Research

UK Mobile Contract Prices Investigation

Fideres identifies suspicious parallel price increases by all major UK mobile network operators.

Despite the importance of accurate ratings, in the build-up to the financial crisis ABS CDO ratings were often misrated, with the coveted AAA rating being assigned to the vast majority of bonds issued.

S&P defines an AAA rating as “the obligor’s capacity to meet its financial commitments on the obligation is extremely strong.” For ABS CDOs issued in 2006, an AAA rating reflected an average probability of default of less than 0.01% during the securities lifetime.1

Despite this, 50% of all AAA rated ABS CDOs issued in 2006 and rated by S&P defaulted during their lifetime, amounting to investor defaults of approximately £23bn.2 When one considers all crisis-related rated ABS CDO write-downs, this figure more than trebles.

S&P ratings were investigated by the DOJ in 2013 for fraud concerning inflated ratings during the financial crisis. The case settled for $687m, with S&P signing a statement of facts acknowledging that there was a delay in implementing ratings models that would have generated lower ratings; although they did not admit to any violations of law.3 Privative litigation followed, concerning SIV ratings set by both Moody’s and S&P, but was settled before it reached trial.

In October 2015 the SEC pressed charges against S&P for violation of US securities laws in relation to CMBS securities.4

While US legal action outside these actions has been few and far between, the Australian system has repeatedly pursued S&P for deceptive practices.

The most recent case to be brought to the Australian courts concerns S&P ratings of CDOs. The case claims that S&P, along with the banks that structured the products, intentionally altered the ratings methodology in order to rate the CDOs higher.

Another case involved ABN AMRO and S&P as defendants and concerned S&P ratings of CPDOs. The judge did not hold back when critiquing S&P’s rating system, repeatedly stating that “a reasonably competent ratings agency could not have assigned the AAA rating” to the product concerned.5

Concerning one of S&P’s ratings, the judge described it as “misleading and deceptive and involved the publication of information or statements false in material particulars and otherwise involved negligent misrepresentations…”.6

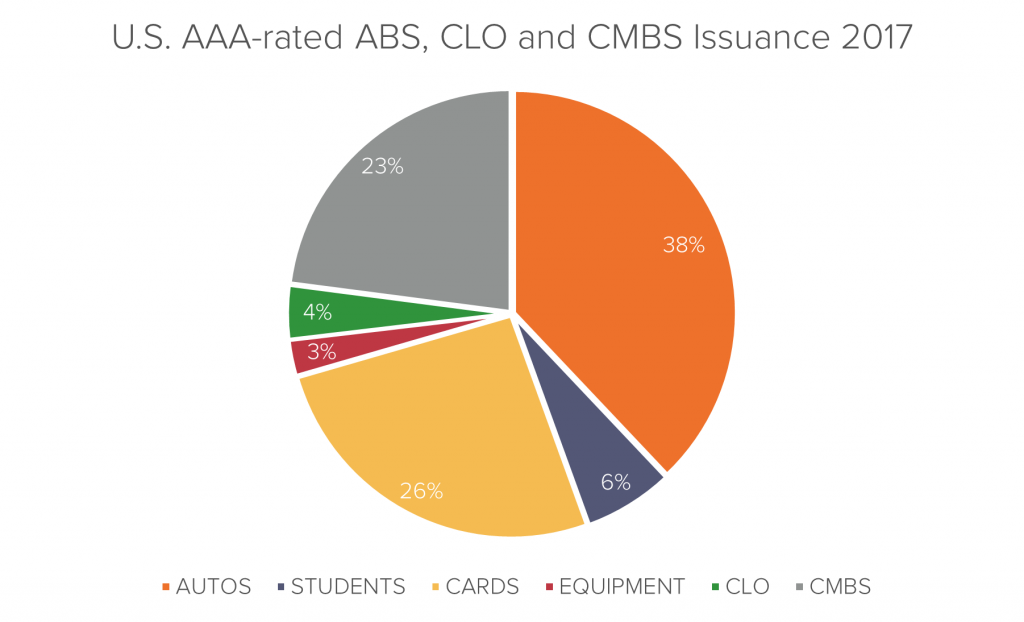

Though issuance of structured finance products has decreased significantly after the financial crisis, there has been a steady increase towards pre-crisis levels over the last few years. Total S&P AAA-rated ABS, CLO and CMBS issuance in the U.S. was approximately $125bn in 2017, an increase of nearly $40bn on the previous year.7

| Structured Product | Auto Loans (ABS) | Student Loans (ABS) | Card Loans (ABS) | Equipment Loans (ABS) | CLO | CMBS | Total |

| Total notional ($m) | 47,287 | 8,124 | 32,475 | 3,253 | 4,902 | 28,586 | 124,627 |

If there has been no intrinsic change to the structures of these ratings models, they may still be prone to model error and manipulation, especially considering the ratings agency industry remains highly concentrated. The financial crisis included extreme disparities in ratings of mortgages, but the next crisis could reveal misratings of numerous other instruments: even if only 10% of the aforementioned AAA structured products issued in 2017 defaulted, investors could face substantial losses.

To read a full overview of our investigation into possible problems with S&P ratings, please click here for the full report.

1 S&P CDO Evaluator 3.0

2 Bloomberg ABS CDO data, Fideres’ calculations physical supply chain

5 Summary of Bathurst Regional Council v Local Government Financial Services Pty Ltd (No 5) [2012] FCA 1200 (5 November 2012)

7 Bloomberg ABS, CLO and CMBS data, Fideres’s calculations

In 2009, Alberto co-founded Fideres. As a partner, Alberto has mainly focused on developing market analyses and novel methodologies aimed at identifying anomalous or illicit behaviors such as: market manipulation, benchmark fixing manipulation, product mis-selling, anti-competitive conduct and discrimination conduct.

Since 2014 Alberto is the managing partner of Fideres Inc USA, Fideres’s US arm. Alberto has acted in an expert witness capacity in disputes involving banks and brokers, on one side, and institutional investors or consumers, on the other side. Examples of such disputes include mis-selling claims on complex financial derivative products and hedging solutions, LIBOR manipulation and fraud claims.

From 2005 to 2009, Alberto was head of Structured Products at the Royal Bank of Scotland in London, leading a team responsible for the structuring of synthetic credit derivatives products and customer driven solutions. In this capacity Alberto oversaw the development and execution of structured products such as CLOs, CDOs, credit default swaps, total return swaps.

From 2004 to 2005, Alberto led the Fixed Income team as Director, Head of Structuring at ABN AMRO. In this role, Alberto was responsible for the delivery of credit related solutions to institutional clients, for developing and executing regulatory capital and balance sheet solutions for global financial institutions, and for developing fund structure for the commercialization to private investors of structured products utilizing fund and insurance products platforms.

From 1997 to 2004, Alberto was at the UBS Limited as Fixed Income. Between 2003 and 2004 Alberto was Global Head of Structuring. In this role, Alberto led a team responsible for the Interest Rates and Credit Derivative Structured Products Desk.

Alberto began his career in New York, where he joined Credit Agricole in 1996 as an Associate in the Structured Products team.

Alberto holds two engineering Masters Degrees: from Ecole Centrale Paris, France and the Polythecnic of Turin, Italy. Alberto is fluent in Italian, French and Spanish.

Fideres identifies suspicious parallel price increases by all major UK mobile network operators.

A lack of competition in the title insurance market in unregulated US states.

Another rough ride for financial institutions?

London: +44 20 3397 5160

New York: +1 646 992 8510

Rome: +39 06 8587 0405

Frankfurt: +49 61 7491 63000

Johannesburg: +27 11 568 9611

Madrid: +34 919 494 330