Research

Australian Gas Market – Troubles Ahead?

An investigation of the Australian natural gas market.

The pharmaceutical industry has been facing increased scrutiny from lawmakers who are now ratcheting up efforts to target pharmaceutical companies over increased prices of prescriptions drugs. It has also been a fiercely debated topic amongst the US presidential candidates with the likes of Hilary Clinton and Bernie Sanders actively campaigning against “big Pharma’s unconscionable greed”.

In October 2014 Bernie Sanders and Rep. Elijah Cummings launched an investigation requesting information from 17 generic drug companies on pricing issues. The investigation uncovered data which showed extremely large generic price increases between October 2013 and April 2014. The DOJ now believes that price-fixing between generic drug manufacturers could potentially be widespread.

A generic pharmaceutical drug is equivalent to a brand-name product in dosage, strength, route of administration, quality, performance, and intended use.

Pharmaceutical companies that manufacture branded drugs can experience a period of exclusive rights to sell their drug due to patent protection. In the US, patents last on average for 12 years and are put in place to, amongst other things, encourage R&D by the pharmaceutical companies.

In most cases, generic products become available after the patent protections expire. Once generic drugs enter the market, competition leads to substantially lower prices for both the original brand-name product and its generic equivalents.

Generic drugs as a whole have increased steadily from 2004 as a share of total prescriptions, and as of 2014, accounted for 88% of the 4.3 billion prescriptions filled in the United States. Empirical studies have shown that within a year of generic entry, generics typically will have obtained about 90% of the market for that drug.1

There are a number of factors that make generic drugs highly susceptible to collusion:

Fideres’s research has identified generic drugs that show signs of potential collusion and anti-competitive behavior. Outlined below is an example of one such drug:

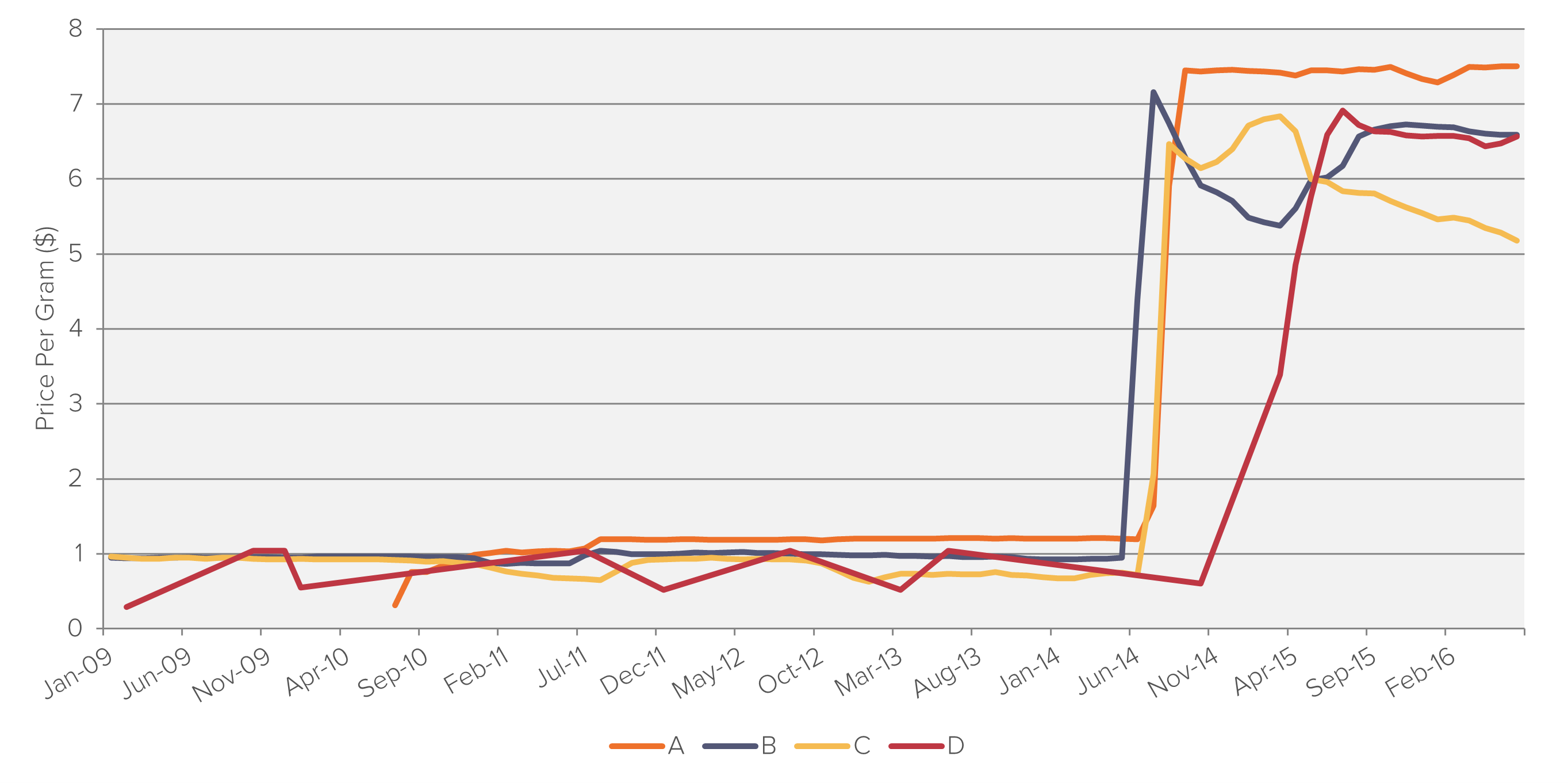

As seen in the graph above in June 2014 the four main manufacturers for this drug increased the price on average 558%.

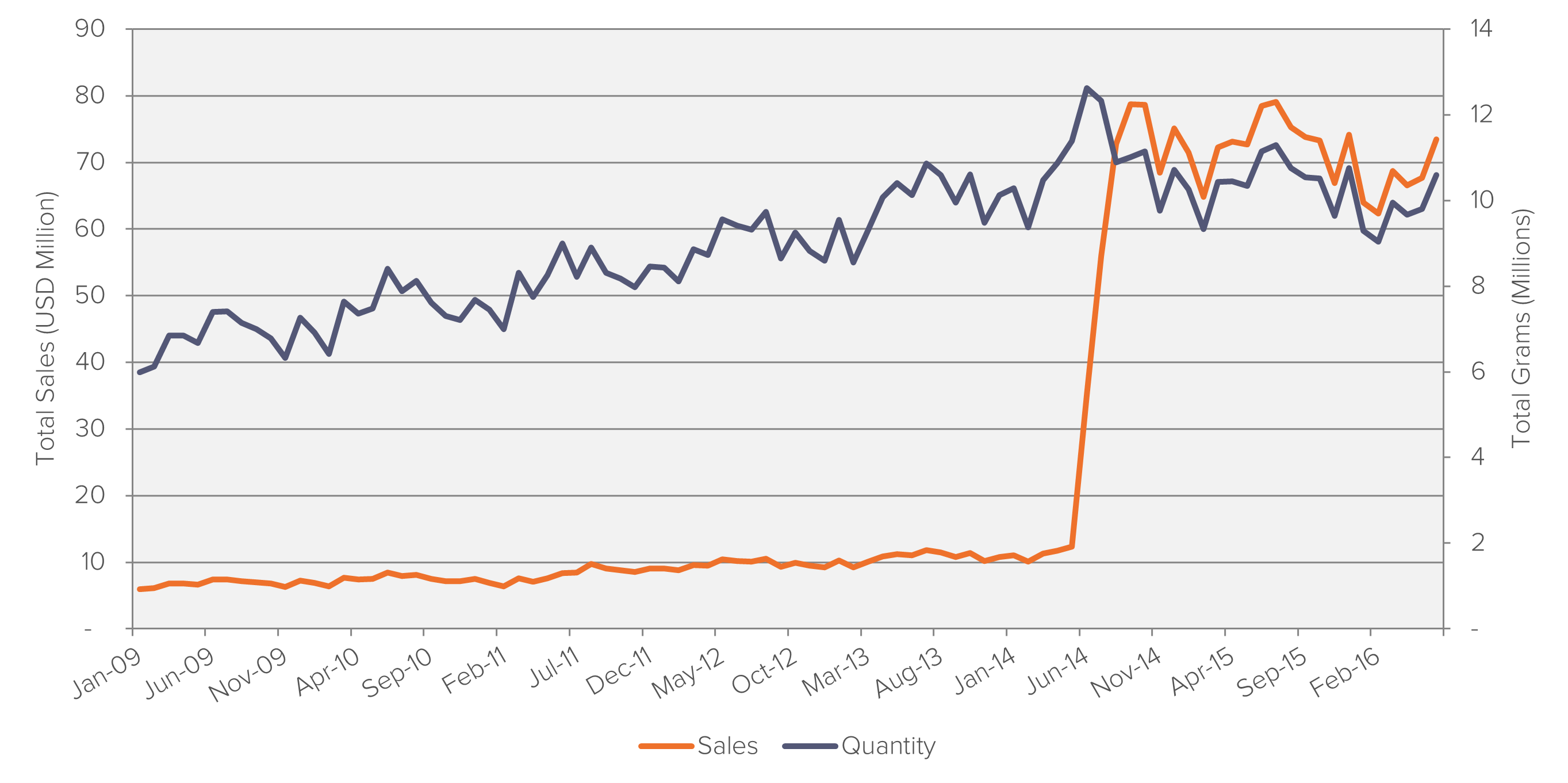

This graph highlights the strong pricing power of generic manufactures. The inelastic nature of this generic drug shows that the dramatic increase in price resulted in a large increase in sales, however quantity sold remained steady.

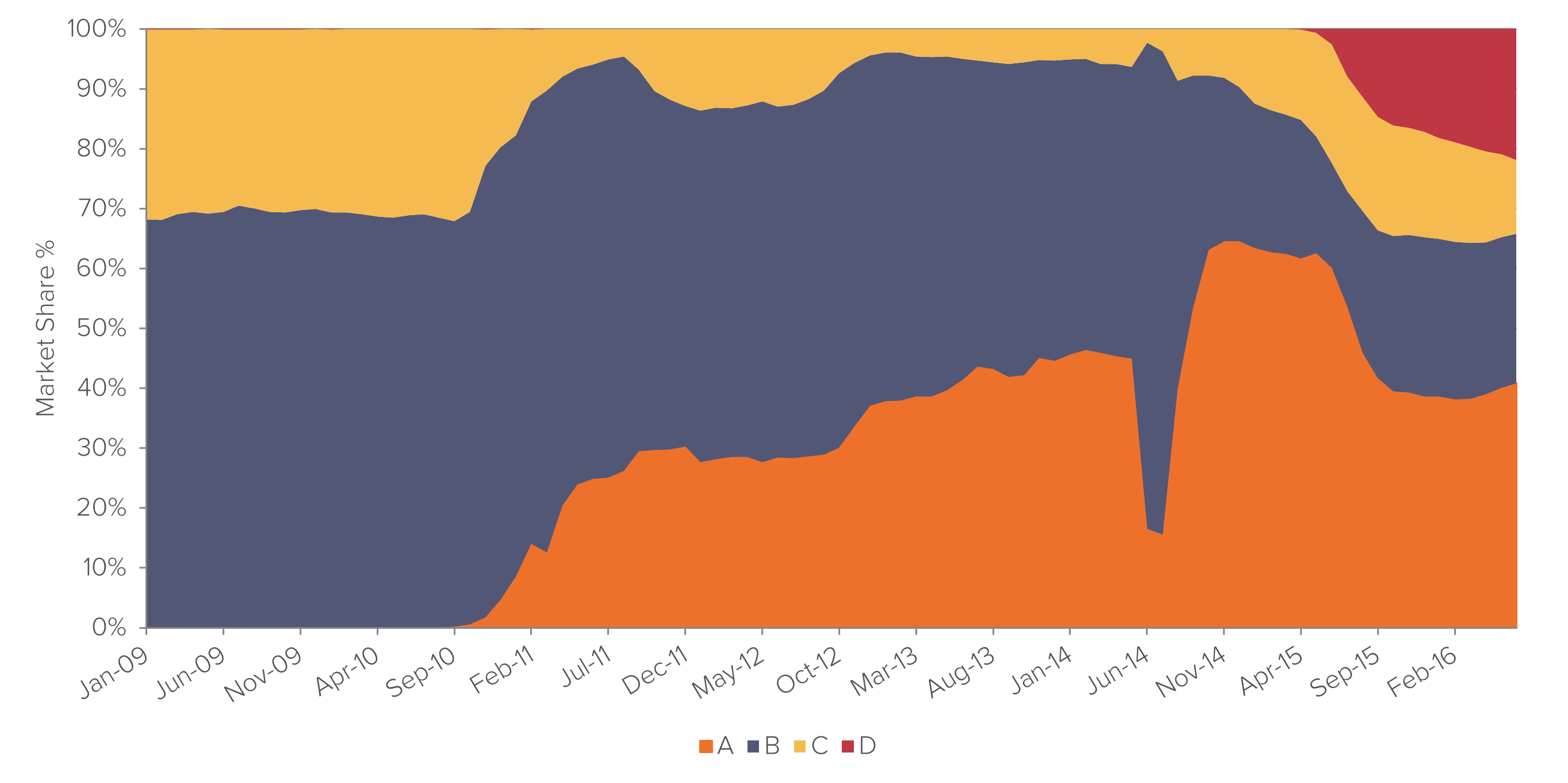

This graph shows the high concentration of this generic drug with only three manufacturers producing the drug during the time the price spike was observed.

Max joined Fideres in 2016. He has led the development and implementation of economic models for major collective actions in the US and the UK, contributing to litigation on a variety of topics. His reports and econometric work has been included in cases for conduct including, among others, the FX and LIBOR benchmark manipulation, digital market monopolisation by Apple and Amazon, and consumer claims against a cartel of US generic drug manufacturers, abuse of market power by large regional US hospital systems, restriction of the right to repair by John Deere, and the combined abuse of dominance by Visa and Mastercard in UK payment systems. Before joining Fideres, Max worked at the national laboratory in Los Alamos, New Mexico, as part of a team designing neural networks for applications in machine learning. Max holds an MSc in Economic History from the London School of Economics.

An investigation of the Australian natural gas market.

Fideres discusses the importance of implied volatility in securities litigation involving options.

Fideres analyses the potential impact of Covid-19 on the CLO market.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330