Research

Muni Bonds: The Price Is Not Enough

Mispricing of US municipal bonds.

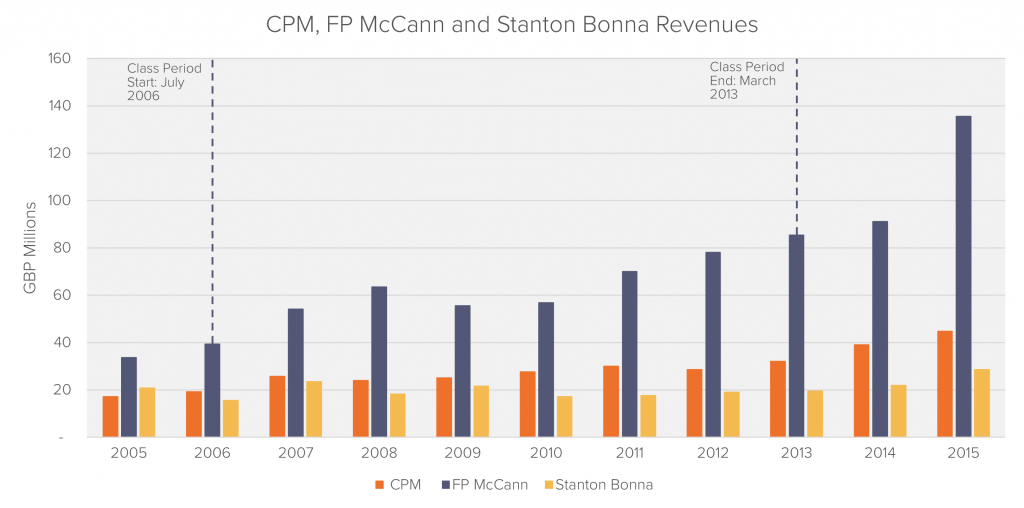

On 23 October 2019, the CMA issued a decision finding that three suppliers of precast concrete drainage products had infringed United Kingdom (UK) and European Union (EU) competition law in relation to the supply of these products to customers in Great Britain between July 2006 and March 2013.

According to the CMA’s decision, the suppliers engaged in anticompetitive conduct by:

The CMA recorded, as evidence, several meetings where the above information was discussed. In 2018, Stanton Bonna Concrete and CPM Group both accepted that they participated in the infringement and as a result, they have received reductions to their fines as part of CMA’s provisions for leniency and settlement processes.1

Precast concrete is a construction product produced by casting wet concrete in a reusable mould or form which is then cured in a controlled environment, transported to the construction site and installed. Precast products can be divided into over ten main types, of which drainage is one of them – it includes pipes, culverts and manholes.2

We estimate the above-ground drainage and the below-ground piping systems market in the UK to be worth more than £250m per year in terms of revenues.

Source: Companies House Data, Company Financial Accounts

Source: Companies House Data, Company Financial Accounts

The CMA decision does state which percentage of the cartelists’ revenues are attributable to collusive activities. There is also very little publicly available data on historical prices for drainage pipes at the wholesale level. As a result, Fideres has developed preliminary estimates of losses sustained by direct purchasers of drainage products during the cartel based on the following assumptions:

The results of our analysis are shown below:

| Price Inflation During Cartel Period | Estimated Losses (£ millions) |

| 10% | 39 |

| 20% | 72 |

Given that drainage pipes are essential for a large infrastructure projects, a wide range of end-user markets such as road systems, railways and water management projects, may have been affected by the cartel. Some examples for each of these markets are given below:

| End-user Markets | Example(s) |

| Water and Sewerage Companies | Anglian Water |

| Rail Companies | East Midlands Trains, Chiltern Railways |

| Road Construction | GF Roadmarkings |

In addition to turnover during the infringement period, the CMA fine also considers any mitigating factors. The follow-on claims that will ensue from hereon may require more robust methods to estimate the actual harm incurred by these purchasers.

1 https://www.gov.uk/government/news/construction-firms-fined-36-million-for-breaking-competition-law

2 https://www.sustainableconcrete.org.uk/Sustainable-Concrete/What-is-Concrete.aspx

Max joined Fideres in 2016. He has led the development and implementation of economic models for major collective actions in the US and the UK, contributing to litigation on a variety of topics. His reports and econometric work has been included in cases for conduct including, among others, the FX and LIBOR benchmark manipulation, digital market monopolisation by Apple and Amazon, and consumer claims against a cartel of US generic drug manufacturers, abuse of market power by large regional US hospital systems, restriction of the right to repair by John Deere, and the combined abuse of dominance by Visa and Mastercard in UK payment systems. Before joining Fideres, Max worked at the national laboratory in Los Alamos, New Mexico, as part of a team designing neural networks for applications in machine learning. Max holds an MSc in Economic History from the London School of Economics.

Mispricing of US municipal bonds.

Could highly concentrated holdings lead to anticompetitive behavior?

Why the status quo poses risks to competition.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330