Research

Better Than Average

Can courts rely on benchmark figures for cartel overcharges?

In this issue we examine the impact of the Twombly Supreme Court decision on case dismissals and at the fines handed out by the major antitrust regulators around the world.

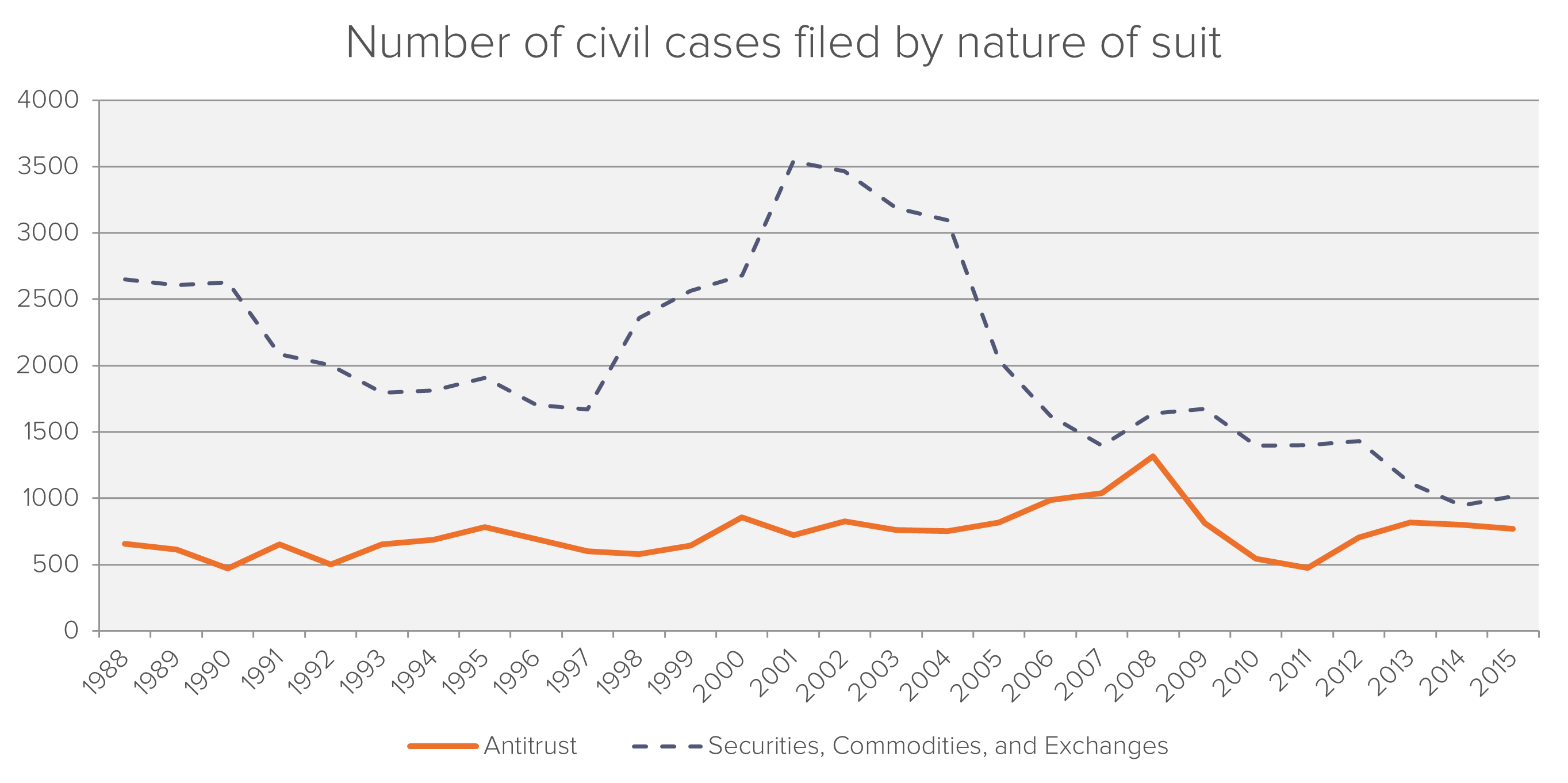

Over the past 25 years, the number of US civil antitrust cases (under section 1 and section 2 of the Sherman Act) has remained range bound with 400 to 800 cases being filed every year. Only in the run up to the global financial crisis period, did filings fall outside this range. The highest number of cases was seen in 2008 with 1,318 civil antitrust claims being filed in the US District Courts. The number of cases recorded in the District Courts seems relatively stable compared to other types of cases such as Securities, Commodities, and Exchanges cases which appear to be more cyclical.

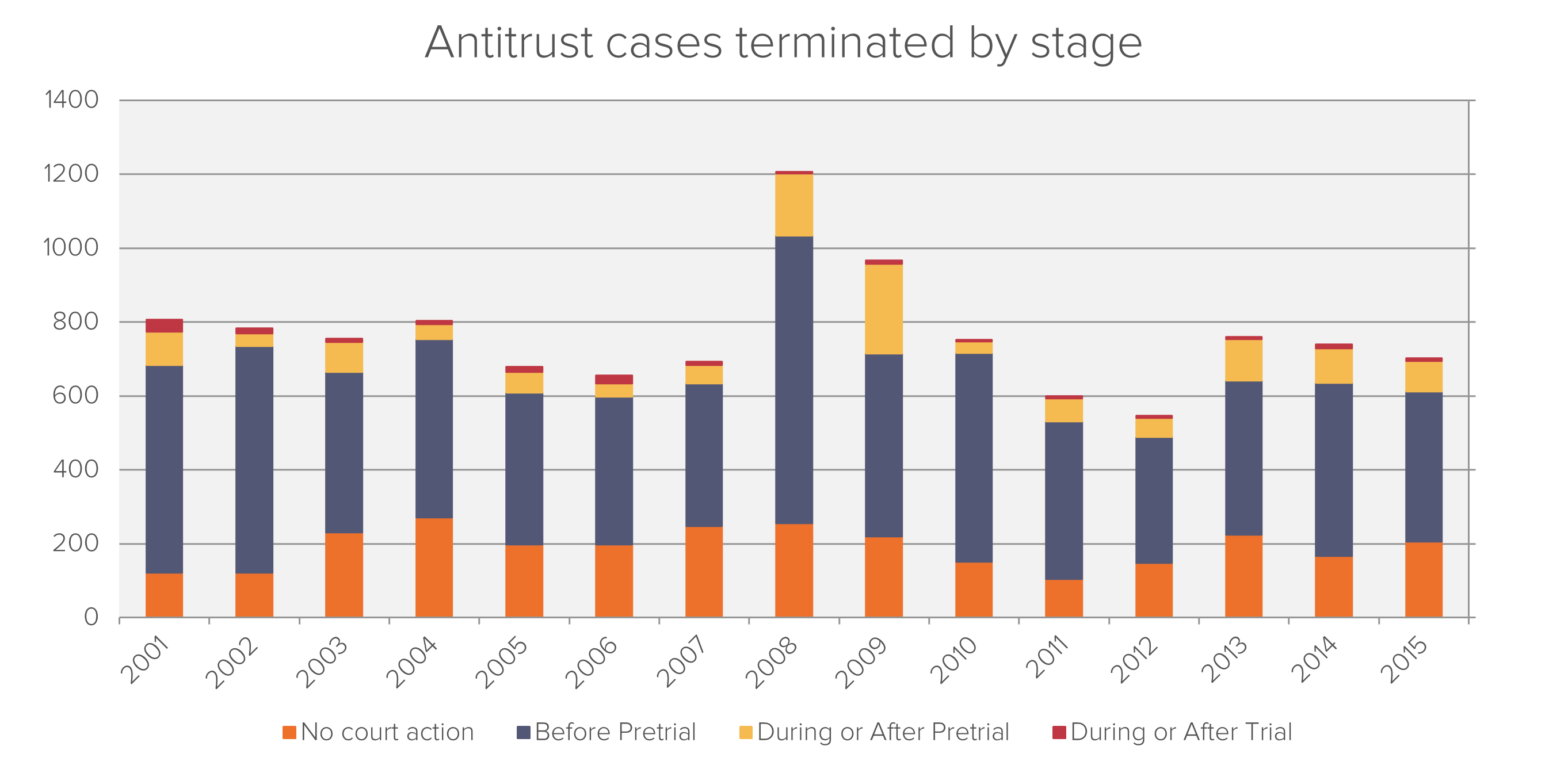

The US Supreme Court decision in 2007 in Bell Atlantic Corp. v. Twombly1 set the new standard of evidence needed to successfully plead an antitrust claim. Over the past 15 years, 87.75% of antitrust civil cases in the District Courts were either terminated before pretrial stage or no court action was taken at all. Only 1.48% of cases are terminated during or after trial.

In order to assess the impact of the Twombly decision on the number of cases brought under different antitrust laws, we have compared the eight years prior to the decision with the eight years after. We found that the average annual number of investigations initiated under specific antitrust laws declined. Sherman section 1 claims, which focus on restraint of trade and which are most closely related to the Twombly case, fell by 44.9% in the post Twombly period analyzed.

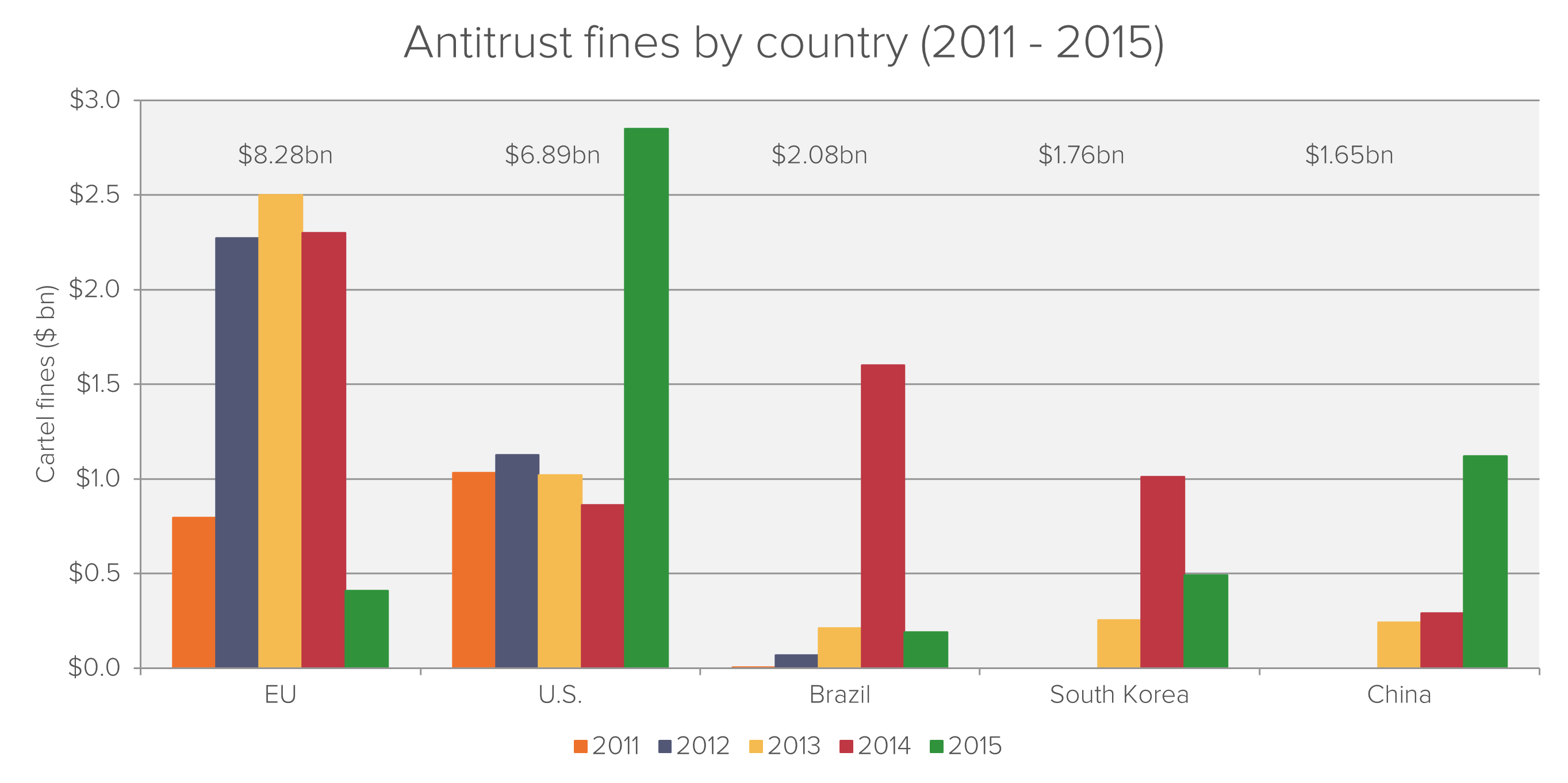

The European Union has been at the forefront of cartel enforcement over the past 5 years, with aggregate fines of $8.28bn. The US follows closely behind with aggregate fines of $6.89bn over the same period. The fines imposed by the US Department of Justice in the fiscal year up to September 2015 were dominated by large foreign exchange market investigation fines, which accounted for approximately 88% of the total 2015 criminal antitrust fines for the US.

Brazil’s competition authority, the Administrative Council for Economic Defense (CADE), issued a $1.40bn fine in 2014 against six cement companies, six individuals and three associations.2

We can expect the 2016 EU figures to be boosted by the European Commission’s €2.93bn fine to a group of truck producers for participating in a cartel. The fines, which were announced in July 2016, are in relation to collusion of truck pricing which took place over a 14 year period.3

As a result of the higher pleading standards imposed by Twombly, recent antitrust cases have increasingly relied on regulatory enforcement notices as evidence of the plausibility of the collusive allegations.

In addition, reliance on advanced investigative economic analysis to assess the so called “plus factors” has played an important role in many of the recent cartel cases surrounding the financial sector in order to increase the chances of surviving at motion to dismiss stage.

We will write about our experience in producing economic evidence of plus factors in a future Research Alert.

1 Bell Atlantic Corporation, et al., Petitioners v. William Twombly, et al.,05-1126 (U.S.) (available at https://www.docketalarm.com/cases/Supreme_Court/05-1126/Bell_Atlantic_Corporation_et_al._Petitioners_v._William_Twombly_et_al./)

2 http://en.cade.gov.br/press-releases/cade-fines-cement-cartel-in-blr-3-1-billion

Russell joined Fideres in 2014. He has acted as a consulting expert in many large legal cases in the US and UK for a variety of industries. In particular, he leads the pharmaceutical antitrust team in relation to generic drug price-fixing allegations, labour economics team in relation to wage suppression and has carried out expert work in financial markets claims involving swap mis-selling and fund management excess fees. Russell is a Chartered Financial Analyst (CFA) charter holder and completed his BSc in Accounting and Finance at the London School of Economics and Political Science.

Can courts rely on benchmark figures for cartel overcharges?

What do telecom price rises tell us about the bottleneck on justice?

FedEx and UPS general rate increases: Collusion or conscious parallelism? Fideres investigates competition issues in the United States courier mark...

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330