this role, Alberto was responsible for the delivery of credit related solutions to institutional clients, for developing and executing regulatory capital and balance sheet solutions for global financial institutions, and for developing fund structure for the commercialization to private investors of structured products utilizing fund and insurance products platforms.

From 1997 to 2004, Alberto was at the UBS Limited as Fixed Income. Between 2003 and 2004 Alberto was Global Head of Structuring. In this role, Alberto led a team responsible for the Interest Rates and Credit Derivative Structured Products Desk.

Alberto began his career in New York, where he joined Credit Agricole in 1996 as an Associate in the Structured Products team.

Alberto holds two engineering Masters Degrees: from Ecole Centrale Paris, France and the Polythecnic of Turin, Italy. Alberto is fluent in Italian, French and Spanish.

Issues with Fund Valuations may yield to future litigation.

A Fideres Special Antitrust Investigation into the UK CO2 Market.

Estimating pass-on damages.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330