Research

Money Down The Drain, Raw Sewage On The Beach

Are UK Water Companies Breaching Competition Law?

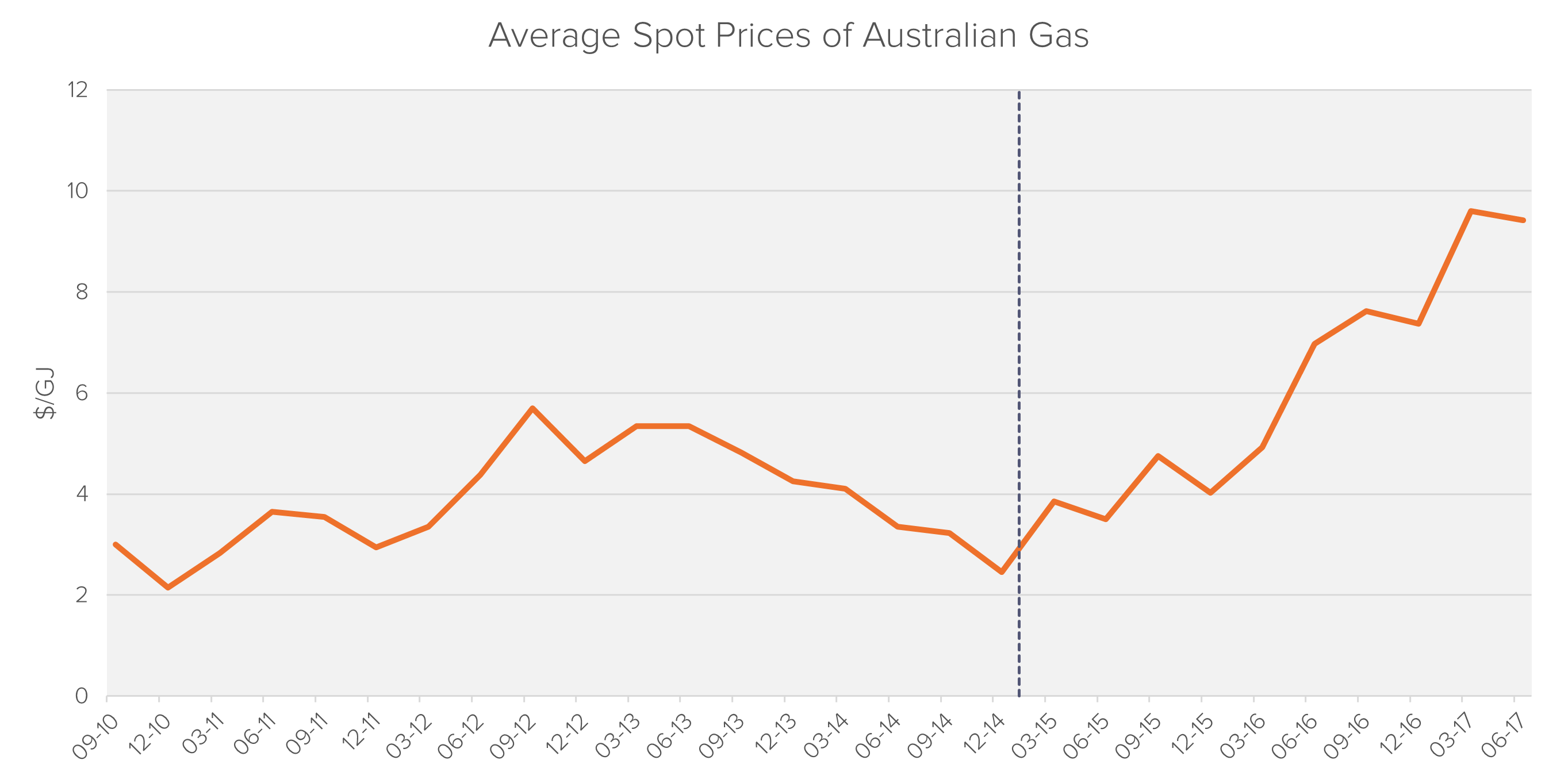

As of 2015, the Australian Energy Market Operator estimated the Eastern Gas Market size at approximately AUD 1,4bn. Fideres found that, over the past 2 years (2015-2017), average wholesale spot gas prices have increased by approximately 290%.

The market has seen a structural shift from a ‘buyer’s market’ to a ‘seller’s market’. Since 2010, natural gas prices have increased from approximately AUD3/GJ to over AUD9/GJ. Approximately 90% of wholesale gas prices are determined by Gas Supply Agreements and spot market prices, and the remaining 10% by transportation charges.

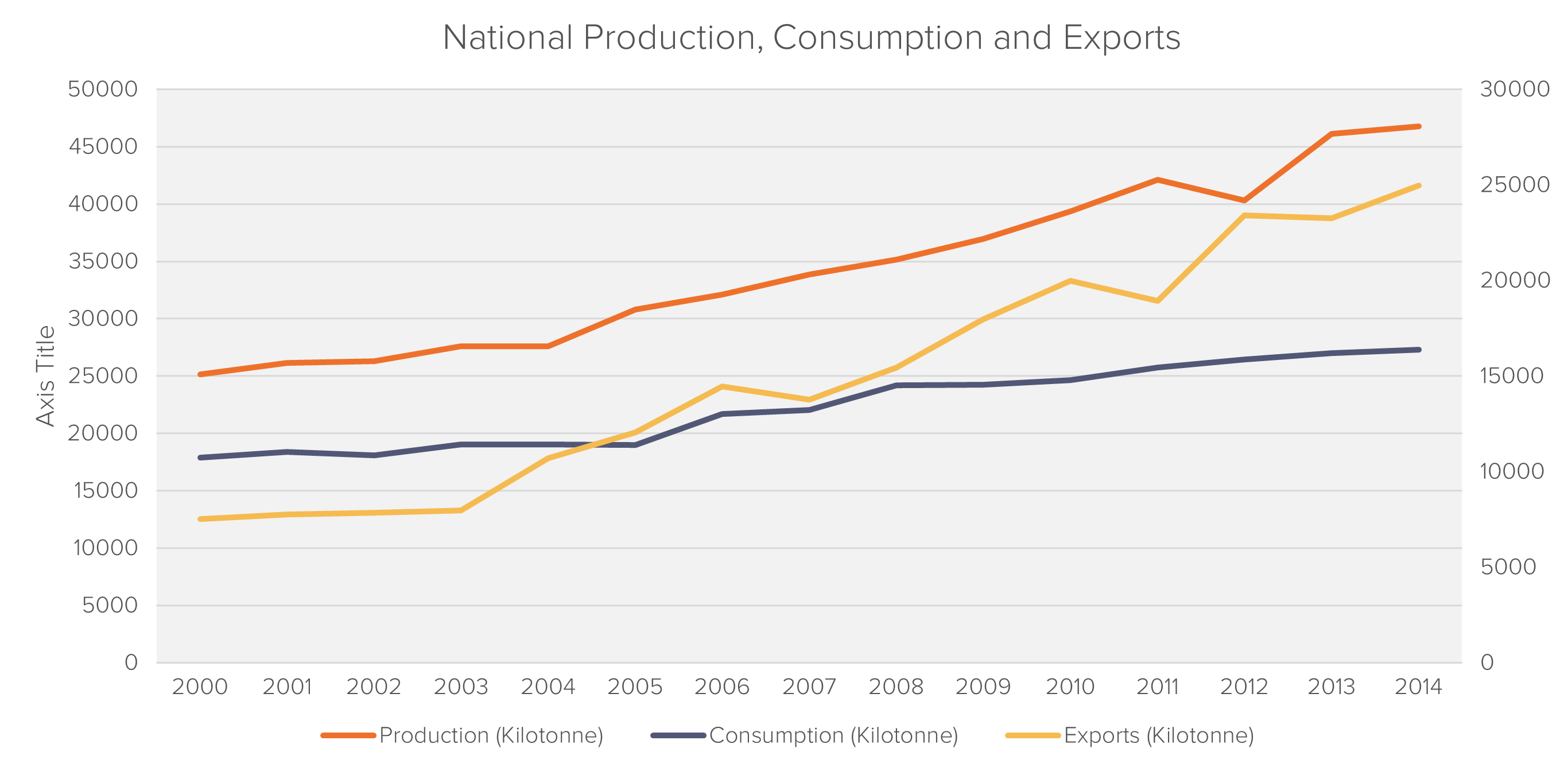

The supply of natural gas in the Eastern Australian Gas market has significantly changed since LNG exports began in 2015.

Many LNG plants have large export contracts with foreign buyers and, due to punitive non-delivery clauses, Australian plants resort to diverting LNG away from domestic markets in order to fulfil their obligations under export contracts. There is also evidence of production-side constraints that may affect pricing. However, after netting out exports we find that production (supply) still exceeds demand, indicating that the alleged production constraints may not be the main reason for the increase in gas prices.

According to the ACCC, joint venture agreements that allow for coordination in production and marketing may have a detrimental effect on competition.

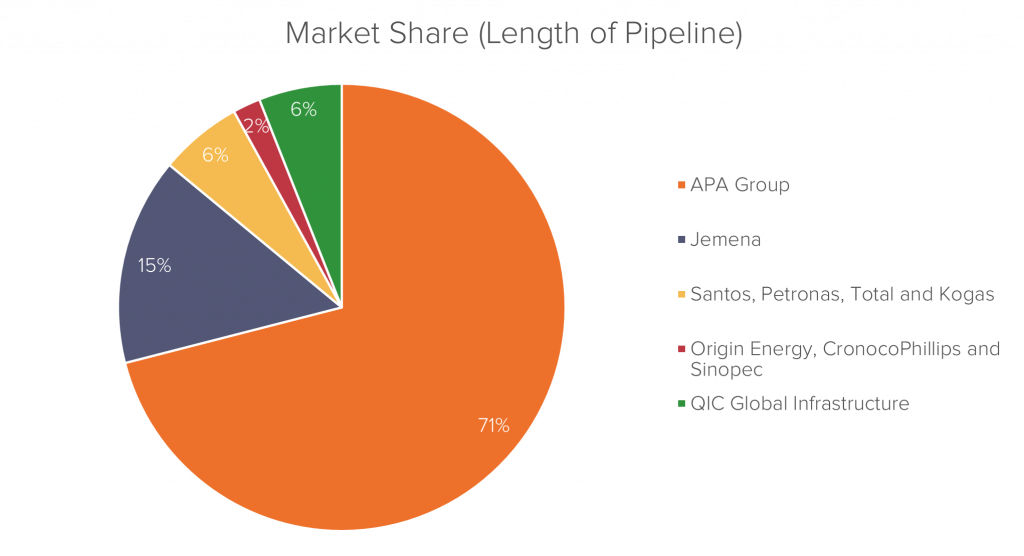

The ACCC also found that pipeline operators’ market power may affect pricing. Fideres found that there is high market concentration in terms of distance covered by pipes and ownership.

Australian regulators and policymakers have made numerous attempts to improve transparency and data availability in the gas market. If the complex and opaque nature of the market is tackled, there is potential to analyse the supply-pricing dynamics further.

Russell joined Fideres in 2014. He has acted as a consulting expert in many large legal cases in the US and UK for a variety of industries. In particular, he leads the pharmaceutical antitrust team in relation to generic drug price-fixing allegations, labour economics team in relation to wage suppression and has carried out expert work in financial markets claims involving swap mis-selling and fund management excess fees. Russell is a Chartered Financial Analyst (CFA) charter holder and completed his BSc in Accounting and Finance at the London School of Economics and Political Science.

Are UK Water Companies Breaching Competition Law?

Fideres analyses the potential impact of Covid-19 on the CLO market.

Key Points In June 2023, the SEC published a complaint against Coinbase, a centralized cryptocurrency exchange that controls 76% of the market, all...

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330