Research

He’s Making A List, And Checking It Twice

Who’s been naughty and nice in 2021?

If you are studying to be a professional pianist, the piano on which you will learn to play is likely to shape your preference on the instruments you will choose throughout your career.

As for other industries,1 Steinway Musical Instruments Inc’s (also known as Steinway & Sons or Steinway), one of the largest manufacturers of concert pianos, has over time adopted a series of strategies to exploit this fact and gain market share in the grand piano segment by forcing music academies and artists to use their instruments. First, they signed deals with schools and concert halls where they agreed to use Steinway pianos almost exclusively in exchange for discounts. Then, they created an artist program that provided a network for top performers in exchange for the artist’s compulsory use of Steinway pianos.

Students who grew up in those academies to become professional musicians tied to Steinway as the instrument they trained with. This created a vertical tie between schools, venues, students, and artists, making it nearly impossible for other piano manufacturers to compete.

Performers, composers, students, and practitioners typically prefer to keep playing the same piano they have been trained on throughout their career. This is because of the unique qualities of each brand and model, which make pianos not interchangeable with other manufacturers, and even with other models of the same manufacturer.2

Acoustic pianos differ based on type and size, serving distinct customer bases. High-end grand pianos, which provide the higher level of customization, are purchased almost exclusively by artists, schools and concert halls. On the other hand, baby grand pianos and smaller scale pianos are targeted to non-performers and likely constitute a separate market compared to grand pianos. In other words, a small but significant increase in the price (SSNIP)3 of grand pianos will not result in artists switching to upright pianos.

Among other well-known manufacturers in the grand piano market segment (such as Yamaha, Kawai, Fazioli, and Bechstein), Steinway pianos are recognized as top-notch instruments played by pianists around the world.4

Source: Park Avenue Pianos

Source: Park Avenue Pianos

In 2020, 76.3% of Steinway’s total sales ($416 million) were acoustic piano sales.5 This represents about 38.6% of global sales of acoustic pianos.6 Approximately 37.6% of Steinway’s acoustic piano sales occurred in the US in the same year.7 According to public sources, the grand piano segment covers 15% of Steinway’s total piano business, or $47.6 million in 2020.8

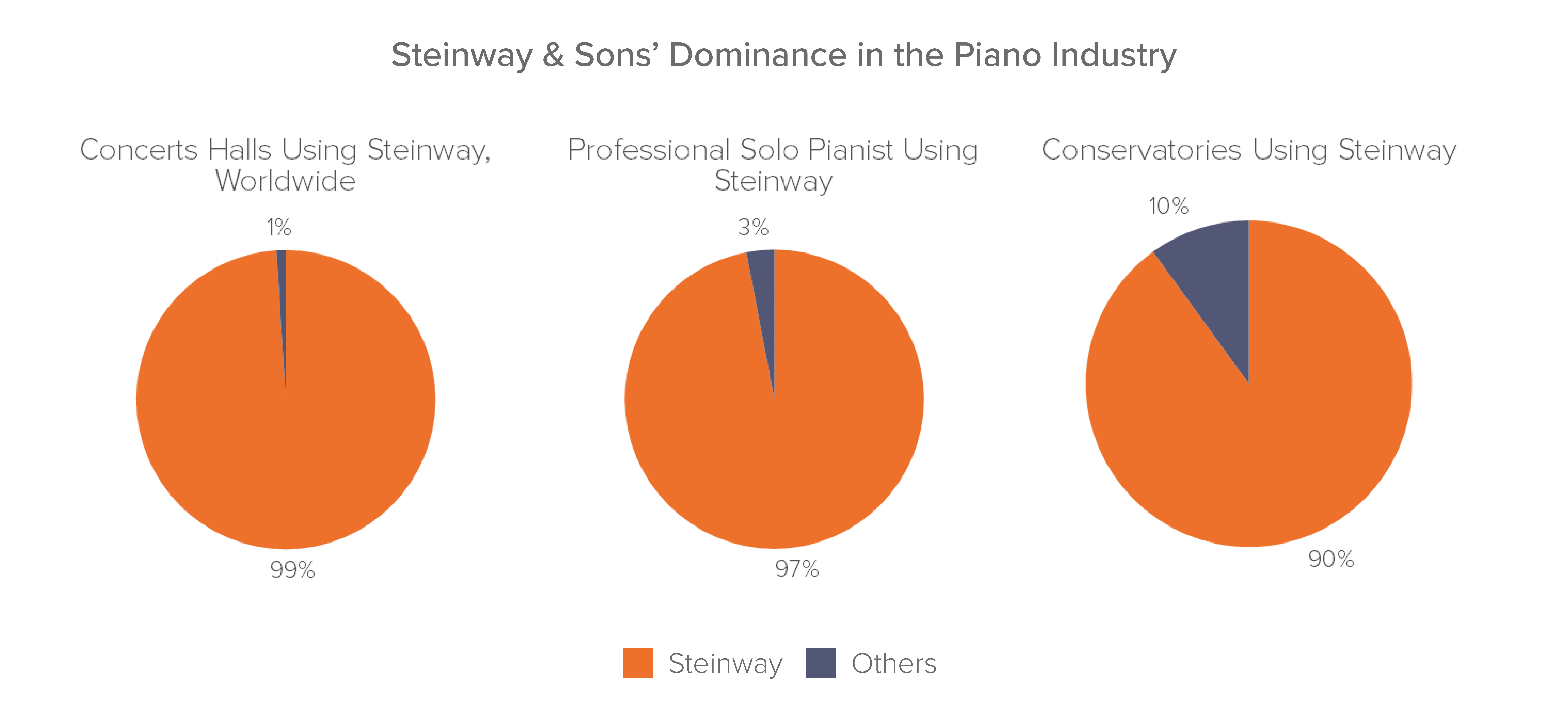

To acquire its global market dominance, Steinway built an extensive network of artists, institutions and schools that accepted to use Steinway instruments exclusively. These networks included:9

According to Steinway, there are approximately 1900 Steinway Artists who represent 97% of all concert pianists.12 Based on Fideres’s analysis, approximately 42% of them studied in a US school. Of these, 68% studied in an All-Steinway school or one that was classified as such until recently.13 About 220 institutions and schools globally are labelled All-Steinway.14

One of the ways Steinway preserved and strengthened its position is through the All-Steinway program. To join and remain in the All-Steinway program, music institutions must have an inventory of at least 10 pianos and 90% of this inventory must be made of Steinway brands (which includes, beyond Steinway, the Boston and Essex brands).15 The share of non-Steinway pianos cannot

exceed 10% in these schools. This 10% is included as buffer to accommodate for pianos that gifted to the school by alumni or historical instruments.16

Many of the most renowned international music schools are part of the All-Steinway program.17 According to Steinway sources, 248 out of 260 pianos at the Juilliard School in New York, one of the most famous music schools in the world, are Steinway.18

The preference of performers for keeping a specific piano throughout their career makes it very important for musical institutions to be able to reflect these preferences in the composition of their instrumental inventory, such as by maintaining a significant amount of Steinway pianos for their practitioners. If forced to choose between dealing exclusively with Steinway or with lesser-known suppliers, most buyers would probably choose to deal exclusively with Steinway.19

As a result, an institution willing to accumulate more than 10% of its inventory of non-Steinway pianos to satisfy the preferences of some of its musicians could lose the All-Steinway label by failing to meet its requirements, potentially resulting in reputational and practical damage, resulting from the loss of discounts and of musicians who rely on Steinway pianos for their performances.

The All-Steinway label works as a gatekeeper to schools. Schools that might have opted for brands that were cheaper, or that offered other qualities, would face the risk of losing the patronage of influential artists with a narrow preference for Steinway instruments.

In fact several grand pianos produced by other manufacturers, such as Yamaha, Kawai, Fazioli, or Bechstein, are comparable in quality to Steinway’s grand pianos and many international artists choose to play on them.20 One of these brands defined as a historic achievement the sale of the first grand piano to the Juilliard School, “breaking a monopoly that for more than 80 years had tied it to the purchase of instruments from another historic brand,” namely Steinway.21

Steinway’s dominance and near-monopoly in the institutional market for grand pianos is mentioned in several articles22 and seems to go beyond supply agreements: in the context of an international

music competition, Fazioli pianos were allegedly replaced to give Steinway pianos23 more visibility, and some participating artists were surprised when they were not given the opportunity to play them for their performances.24

Steinway themselves admitted that the purpose of their programs is precisely to maintain and grow their reputation among top artists and institutions strong and solid, and that:

“The loss of the support of artists and institutions for our musical instrument products or our inability to gain endorsements from new artists or institutions may harm our business, financial condition and cash flows. […] if these artists or institutions attract negative publicity or are no longer popular or if we are unable to continue to attract the endorsement of new artists or institutions in the future, the value of our brands and our business, financial condition and cash flows could be harmed”

and therefore they have:

“created a number of programs to further promote our brands”.25

The grand piano market seems to present two levels of contestability:

Assuming that a significant part of the market for grand pianos for musical institutions and professionals is dominated by Steinway and is therefore not contestable, Steinway should still face competition from other manufacturers for artists that are not as loyal to Steinway. Consumers (musicians and institutions) would benefit from this process in the form of lower prices and higher incentives to innovate.

By enforcing its exclusive programs Steinway refuses to supply its pianos to a buyer who decided to purchase one or more grand pianos from a different brand, implying that:

For these reasons, an exclusionary vertical conduct may produce an anticompetitive result and violate competition laws: in a competitive world, Steinway and other piano makers, would compete for available market share, while with this exclusionary conduct Steinway obtains, at a premium price, both the contestable and non-contestable share.

We argue that Steinway violated competition law by foreclosing its competitors from competing for the contestable market share in grand pianos. As a result, Steinway’s competitors have been harmed in the form of lost profits they could have achieved in the absence of the conduct.

Similarly, Steinway may have been overcharging schools with a supracompetitive price on its grand pianos, enabled by exclusive provisions that eliminated competition. As stated by the price guide of Park Avenue Pianos, a large resellers of Steinway pianos, “Of course new Steinways go up in price over time! They set their own prices without competition, plus there’s inflation”.26 Steinway pianos prices have increased significantly more than inflation. A model B has gone from $8,900 in 1975 to approximately $101,800 in 2017, over a 1000% price increase, compared to 355% cumulative price change between the two dates.27

Source: Park Avenue Pianos

We have analysed a sample of three different types of concert pianos for the US:

In each bucket, Steinway’s prices are consistently higher than those of its competitors, by at least 36.7%.28 On this basis, Steinway pianos are on average overcharged by $36.8k for a model A and by $45.9k for a model B, compared to rival models of the same type. In the market for upright pianos, where Steinway faces competition, Steinway’s K model (the only upright model they manufacture) is priced at a 17% premium over the average price of the pianos in the same segment.29

Steinway has been able to gain dominance in the market for professional grand pianos through a series of exclusive deals with schools, concert halls, and artists. This enabled them to avoid competition from other piano manufacturers and raise prices gradually over time. We consider this a potential example of unlawful conduct, resulting in higher prices to artists and schools, as well as a suppression of competition that might have resulted in lower incentives to innovate in the market for grand pianos.

1 For instance, in the US nearly every student who have gone through a math class has encountered a Texas Instrument calculator. Even after alternative models emerged, Texas Instrument maintained its monopoly over school, developing strong relationships with teachers, standardized test organizations (e.g. SAT), and textbook publishers. Microsoft and Apple also heavily invest in promotional activities with schools to adopt their devices, resulting in students getting used to their products. See https://webcache.googleusercontent.com/search?q=cache:https://gen.medium.com/big-calculator-how-texas-instruments-monopolized-math-class-67ee165045dc and https://www.microsoft.com/en-gb/education/students.

2 “[…] in the university setting, intimate relationships develop between pianist and piano, and between piano and technician: learning what each pianist prefers, the technician eventually customizes the piano to the pianist’s taste.” in https://pianoperfectllc.com/blog/2017/3/4/general-piano-information-the-all-steinway-school-program.

3 OECD, 2012, https://search.oecd.org/daf/competition/Marketdefinition2012.pdf.

4 Cost Of A Steinway Piano | Price Chart and Buyers Guide to New vs Used (steinwaygrand.com)

5 https://www.sec.gov/Archives/edgar/data/1897640/000119312522104954/d212165ds1.htm#rom212165_12 (hereinafter, “IPO Prospectus”), page 107. It is noted that Steinway’s production includes only high-end acoustic pianos. The remaining sales involve other orchestral instruments such as percussion instruments, strings, woodwinds, and brass (see IPO prospectus, page 4).

6 In 2020, the global piano market was valued at about $2.5 billion. The acoustic piano segment is worth about 33.2% of this market, or $822.7 million in 2020. Referring to data for the United States and global market shares from https://www.globenewswire.com/news-release/2020/07/14/2061705/0/en/Global-Pianos-Industry.html.

7 Considering total piano sales, US revenues contributed for 51.7% in 2020. See IPO prospectus, pages 95-96 and F-43.

8 The Prestige and Exclusivity of a Steinway Piano | Steinway-Piano.com.

9 IPO prospectus, page 2.

10 IPO prospectus, page 147.

11 https://www.steinway.com/music-and-artists/young.

12 See https://www.steinway.com/about and https://www.steinway.com/music-and-artists/solo. See also IPO prospectus, page 2.

13 Fideres elaboration on https://steinway.co.uk/education/all-steinway-schools/.

14 IPO prospectus, page 2.

15 https://pianoperfectllc.com/blog/2017/3/4/general-piano-information-the-all-steinway-school-program.

16 https://pianoperfectllc.com/blog/2017/3/4/general-piano-information-the-all-steinway-school-program.

17 https://www.steinway.com/education/institutions/all-steinway-schools.

18 https://www.steinway.com/news/steinway-chronicle/winter-2019/juilliards-ever-popular-practice-rooms-a-steinway-grand-tradition. Other Steinway sources report Juilliard School having 253 Steinway pianos – see https://www.steinway.com/news/articles/the-juilliard-school-purchases-twelve-new-steinway-grands/#.

19 “[…] most of the high-level pianos the students will one day play as professionals, especially in performance, are likely to be Steinways — virtually every concert hall of any importance has a Steinway, and you don’t have to be a Steinway Artist to play one. Therefore, […] learning to work with Steinways in a school setting is very important” in https://pianoperfectllc.com/blog/2017/3/4/general-piano-information-the-all-steinway-school-program.

20 See https://digitalpianoplanet.com/baldwins-vs-steinways/ and Fazioli pianos undermine Steinway myth, AGI, May 19, 2016, accessed at https://www.agi.it/economia/made-in-italy/i_pianoforti_fazioli_insidiano_il_mito_di_steinway-786646/news/2016-05-19/.

21 See https://www.fazioli.com/profilo/. See also Juilliard breaks with all-Steinway tradition, purchases at Fazioli, The Globe and Mail, March 29, 2011. Accessible at https://www.theglobeandmail.com/arts/music/juilliard-breaks-with-all-steinway-tradition-purchases-a-fazioli/article4266813/

22 See among others Piano nobile, The Economist, May 5, 2016, accessed at https://www.economist.com/books-and-arts/2016/05/05/piano-nobile and Pianos: Beyond the Steinway monoculture, The Washington Post, September 5, 2015, accessed at https://www.washingtonpost.com/entertainment/music/the-piano-keys-of-the-future/2015/09/03/9bbbbfee-354c-11e5-94ce-834ad8f5c50e_story.html.

23 “[…] They [Fazioli] say competitors were not offered equal access to their pianos. Each of the 10 homes where the finalists were staying was provided with a new Steinway for practicing. Steinway pianos were used at non-competition festival events. There were Steinway pianos in rehearsal, warm-up and green rooms, and three Steinways on stage at the concert hall compared with two Faziolis for semi-finalists to choose from on selection day, when competitors determine which piano they would like to play in the various rounds. “When we showed up at the concert hall, they had positioned the Steinways front and centre and the Faziolis in both corners. It was so obvious; you almost couldn’t see the Faziolis from the auditorium,” Vancouver Fazioli dealer Manuel Bernaschek says. […]”, Sponsorship feud strikes a sour note at Honens International Piano Competition, The Globe and Mail, December 1, 2018. Accessible at https://www.theglobeandmail.com/arts/theatre-and-performance/article-sponsorship-feud-strikes-a-sour-note-at-honens-international-piano/?fbclid=IwAR11y9M7ARzujYNastbZEq6suSfv3JS4wYORGW-fyxu0BpA6DGZRrBW0o_M.

24 “[…] two previous international piano competition winners, Luca Buratto and Szymon Nehring, who performed with the Calgary Philharmonic Orchestra during the festival – including a Mozart concerto for two pianos – were told they would have to play on the Steinways; that Fazioli pianos were not an option for them, even though both are Fazioli fans […] “Please be advised that there will be no Fazioli pianos used for the concert involving Luca Buratto and Szymon Nehring. Please also be advised that any further interference from your company or local dealer will result in the removal of all Fazioli pianos from the 2018 Honens International Piano Competition,” Edwards [Honens competition executive director] wrote in the August e-mail […],” Id. 2018.

25 IPO prospectus, page 43.

26 https://steinwaygrand.com/pages/price-guide

27 Data from Park Avenues Pianos at the link Cost Of A Steinway Piano | Price Chart and Buyers Guide to New vs Used (steinwaygrand.com). US inflation from https://www.in2013dollars.com/us/inflation/1975?endYear=2017&amount=8900.

28 Price data for grand pianos from https://pianopricepoint.com/pianos-categorized-by-size/x-lrg-grand/#!.

29 Piano prices change depending on size, color and finish of the instrument. In this case, we compared Steinway model K with other 52 inches upright pianos of the same color (ebony). Source: https://www.pianobuyer.com/new-piano-pricing.

Ludovica joined Fideres in 2022 and is based in Fideres’s Rome office. Her main expertise is related to the development of economic analysis and the quantification of harm for antitrust claims across many industries, i.e. Pharmaceuticals, Agriculture, Digital, Transport and Energy sectors.

She obtained a MSc in Economics at the University of Rome Tor Vergata with a dissertation on the economic effects of the abuse of dominant position in EU telecommunication markets and has gained experience in two economic consultancy firms during and right after her Master’s studies. Before joining Fideres, Ludovica gained experience in management consulting, mainly supporting European institutions and private organisations with the development of socio-economic impact assessments of their policy strategies and investment plans, and with the implementation of funding strategies based on European and national funding opportunities.

Who’s been naughty and nice in 2021?

Has enough been done to prevent future FX scandals?

The role of pharmacy benefit managers In US drug pricing.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330