Research

Keeping Your Options Open

Damages in 10b-5 claims.

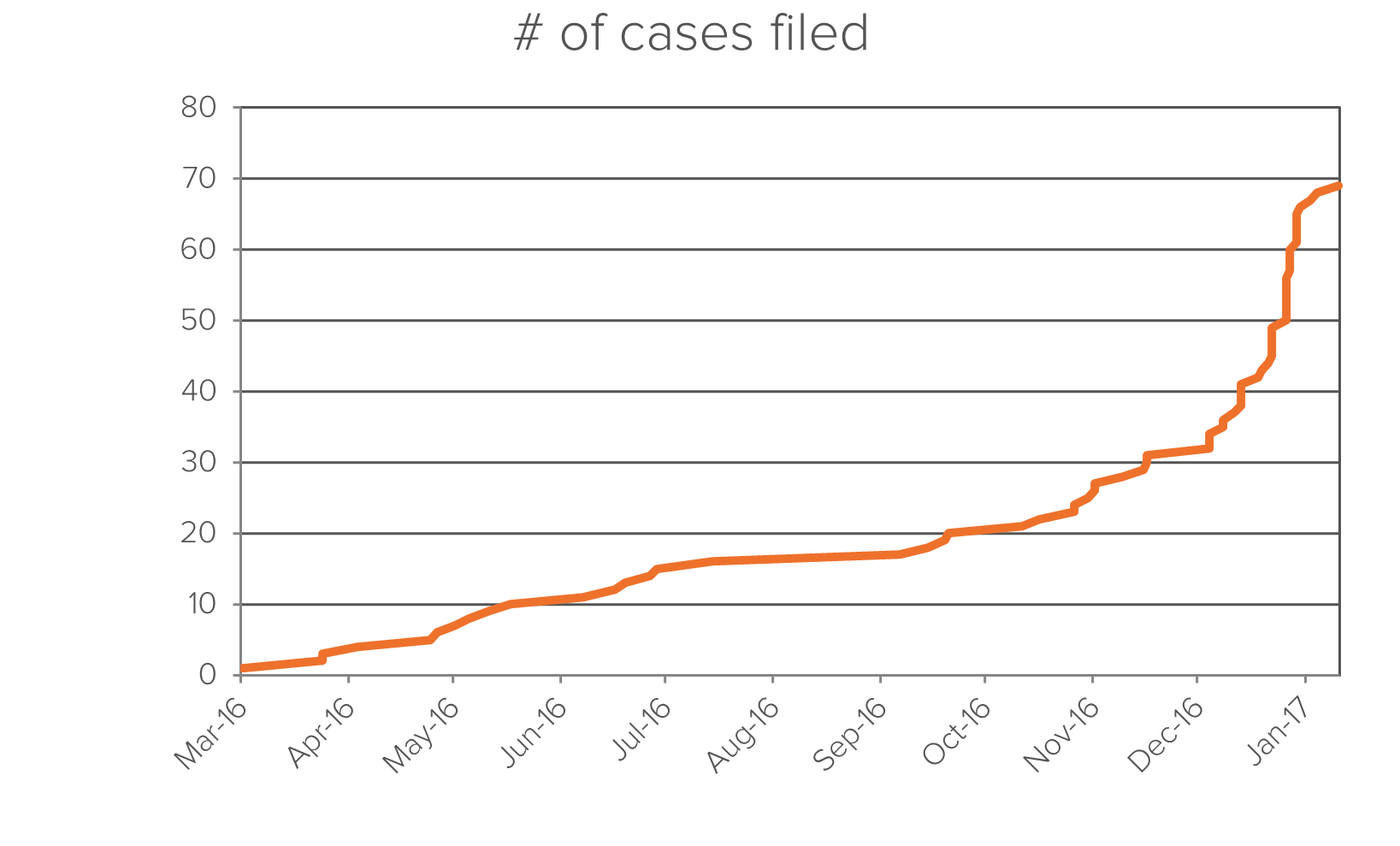

Since Senator Sanders’ initial 2014 investigation into drug prices, there have been over 68 antitrust lawsuits concerning over 10 different generic drugs. Fideres has found anomalous pricing patterns for a much larger number of drugs than what is covered by the current 68 cases, the DOJ investigation and the lawsuit filed by the Attorney Generals of 20 U.S. States, all alleging price-fixing.

Below is a timeline of cases filed concerning generic drug pricing:

There are a number of factors that make generic drugs highly susceptible to collusion:

A report from the Government Accountability Office stated that more than 20% of the 1,441 generic drugs examined by the department had experienced a price hike of 100% or more between 2010 and 2015.

The phenomenon appears to be limited to the US generic drugs market. Fideres compared drug prices for a sample of drugs in the US, Norway, Denmark, and the UK and found that, over the period of 2010-2015, generic prices for the sample remained roughly constant outside the US. Other aspects of the US generics drug market include high barriers to entry and high market concentration among manufacturers.

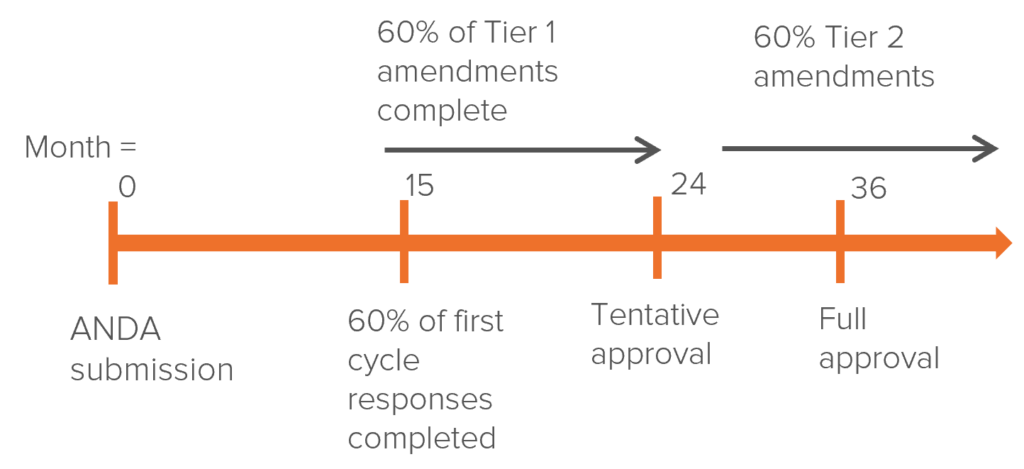

Obtaining the rights to manufacture generic drugs is a lengthy process, even for specialized companies within the field. Drug manufacturing faces intense regulatory oversight and high manufacturing costs for every drug made. To bring a new generic drug to the market, manufacturers require an Abbreviated New Drug Application (ANDA). This takes on average 36 months to be approved by the FDA. However, the process can be lengthened if the FDA requires any amendments to the ANDA (Tier 1 & 2).

A sample timeline is below:

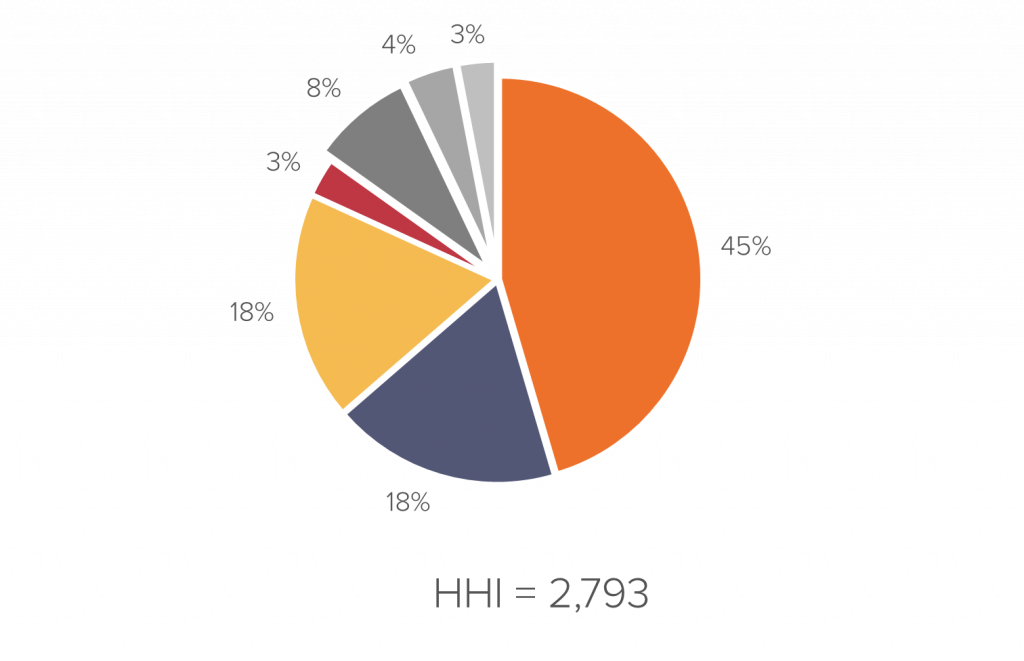

High market concentration makes it easier for manufacturers to implement price-fixing schemes. In the generic drugs market, drug manufacturer concentration is commonly ranked by the DOJ as highly concentrated.

The following chart shows the market concentration for a sample drug:

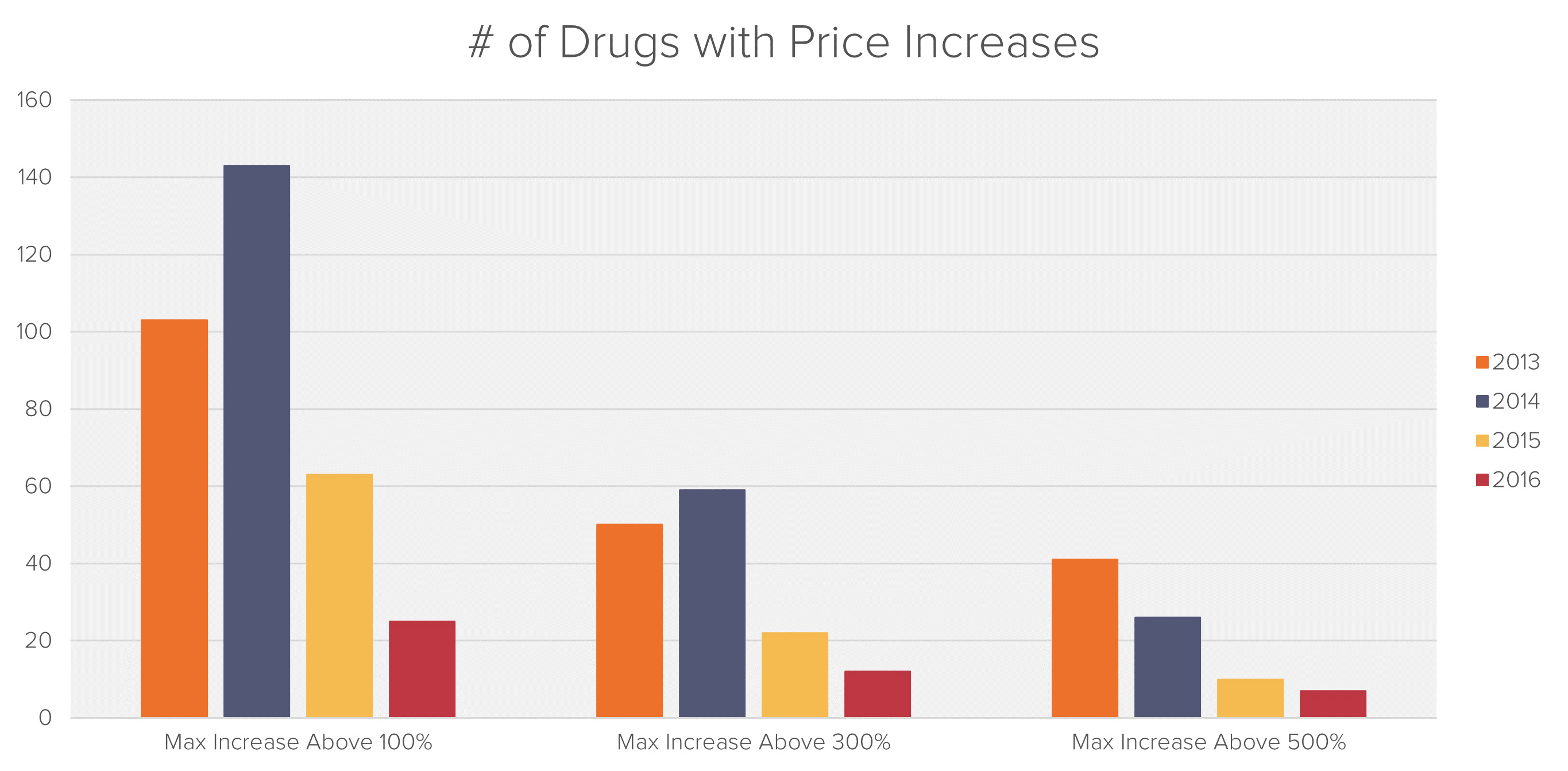

Fideres has analyzed the entire universe of generic drugs and calculated price changes over the period 2013-2016. The list was then narrowed down to include only generic drugs that experienced an increase in price by more than one manufacturer of more than 250% during this time period.

Included in the drug list were the various forms and dosages that the generic drugs were available in. These drugs were sorted according to the various price increases. This produced a list of around 180 drugs which experienced a price increase of 250% or more.

The outcome of Fideres’s analysis is a shortlist of over 90 drugs that experienced significant price hikes combined with similar timing of sales increases between 2013 and 2016.

Max joined Fideres in 2016. He has led the development and implementation of economic models for major collective actions in the US and the UK, contributing to litigation on a variety of topics. His reports and econometric work has been included in cases for conduct including, among others, the FX and LIBOR benchmark manipulation, digital market monopolisation by Apple and Amazon, and consumer claims against a cartel of US generic drug manufacturers, abuse of market power by large regional US hospital systems, restriction of the right to repair by John Deere, and the combined abuse of dominance by Visa and Mastercard in UK payment systems. Before joining Fideres, Max worked at the national laboratory in Los Alamos, New Mexico, as part of a team designing neural networks for applications in machine learning. Max holds an MSc in Economic History from the London School of Economics.

Damages in 10b-5 claims.

Automotive cartels and emissions technology.

Inefficiencies and potential competition issues.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330