Research

Pre-Arranged Bids On Prepaid Cards

Assessing the impact of the cartel allegations.

The issue of fund managers merely tracking their benchmark index while charging fees to investors in line with actively managed funds has become the subject of interest over the past few years. Various academics, regulators and research firms have launched investigations to identify these so called ‘closet index funds’. One of the primary metrics used to uncover potential closet index funds is active share, a measure of the difference between a fund’s portfolio and the composition of its benchmark index. However, analysis conducted by Fideres suggests that active share alone is not a good measure of the index-tracking behavior of mutual funds.

This point is illustrated by the following three funds with the characteristics set out below:

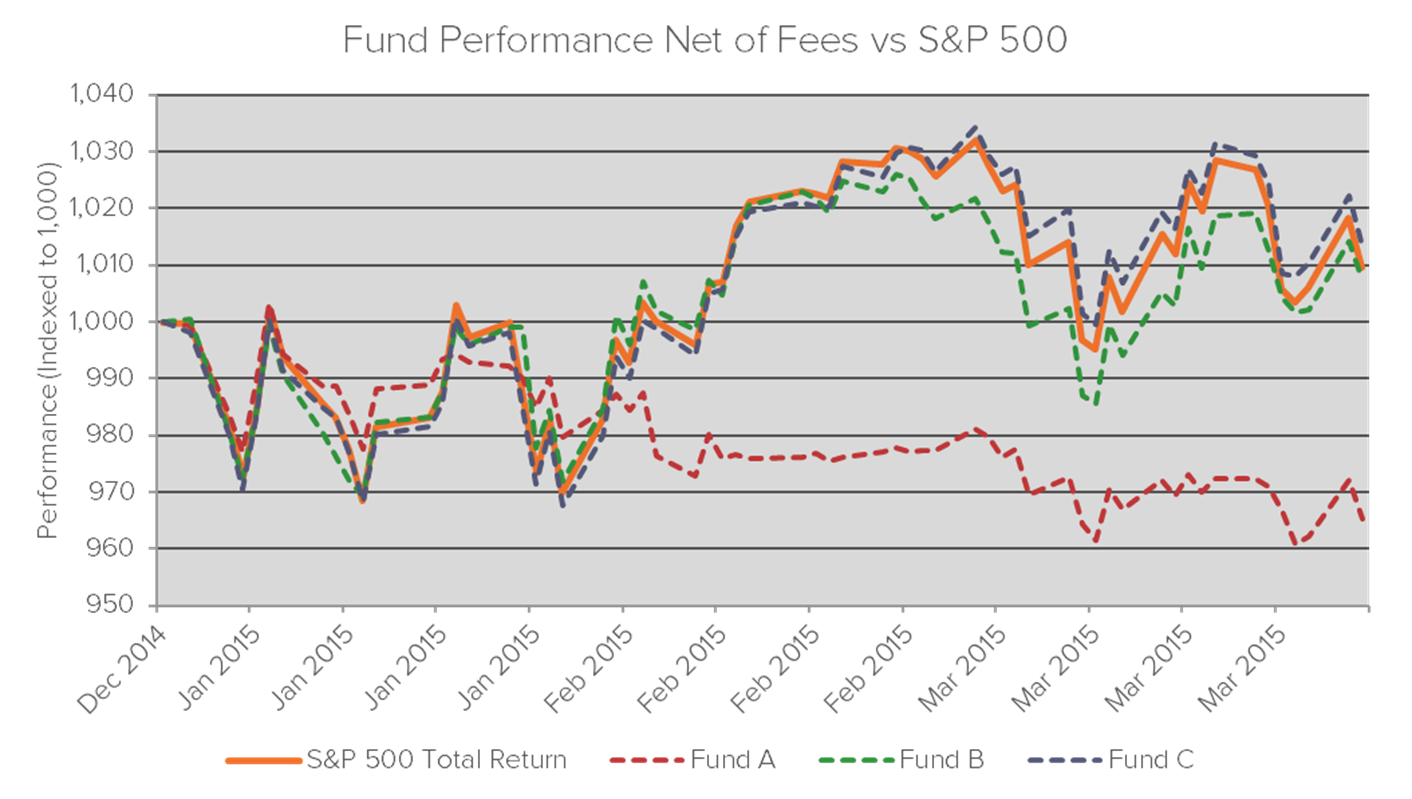

The active share1 was calculated as of January 1, 2015, and during Q1 2015 the funds performed as follows:

| Fund A | Fund B | Fund C | |

| Active Share | 22% | 75% | 45% |

| Tracking Error | 7.81% | 4.40% | 1.35% |

Considering active share alone is not sufficient to identify closet index funds, and it is necessary to analyze a range of additional performance metrics including tracking error and R-squared, among others, on a historical basis.

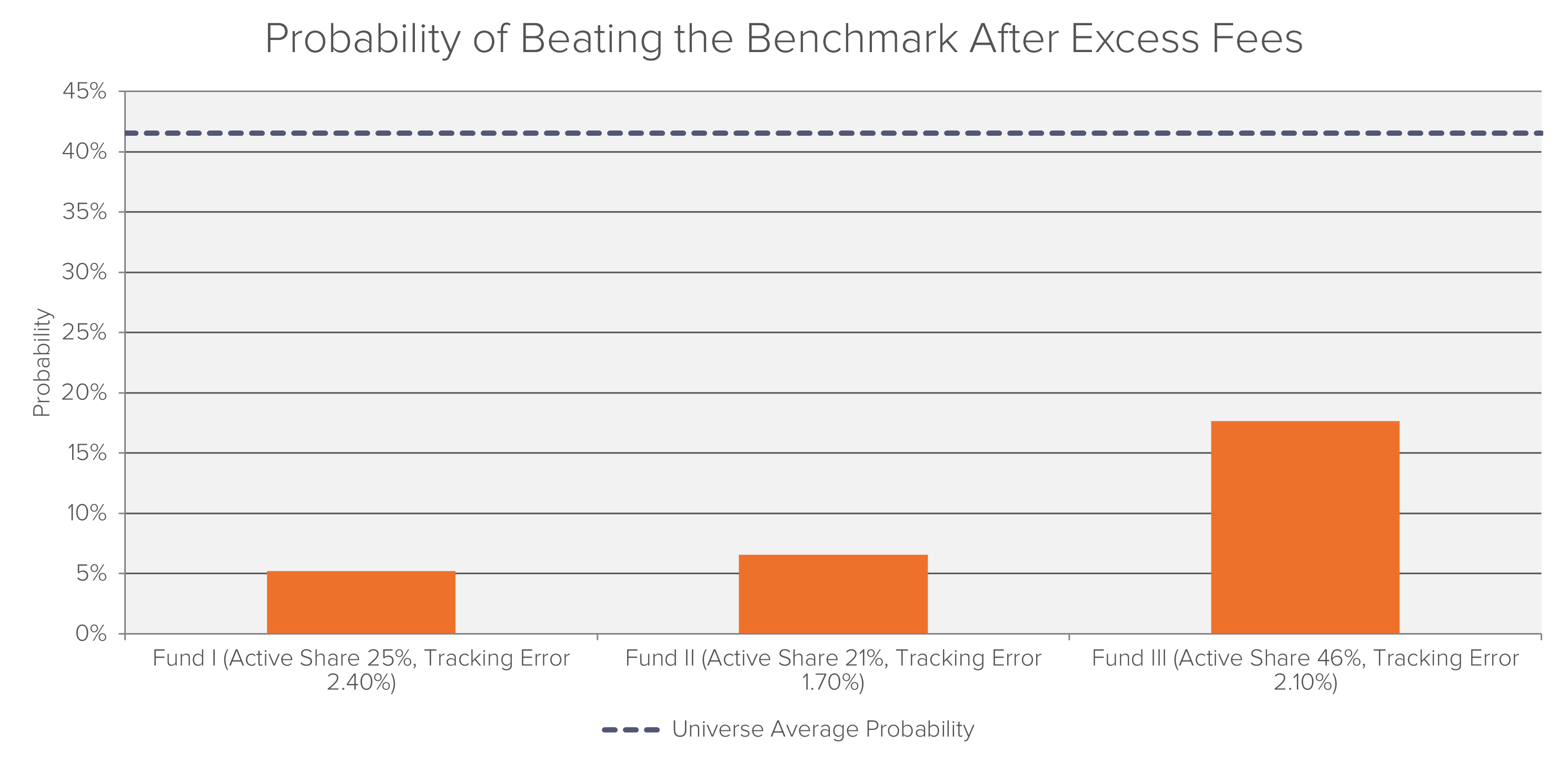

Fideres has developed a robust quantitative framework to identify closet index funds applying this approach. Part of this approach involves estimating the probability of a fund beating the benchmark after excess fees (over an actual index-tracking ETF) on the basis of the fund’s active share, tracking error, and portfolio holdings. When applied to a North American universe of funds, it can be seen that closet index funds are substantially less likely to beat the benchmark than actively-managed funds:

1 Active share calculated as of 1 January 2015; (annualised) tracking error of daily returns calculated for Q1 2015

Russell joined Fideres in 2014. He has acted as a consulting expert in many large legal cases in the US and UK for a variety of industries. In particular, he leads the pharmaceutical antitrust team in relation to generic drug price-fixing allegations, labour economics team in relation to wage suppression and has carried out expert work in financial markets claims involving swap mis-selling and fund management excess fees. Russell is a Chartered Financial Analyst (CFA) charter holder and completed his BSc in Accounting and Finance at the London School of Economics and Political Science.

Assessing the impact of the cartel allegations.

Fideres analyses the potential impact of Covid-19 on the CLO market.

Unavailable and inaccessible.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330