Research

Drug Cartels In The USA

Could manufacturer drug cartels lead to higher generic drug prices?

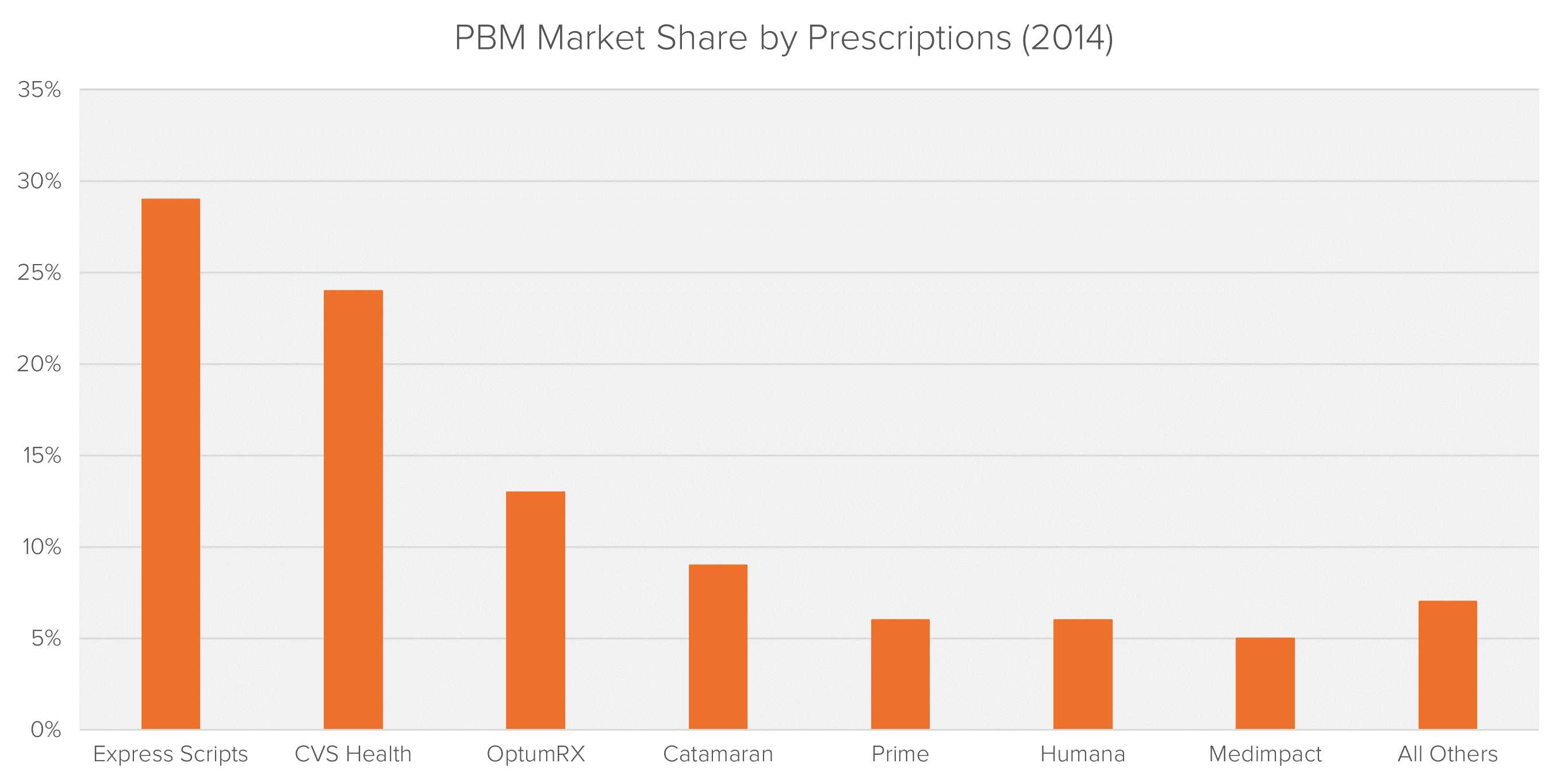

While not a direct link in the physical supply chain, PBMs play an integral part of most consumer purchases. As is the case with manufacturers, wholesalers and pharmacies, the market for PBMs is highly concentrated. Following years of M&A activity, the top five PBMs account for more than 80% of all prescriptions dispensed in the U.S.

PBMs provide services to insurers including claims processing, record keeping, reporting programs, utilization review, disease management and consultative services. Their main role is to:

Manufacturers pay rebates retroactively to PBMs based on their ability to include drugs on a health insurer’s formulary and increase a manufacturer’s market share. These rebates are kept private and confidential. PBMs profit by taking a percentage of the spread between the list price and the “Net Price”. The “Net Price” generally means the true costs of the drug that insurers will pay, taking into account discounts and rebates. Pharmacies contract with PBMs to join their pharmacy network, which provides pharmacies with access to a greater number of customers, buying power and stable reimbursement.

Substantial conflicts of interest arise when a PBM owns their own pharmacy operations as incentives shift from negotiating the lowest cost method of drug distribution to driving profits from its own pharmacy operations.

The two biggest PBMs, Express Scripts and CVS, also own the two largest specialty pharmacies, These pharmacies have been rapidly expanding and now accounts for over 31% of all prescription drug spending.1 PBMs also own a number of mail order and retail pharmacies. For example, the CVS retail chain pharmacy accounts for nearly 14% of all prescription revenues.2

Due to the non-transparent and secret nature of rebates between manufacturers and PBMs it is difficult to know what percentage of these rebates are passed on as savings to insurers and how much is kept by the PBM.

Towards the end of 2016 Express Scripts received subpoenas from the DOJ and United States Attorney’s Office requesting information about its relationship with pharmaceutical companies, specialty pharmacies, prescription drug plan clients and payments made to and from those entities.4

With most consumers at some stage having to pay the list prices for drugs, the questions is, how much are the PBMs profiting from the “Spread”?

To date PBMs have received surprising little scrutiny over drug price increases, however is it time to start taking a deeper look into their business model?

To read a full overview of the pharmaceutical market, including detailed overviews of the full supply and payment chain, please click here.

1 The Express Scripts 2014 Drug Trend Report

2 The 2016 Economic Report on Retail, Mail and Specialty Pharmacies

3 “Federal and State Litigation Regarding Pharmacy Benefit Managers”

Max joined Fideres in 2016. He has led the development and implementation of economic models for major collective actions in the US and the UK, contributing to litigation on a variety of topics. His reports and econometric work has been included in cases for conduct including, among others, the FX and LIBOR benchmark manipulation, digital market monopolisation by Apple and Amazon, and consumer claims against a cartel of US generic drug manufacturers, abuse of market power by large regional US hospital systems, restriction of the right to repair by John Deere, and the combined abuse of dominance by Visa and Mastercard in UK payment systems. Before joining Fideres, Max worked at the national laboratory in Los Alamos, New Mexico, as part of a team designing neural networks for applications in machine learning. Max holds an MSc in Economic History from the London School of Economics.

Could manufacturer drug cartels lead to higher generic drug prices?

Fideres replicates ESMA’s study on closet indexers.

Insights from the Stanford clearinghouse.

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330